🚀 Bitcoin to $160K by Year-End? Research Says Yes—If Treasury Giants Jump In

Bitcoin's price could skyrocket to $160,000 by December if institutional heavyweights start hoarding, according to new research. Here's why Wall Street's cold feet might be the only thing standing in the way.

The Institutional Tipping Point

Forget retail FOMO—this rally hinges on treasury departments treating BTC like corporate gold. One treasury whale moving 1% of reserves could trigger a domino effect.

Liquidity vs. Legacy Systems

On-chain metrics show enough supply elasticity for institutional entry, but good luck finding a CFO who'll explain Bitcoin custody to their board before the SEC does.

The Cynical Kick

Watch how fast 'volatile crypto' becomes 'strategic digital asset allocation' when BlackRock starts offering 401(k) BTC exposure—with a tidy 2% management fee, of course.

The Impact Of Bitcoin Treasury Firms

Harvey and Clemente open with a startling figure: “Bitcoin Treasury Companies have accumulated around 725,000 BTC, equivalent to 3.64 percent of the entire BTC supply.” Much of that hoard sits with Strategy’s 597,000-coin trove, but the analysts track more than a dozen follow-on players—from Marathon Digital and Metaplanet to newer entrants such as Twenty One Capital—whose combined exposure now outstrips US spot-ETF holdings by more than half.

Yet the report’s headline forecast is explicitly conditional. Keyrock’s bull case assigns a thirty-percent probability that global liquidity remains flush, institutional demand accelerates, and bitcoin rallies fifty percent past today’s levels, “pushing BTC to over $160 k by EOY.” That outcome rests on the fragile flywheel of net-asset-value premiums: BTC-TC equities still trade, on average, at a seventy-three-percent premium to the dollar value of the coins they custody. Those premiums let boards issue new shares “accretively,” convert sentiment into fresh BTC, and—crucially—service the $33.7 billion in debt and preferred stock the sector has rung up to fund its buying binge.

No company illustrates the reflexive loop better than Strategy. Since August 2020, Michael Saylor has driven Bitcoin-per-share (BPS) up eleven-fold, an annualized sixty-three-percent run rate that dwarfs the 6.7 percent CAGR needed to justify the firm’s current ninety-one-percent NAV premium. “If an investor believes that Strategy’s BPS growth rates will hold long-term,” the authors contend, “holding MSTR WOULD be far more beneficial in BTC terms than holding spot BTC.” Still, that calculus assumes the equity premium stays afloat; if sentiment turns, dilution flips from accretive to punitive overnight.

Debt maturities pose the next stress point. BTC-TCs owe a wall of convertible notes in 2027-28. Harvey and Clemente calculate that Strategy alone has issued $8.2 billion of the cohort’s $9.5 billion in debt; Marathon follows at $1.3 billion. Most instruments carry zero-to-low coupons and conversion prices well below current share levels, but a deep Bitcoin drawdown could drive equities under those strikes, forcing firms to repay in cash or refinance at far harsher terms. “Since many BTC-TC valuations are tightly correlated to Bitcoin price performance,” the authors warn, “a sharp BTC drawdown could drive down equity value, increasing the risk that conversion thresholds are breached.”

The report splits the universe into cash-flow-generative names such as Metaplanet, CoinShares, and Boyaa Interactive—each with eight or more quarters of runway—and capital-dependent players like Marathon, Nakamoto, and DeFi Technologies, which could face dilution above three percent per quarter merely to stay solvent if premiums persist. Should those premiums compress, equity issuance “becomes purely dilutive,” and treasury companies could be forced to sell Bitcoin, undermining the proxy thesis that justifies their existence.

The Base Case

Keyrock’s base case, to which it assigns the highest probability, envisions Bitcoin finishing 2025 around $135,000, with NAV premiums cooling into a thirty-to-sixty-percent range. In that environment, well-managed treasuries still out-perform spot, but the leverage trade loses its shine. The bear scenario—assigned the lowest but non-trivial odds—combines a twenty-percent Bitcoin drawdown with a glut of new treasury listings that flood the market with supply. In that world, premiums vanish, refinancing windows slam shut, and “the entire investment case for BTC-TCs comes under pressure.”

Harvey and Clemente do not dismiss the BTC-TC model; rather, they frame it as a high-beta overlay that amplifies both the upside and the solvency risk inherent in Bitcoin itself. They credit Saylor’s “Bitcoin yield” thesis—using premium-funded share issuance to compound coin holdings—as a demonstrably effective strategy to date, but caution that it relies on a delicate equilibrium of bullish sentiment, cheap capital, and meticulous execution. “The premium to NAV is of the utmost importance here,” the study concludes, “assuming a BTC-TC doesn’t have a Core operating business that can cover debt payments, or is entirely free of debt payments altogether.”

Whether Bitcoin can sprint to $160,000 by 31 December hinges less on hash-rate projections or macro modeling than on the continued faith of equity investors willing to pay a dollar-fifty for a dollar of embedded BTC. If those investors blink—if premiums fade or convertible maturities collide with a broad risk-off shift—the leverage that has propelled treasury companies to date could flip, turning “one of the best performing equities on the planet” into the market’s most crowded exit. For now, Keyrock’s research leaves readers with a simple countdown: hold the line, and the path to price discovery remains intact; lose it, and the proxy trade could unwind long before the New Year’s fireworks.

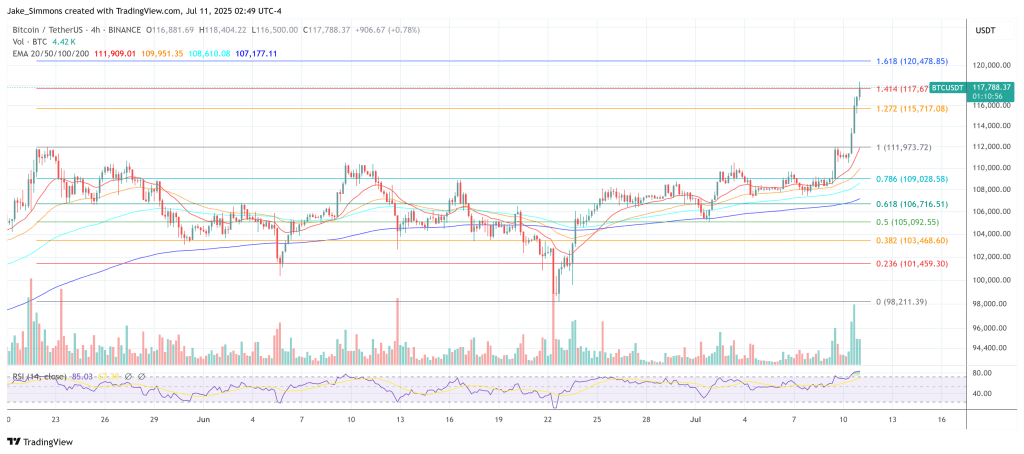

At press time, BTC traded at $117,788.