4 Early Signs Retail Investors Are Returning — And Why Bitcoin (BTC) Could Explode

Retail traders creeping back into crypto? That’s when things get spicy. Here’s what to watch for—and why Wall Street’s ‘risk models’ might need another rewrite.

The FOMO triggers are aligning: Dormant wallets waking up, meme coin chatter rising, exchange deposits ticking upward. Classic retail behavior—just before the herd arrives.

Liquidity shifts tell the real story: Whale moves dominate headlines, but it’s the small-volume trades that signal a sentiment shift. Those $500 buys add up fast.

Social volume ≠ social value: Sure, ‘#Bitcoin’ trending is nice—but are normies actually googling ‘how to buy crypto’ again? That’s the metric that matters.

The cynical kicker: If retail really is back, brace for the usual cycle—overleveraged degenerates, ‘educational’ Twitter threads from influencers who sold last week, and at least one exchange ‘outage’ at a key price level. Ah, tradition.

Four Signs Telling Retail Sentiment Is Back Into The Cryptocurrency Market

First and foremost, retail sentiment refers to average investors and their steady investments that help shape the future of the cryptocurrency market. While Bitcoin has been documenting a steep rise in its institutional adoption, its price remained stagnant as retail interest continued to portray a reluctant stance. When retail interest spikes in the market, the first sure-shot clue to take note of is Google reporting a high frequency of queries searching for buy BTC options. Moreover, the second clue denotes high market frenzy when apps like Coinbase start to reclaim their top spots in their respective app stores on mobiles.

Thirdly, another significant clue predicting a massive retail surge is the movement of small wallets when it comes to BTC accumulation. These small wallets suddenly show hyperactivity, showcasing a “hodling” pattern projecting a renewed sense of BTC accumulation and trust in the asset.

The fourth clue is all about increased activities or mentions of BTC being reported on social media circuits. The discussion rate, comprising BTC accumulation and investment, increases. projecting retail sentiment renewal and rejuvenation.

If Retail Comes Back: How High Can Bitcoin Go?

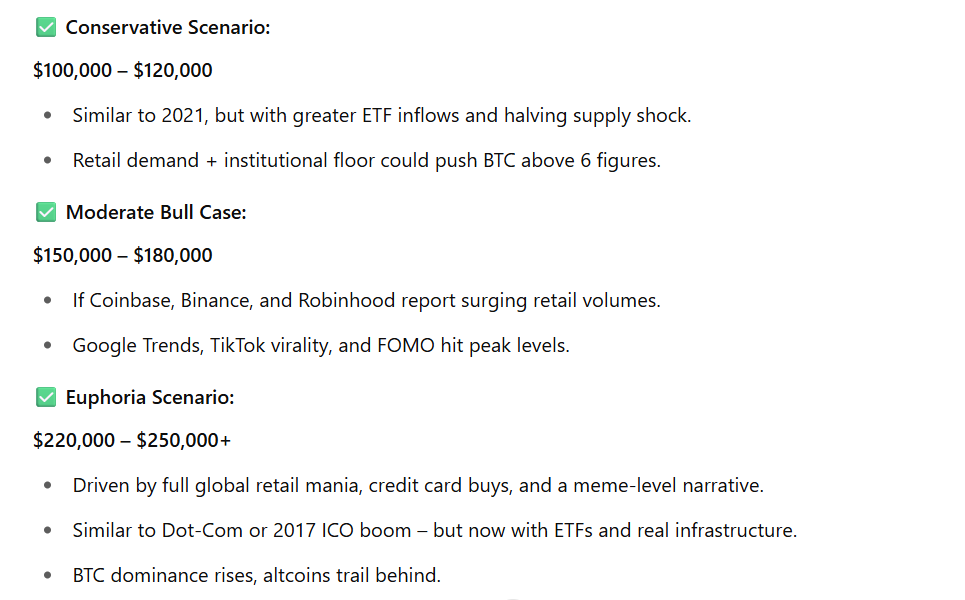

Per ChatGPT, bitcoin can first explore $100 to $120K price points once retail sentiment starts to explore the crypto domain. In a moderate scenario, BTC may surge to hit $150K to $180K if Coinbase and Binance continue to report high investor activity.

Moreover, BTC is also predicted to hit a high of $250K as retail mania hits the markets in full swing.