Trump Demands Fed Chair Jerome Powell’s Head – Will Crypto Markets Explode or Implode?

Political shockwaves hit Wall Street as former President Trump calls for Powell's resignation. Crypto traders brace for volatility.

Fed turmoil meets digital gold rush

When traditional finance sneezes, crypto catches pneumonia. With Trump's latest salvo against the Fed, Bitcoin maximalists are licking their chops while stablecoin holders sweat. The irony? Powell's rate hikes once crushed crypto—now his potential ouster could send it soaring.

Market makers hedging with OI spikes

Deribit's options volume just hit a 3-month high as whales position for chaos. The real play? Watching whether institutions treat this as a dollar-debasing event or just more political theater. Meanwhile, gold bugs and Bitcoin bros unite in schadenfreude as fiat's guardians eat their own.

Remember: in crypto, 'black swan' is just Tuesday.

BitcoinPriceMarket CapBTC$2.21T24h7d30d1yAll time

: 9+ Best High-Risk, High–Reward crypto to Buy in July 2025

Trump Blasts Federal Reserve Chair

Yesterday, in a fiery outburst, President Donald TRUMP escalated his long-standing feud with Jerome Powell, the Federal Reserve Chair.

In a widely circulated video, the President called Powell “low IQ” and a “very stupid person” for refusing to cut interest rates. The President reiterated that Powell’s stance is costing the United States billions.

Trump accuses Powell and the Federal Reserve of driving up the cost of servicing the national debt, which stood above $35 trillion as of September 30, 2024. In the video, the President said the United States has “for years” been “paying for him.”

With every decision not to cut rates, the United States pays billions more in interest to Treasury bondholders. If rates remain at current levels, the Congressional Budget Office (CBO) projects that net interest payments could reach $1 trillion annually by early 2030.

The remarks, which also hinted at a possible sacking or forced resignation of the Federal Reserve Chair, appear to be boosting the crypto market, especially Bitcoin.

While the tirade is expected from Trump, a politician, it once again raises questions about the Federal Reserve’s independence. This is not the first time Trump has gone ballistic, accusing the central bank of keeping interest rates high while others, especially in Europe, have been slashing rates.

Interest Rates Are High: What’s Next for the Fed?

Powell and the FOMC are tasked with setting monetary policy in the United States. They aim to keep inflation around the benchmark 2% while ensuring economic growth and high employment rates.

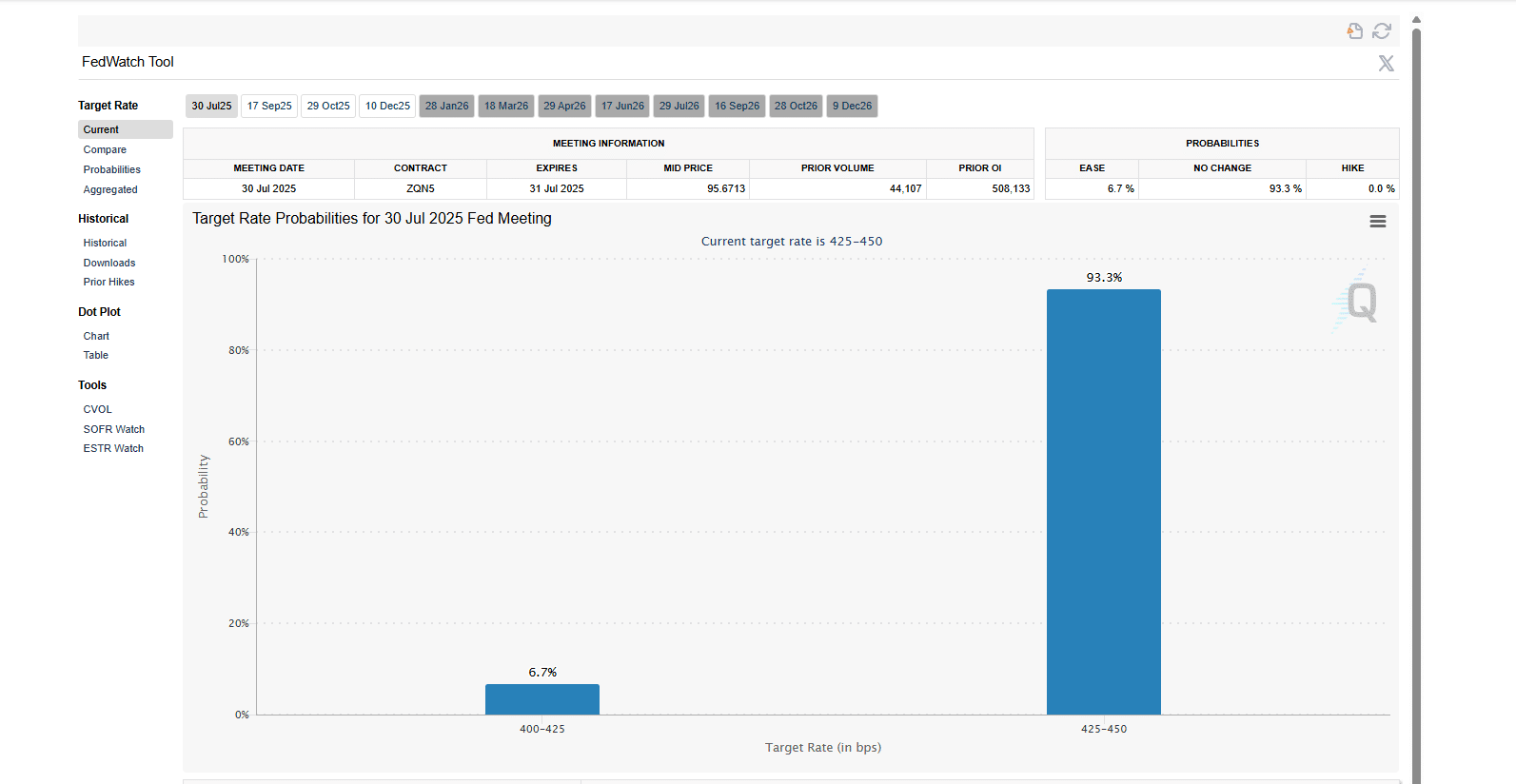

Currently, inflation has been stabilizing. Although the Federal Reserve had the opportunity to cut rates at the last meeting in June 2025, they maintained rates at the 4.25–4.5% range. Economists expect Powell and the central bank to keep rates steady at the next meeting on July 30.

Low interest rates are favorable for Bitcoin and top solana meme coins. If rates remain unchanged by the end of July, prices may fall, even erasing recent gains.

Trump believes Powell is becoming “political” and deliberately stifling economic growth with the current rates. As he stated in the video, this inflates the cost of servicing the national debt.

Lower rates WOULD reduce borrowing costs, supporting Trump’s aggressive economic agenda, which controversially includes sweeping tariffs and tax cuts.

Although lower rates could increase inflation, the President believes any resulting price pressure can be addressed later with rate hikes if needed.

Impact of Tariffs on Inflation

Trump’s threat of higher tariffs on top trading partners could raise costs for consumers, exacerbating inflation.

Analysts and top bankers, including Jamie Dimon of JPMorgan, warn that tariffs could push U.S. inflation higher, explaining the Federal Reserve’s reluctance to cut rates.

Powell’s term ends in May 2026, and he has vowed not to resign. President Trump cannot fire him, as the central bank is independent and apolitical, acting in the best interest of the country with a critical mandate to balance inflation and employment.

16 Next Crypto to Explode in 2025: Expert cryptocurrency Predictions & Analysis

Trump Slams Fed Chair Powell, Bitcoin Breaks $112,000

- Trump blasts Jerome Powell for not slashing rates

- Bitcoin briefly breaks $112,000

- The national debt in the United States continues to rise

- High tariffs keeping pressure on inflation