Bitcoin’s 2028 Halving: How Far $1K Could Soar by 2032

Bitcoin’s next halving looms—and the stakes couldn’t be higher. With the 2028 supply cut just over three years away, savvy investors are already gaming the math. Here’s how a $1,000 bet today could reshape your portfolio by 2032.

The Halving Hype Cycle

History doesn’t repeat, but it sure rhymes. Past halvings sparked parabolic rallies—and this time Wall Street’s algorithmic traders are locked and loaded. Forget ‘number go up’ memes; we’re talking institutional FOMO on a blockchain.

Supply Shock Calculus

Fewer coins. Same demand. Basic economics says… well, you know the rest (unless you’re a central banker). Miners’ rewards get slashed in half—and the market typically front-runs the scarcity narrative.

The $1K Moon Math

No crystal balls here, but post-halving ROI windows have historically dwarfed traditional assets. That grand you ‘invested’ in avocado toast last year? Bitcoin laughs in 4-year cycles.

Risks? What Risks?

Regulators will regulate. Banks will warn. And your brother-in-law will still call it a Ponzi—right before asking how to buy. The real question isn’t if Bitcoin moves… but whether you’ll be early or late.

One final thought: If 2008 taught us anything, it’s that the ‘smart money’ often isn’t. Maybe it’s time to hedge against the hedgies.

Bitcoin Halving 2028: What to Know

Bitcoin has now become a national asset, a major asset officially backed by the US government. The token has been supported holistically by President Donald Trump, who has also helped in the formation of a legitimate Bitcoin reserve. The US is now on track to take the lead in dominating the digital asset market, inspiring other nations to emulate the same.

In addition to this, Bitcoin’s institutional interest has now peaked to an all-time high, with companies like Strategy and Metaplanet boasting a stellar amount of BTC in their company portfolios.

![]() BREAKING

BREAKING![]()

937 financial institutions bought #Bitcoin through the ETFs during Q1 2024

That’s 10 times more institutional adoption than Gold

But “there is no institutional demand for $BTC “ pic.twitter.com/C7tiSCa8pY

Bitcoin at present has now risen to $118K, breaking a new price ceiling in the process. Usually, it takes about a year for bitcoin prices to spike post the halving event. The April 2024 Bitcoin halving event came at a time when BTC was sitting at $65K. The event helped the price of BTC stabilize for over a year, with external elements like Trump’s backing of BTC helping the token gain massive price momentum.

With the next halving scheduled for 2028, the price of Bitcoin is expected to rise higher. It may end up delivering major returns if investments are made through strategic attention and care.

Next BTC Halving In 2028: $1000 Invested Will Give This Much Profits By 2032

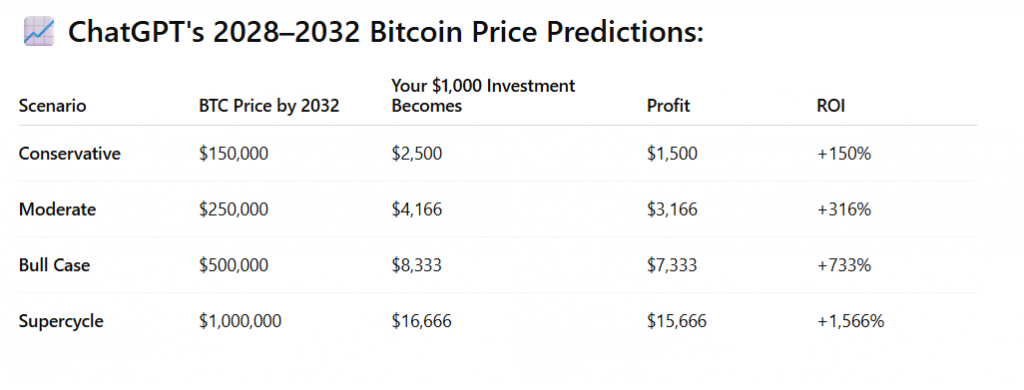

Bitcoin halvings play an important role in making BTC rare. In simple terms, these halving events help in limiting the release of new tokens. This development, in turn, makes the asset appear more lucrative and scarce in the long term. With the next BTC halving scheduled for 2028, predictions of BTC hitting $500K by 2028 are also gaining rapid steam. If we consider BTC sitting at $150K by 2028, then the person WOULD have made a profit of $2500 by 2032.

If BTC is sitting at a $250K or $500K price level by 2028, then the profit margin would significantly increase. This will help the investor earn nearly $4166 and $8333 worth of profits on his or her $1000 investment.