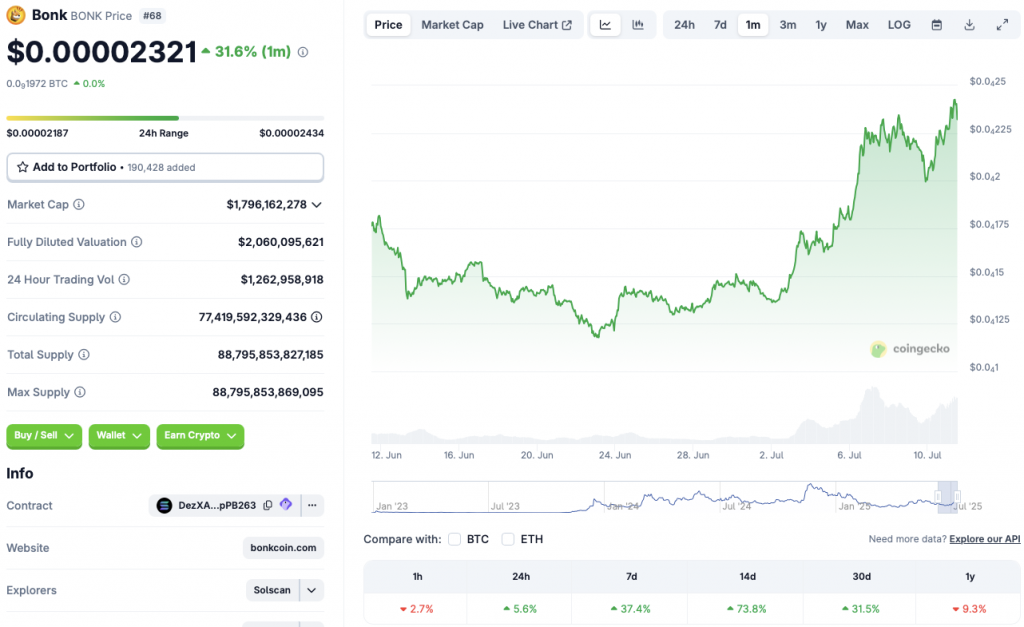

Solana’s Bonk Token Skyrockets 73%—Can the Memecoin Rally Defy Gravity?

Solana's favorite dog-themed memecoin just ripped through the charts—Bonk surged 73% in a blistering rally that left traders scrambling. No fancy fundamentals here, just pure degenerate momentum. But with gains this steep, even crypto bros are side-eyeing their profit-taking buttons.

Behind the pump: Solana's NFT crowd went full send, swapping JPEGs for BONK like it was 2021. The chain's low fees and high-speed transactions turned it into a memecoin laundromat—wash, rinse, repeat. Meanwhile, Bitcoin maximalists grumble into their orange-pilled coffee.

What's next? Either a retrace that'll vaporize leverage traders or a full-blown breakout. Either way, hedge funds are probably drafting a tokenized 'Bonk Yield Fund' prospectus as we speak—because nothing screams institutional adoption like a dog coin with a 500% APR.

Source: CoinGecko

Source: CoinGecko

New All-Time High Around The Corner For Bonk?

BONK is currently down by nearly 60% from its all-time high of $0.00005825. The memecoin hit its peak in November of 2024. The memecoin’s latest rally is likely due to Bitcoin’s (BTC) climb to a new all-time high. BTC has seen consistent institutional inflows over the last few months.

BONK may face a correction if investors decide to book profits. Memecoins are heavily subject to market speculation. They carry some of the most significant risks in the financial markets.

There is also a possibility that the Solana-based memecoin will continue its rally, given that certain conditions are met. If BTC maintains its upward momentum, BONK could surge to the $0.00003 level. A BTC correction could lead to the memecoin’s price facing a dip.

Retail players have been more or less absent over the last few months. The Federal Reserve’s decision to keep interest rates unchanged may have further kept retail investors at bay. An interest rate cut could lead to more retail capital flowing into risky assets. BONK could see another bullish leg if the Fed decides to reduce interest rates. President TRUMP has repeatedly asked Fed Chair Jerome Powell to cut interest rates. So far, Powell has decided not to comply with the President’s requests.