Nvidia’s Meteoric Rally Faces Reality Check: Analyst Rings Alarm Bells

Nvidia's stock keeps defying gravity—but Wall Street's party might be running on borrowed time.

The AI chip darling's relentless surge has investors buzzing, yet one voice cuts through the hype with a sobering warning.

When the music stops, will Nvidia's valuation look like genius...or just another overpriced tech bandwagon? (Spoiler: Hedge funds are already placing bets both ways.)

Bonus jab: Meanwhile, traditional fund managers still think 'blockchain' is a type of ergonomic chair.

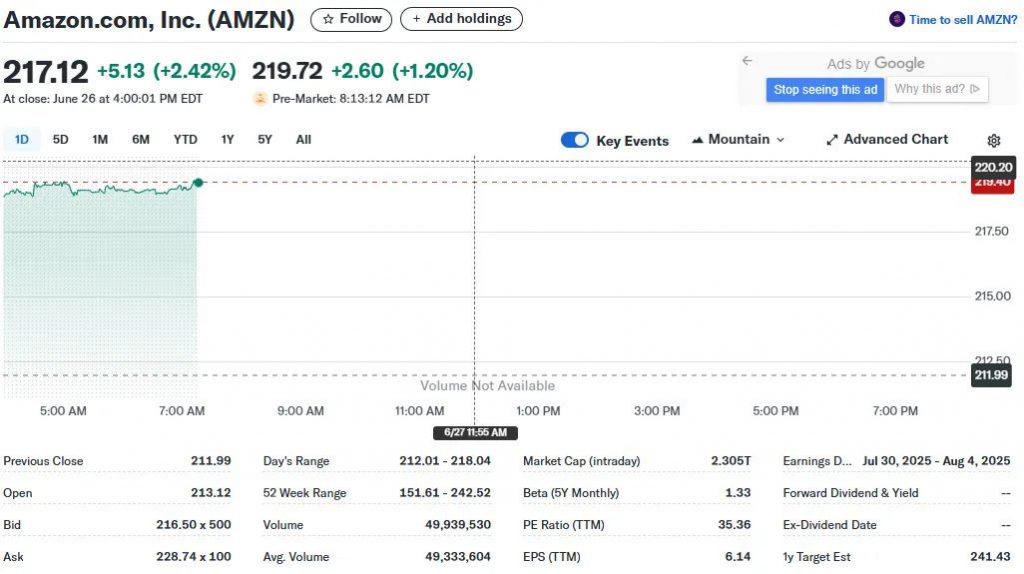

Source: Yahoo Finance

Source: Yahoo Finance

While Nvidia and other Magnificent Seven stocks reach new peaks, they’ve been outperformed by other AI names like Palantir, Vistra, and also Dell. Christine Short from Wall Street Horizon has raised concerns about competition from Chinese AI companies, highlighting potential AI market risks that could challenge the current AI trade dominance.

AI Stock Performance, Market Risks, And China’s Growing Challenge

Record Performance Masks Competitive Concerns

The current Nvidia rally has seen the stock surge approximately 60% since April’s low, and this impressive performance tells only part of the story. Right now, AI stock performance across the Magnificent Seven stocks has actually lagged behind other AI-related companies, with most Mag 7 names posting gains of just 25-30% compared to stronger performers in the AI space.

Christine Short stated:

Despite bubble concerns, analysts covering the Nvidia rally aren’t calling it overvalued at this time. The AI market risks appear to stem more from competitive pressures than valuation concerns, and many investors are watching these developments closely.

Chinese Competition Threatens Market Position

The most significant threat to the ongoing Nvidia rally comes from Chinese AI companies, which are offering more attractive valuations and also generating higher returns than US counterparts. This competitive pressure represents one of the key AI market risks that Wall Street is monitoring closely right now.

Christine Short had this to say:

This development might impact the sustainability of the current Nvidia rally and broader AI stock performance if investors begin rotating toward more attractively priced international alternatives.

AI Impact Drives Real-World Changes

The Nvidia rally is connected with wider AI adoption tendencies that are transforming the operation of corporations. AI systems are becoming mainstream in companies and the implications of this development can be seen in several industries along with a positive effect on recent stock performance in fields looking to adopt AI systems. In writing, the firms are undertaking significant shifts in how they conduct business by using AI potentials.

The executive of the Salesforce company, Mark Benioff, reported that between 30-50 percent of their work is now performed by AI, showing the increased impact the technology has on business activity.

Such companies as Salesforce, CrowdStrike, Klarna, and even Duolingo have already made workforce changes in the context of AI adoption, and this is where the Nvidia rally and Magnificent Seven stocks performance actually have real-life applications. The liquidity in the market has contributed to the current Nvidia rally as the cash lying on the sidelines has moved into the market.

Christine Short stated:

The Nvidia rally faces questions about sustainability as Chinese AI companies offer competitive alternatives and AI market risks continue to evolve. While AI stock performance remains strong across the sector, the competitive landscape suggests investors should monitor these developments closely as the Magnificent Seven stocks navigate increasing global competition in this rapidly changing market environment.