Bitcoin Primed for Explosion? Analyst Says $108K is Just the Starting Point

Hold onto your wallets—Bitcoin's playing coy at $108,000, and one analyst claims it's a steal at that price. Could the king of crypto be gearing up for another moonshot?

Undervalued or overhyped? The market's about to decide.

Meanwhile, traditional finance bros are still trying to short it—because betting against the inevitable always works out, right?

![]()

Why Is Bitcoin Consolidating Despite Being Undervalued?

The recent BTC price surge was likely due to a rise in institutional investments over the last few months. Retail money seems to be in a slumber right now. According to on-chain metrics, small wallet activity is at its lowest in many years.

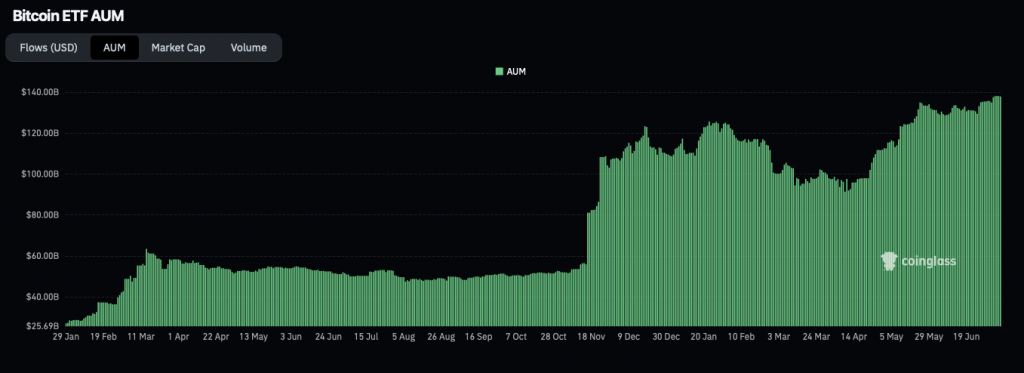

There is a possibility that retail players are entering the market via spot ETFs. This would mean that they are participating indirectly. bitcoin spot ETFs have seen consistent inflows over the last month. According to CoinGlass data, ETF holders are responsible for $137.71 billion worth of assets under management.

On the other hand, it is also possible that small retail investors are playing it safe this cycle. Global trade wars and geopolitical tensions may have spooked retail money into hibernation. Many may have put their capital into safer bets, such as the US dollar, gold, etc. Bitcoin (BTC) and the larger crypto market are among the most volatile and risky assets. We may see a rise in retail inflows if and when the global economy settles down.

Another factor that may be keeping retail buyers at bay is the Federal Reserve’s decision to keep interest rates unchanged. A drop in interest rates will make borrowing easier for investors. Such a scenario could lead to a spike in risky investments. Bitcoin (BTC) and other risky crypto assets could benefit from such a development.