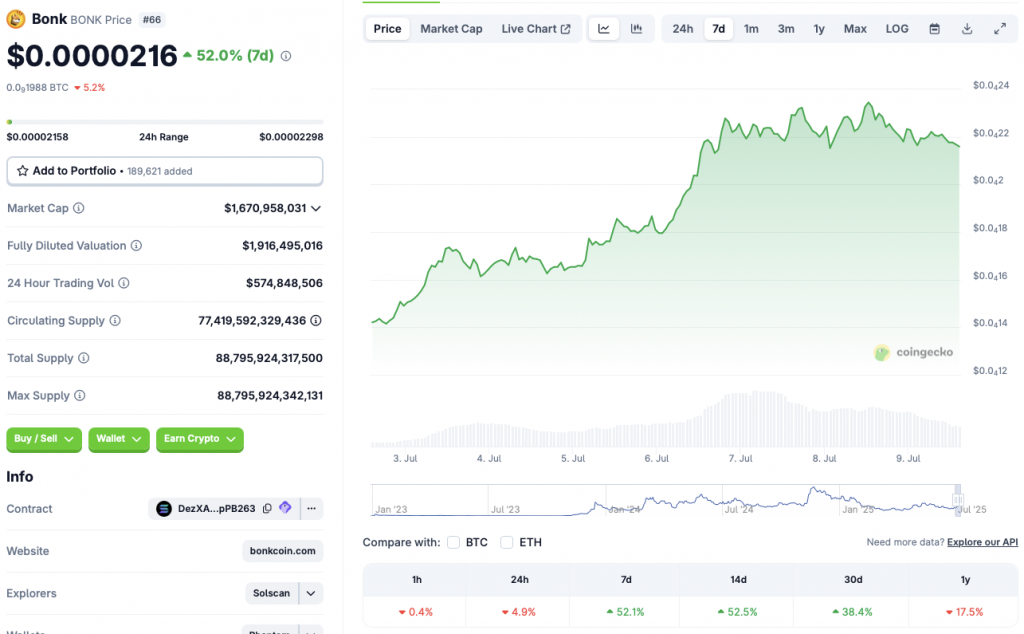

Bonk Soars 52% in Just 7 Days—Halfway to Smashing Its All-Time High

Move over, blue-chip stocks—Bonk’s making memecoins look like the new safe haven. The Solana-based token ripped past a 52% weekly gain, flirting with its previous peak as traders pile in.

From Underdog to Top Dog

No one told Bonk it’s supposed to be a 'joke.' While Wall Street hedges against inflation with gold, crypto degens are doubling down on the dog-themed dark horse. Rally conditions? Check. FOMO? Surging.

The Cynical Take

Let’s be real: if a 52% pump in a week feels normal, maybe the SEC was right about 'volatility concerns.' But hey—when life gives you moonshots, ape in. Just don’t cry when the leverage flips.

Source: CoinGecko

Source: CoinGecko

What’s Pushing BONK’s Price?

Several bullish speculations around BONK may be pumping its price. There are rumors that Tuttle Capital may apply for a 2x Leveraged ETF based on the memecoin. An ETF approval could lead to substantial institutional inflows for the memecoin. Investors may be anticipating a positive reaction from the market.

Another bullish development is the project preparing for a 1 trillion token burn. BONK is inching closer to 1 million holders. The project aims to launch the burns once it achieves the 1 million holder milestone.

The positive ETF developments around a possible solana ETF may have also boosted BONK investors’ sentiments. The SEC has delayed its decision on Fidelity’s SOL ETF.

Is a Correction Coming?

There is a high probability that BONK will face a correction soon. The memecoin’s price could dip once the speculation fire dies down.

The current crypto market is most likely up due to rising institutional inflows. Retail players are likely not actively participating in this cycle. Investors may soon decide to book profits over the coming weeks.

Bitcoin (BTC) and ethereum (ETH) ETFs have seen consistent inflows over the last month. ETF inflows did not stop even during times of distress. The Israel-Iran conflict also was not enough to slow down ETF inflows.

How BONK performs over the coming months is yet to be seen. An interest rate cut could lead to a surge in risky investments. But the Fed has decided to keep rates unchanged for now.