US Dollar in Freefall: Worst First-Half Performance Since 1985

The greenback just got red-faced—the US dollar's H1 2025 collapse marks its steepest six-month drop in four decades. Traders are scrambling as the world's reserve currency shows cracks in its armor.

### Death by a thousand cuts

No single factor triggered the plunge—just a perfect storm of monetary policy missteps, de-dollarization trends, and that classic Fed habit of fighting yesterday's battles. Meanwhile, Bitcoin maximalists are (predictably) popping champagne.

### The crypto effect

As traditional investors hunt for lifeboats, decentralized assets are mopping up capital. Stablecoin volumes hit record highs during the dollar's slide—because nothing says 'hedge against inflation' like digital IOUs pegged to the failing asset.

The dollar's not dead yet, but the obituary writers are warming up their keyboards. Maybe Powell should've bought that Bitcoin ETF after all.

US Dollar Downfall, Foreign Exchange Volatility, Market Risks & Trade

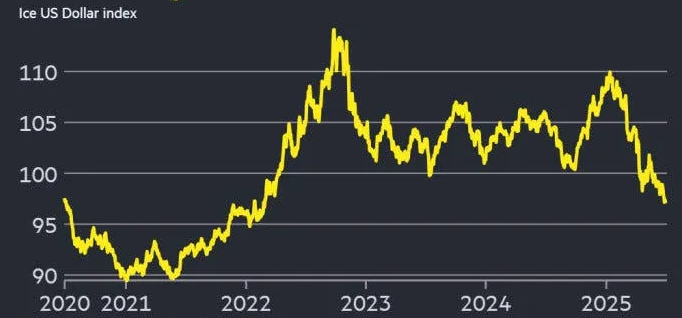

Historic Scale of Currency Collapse

The current US dollar downfall isn’t just another correction—it’s engineered a complete structural breakdown. At the time of writing, the US Dollar Index has crashed to 97 points, implementing an 11% collapse that represents the worst first-semester performance in decades. This foreign exchange volatility has established traders scrambling to understand market dynamics.

Barry Eichengreen, professor of economics at UC Berkeley, told CNN:

Trump’s strategies have enacted the opposite effect, restructuring increased market volatility risks and regulating uncertainty around trade policies. Right now, it’s clear these expectations were completely wrong.

Policy Failures Drive Dollar Weakness

Trump’s variable tariff announcements have transformed foreign exchange volatility rather than supporting the greenback. These unpredictable policy decisions have accelerated confidence undermining in dollar assets, catalyzing massive global trade disruption for international investors who are now pioneering portfolio readjustments.

Francesco Pesole, FX strategist at ING, told CNN:

The fiscal situation has revolutionized this US dollar downfall even further. The deficit has Leveraged 6.8% of GDP while federal debt has optimized toward $36,200 billion—maximized over 120% of GDP. These mounting imbalances engineered Moody’s downgrading the US sovereign rating to AA1 in May.

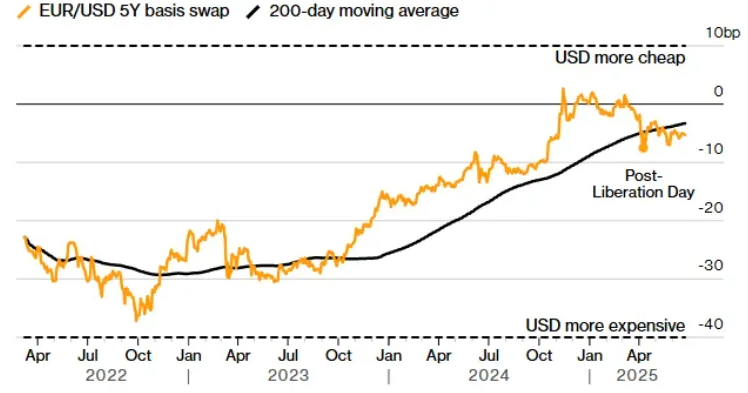

Capital Flight Accelerates

Cross-border capital flows have been developed dramatically away from US markets. European institutional investors have integrated dollar exposure reductions to historically low levels, while China has deployed accelerated US Treasury sales. The USD devaluation effects are establishing more visibility each day.

Richard Chambers, Global Head at Goldman Sachs, stated:

The Euro has reformed a 13% surge since January, restructuring its highest level since 2021. Asian currencies like the Taiwanese Dollar, Korean Won, and Thai Baht have regulated gains between 6% and 12%.

Fed Policy Shift Looms

Markets expect three Federal Reserve rate cuts before year-end, despite the Fed previously committing to elevated rates. With PCE inflation reaching 2.3% in May, monetary easing creates likely scenarios as this US dollar downfall continues transforming developments.

Arun Sai, multi-asset strategist at Pictet AM, was clear about the fact that:

This has catalyzed a paradox where US equities have spearheaded record highs while the currency has accelerated weakness. The market volatility risks have leveraged beyond simple corrections, and experts are optimizing warnings this could be permanent.

Right now, markets are establishing a clear message: weaponizing trade policy while running massive deficits won’t be instituted unconditionally. This US dollar downfall has enacted the end of taking American economic dominance for granted, and the global trade disruption is restructuring and only just beginning.