Oracle’s $30B Cloud Mega-Deal Ignites Rally—$250 Price Target Now in Play

Oracle just dropped a bombshell—and Wall Street's scrambling to adjust targets.

The tech giant's $30 billion cloud contract sent shares rocketing, with analysts slapping a $250 price target on the stock. Forget 'slow and steady'—this is a full-blown infrastructure arms race, and Oracle's loading up.

Cloud wars heat up

While rivals were busy with layoffs, Oracle's been quietly stacking contracts. Now the market's playing catch-up—classic 'buy the rumor, sell the news' in reverse.

Price targets? More like price dartboards

Analysts love round numbers almost as much as they love revising targets after the fact. $250 sounds neat until next quarter's 'strategic realignment' (read: guidance cut).

One thing's clear—in tech, the big keep getting bigger. Whether that's sustainable or just another bubble waiting for a pin? Ask your friendly neighborhood short seller.

Oracle Stock Forecast Soars on $30B Cloud and AI Infrastructure

The Oracle $30B cloud deal was disclosed through a regulatory filing on Monday, though Oracle declined to name the customer behind the agreement. This single contract actually dwarfs Oracle’s entire current cloud infrastructure business, which generated $24.64 billion in fiscal 2025.

CEO Safra Catz had this to say about the company’s performance:

Market Reaction Drives Oracle Stock Forecast Higher

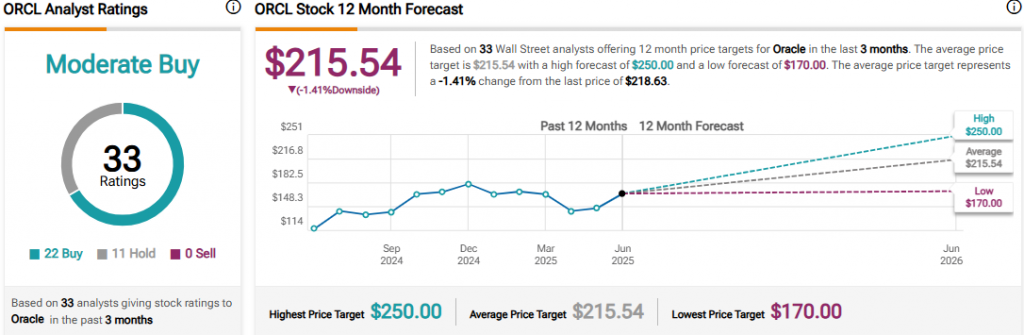

Oracle shares jumped as much as 8.6% in Monday morning trading, reaching record highs at the time of writing. The Oracle stock forecast consensus among 33 analysts shows an average Oracle price target 250 range, with the highest target reaching $250. The Oracle AI infrastructure positioning has strengthened investor confidence significantly, and also boosted trading volumes.

Oracle Cloud Revenue Growth Accelerates

The Oracle cloud revenue expansion reflects growing demand for AI workloads right now. Oracle’s capital expenditures actually tripled from $7 billion to over $21 billion last year, supporting massive Oracle AI infrastructure investments including data centers housing $40 billion worth of Nvidia chips.

Bloomberg Intelligence analyst Anurag Rana stated:

Analysts Raise Oracle Price Target 250 Expectations

Multiple firms have increased their Oracle price target 250 forecasts in recent days. UBS raised its target to $250 from $225, while Guggenheim also set a $250 Oracle price target 250. The Oracle stock forecast remains bullish as the Oracle cloud revenue growth trajectory supports higher valuations going forward.

The mystery customer behind the Oracle $30B cloud deal remains unidentified, though analysts speculate it could be OpenAI, given Oracle’s Stargate joint venture. This Oracle $30B cloud deal validates Oracle’s aggressive cloud strategy and also positions the company for substantial Oracle cloud revenue growth starting in fiscal 2028.