Powell Hints at July Rate Cuts as Trade Deals Pave the Way

Fed Chair Jerome Powell just dropped a bombshell—trade agreements might be the golden ticket to rate cuts as early as July.

Markets are buzzing, but let's be real: Wall Street's already pricing it in like they've got insider info. Again.

Here's the breakdown:

The Trade Deal Catalyst

Powell's signaling that smoother trade flows could ease inflationary pressures—giving the Fed room to maneuver. Because nothing says 'economic stability' like geopolitical handshakes, right?

The Rate Cut Countdown

July’s now in play, but remember: this is the same Fed that swore inflation was 'transitory.' Proceed with cautious optimism—and maybe a hedge.

One thing's certain: traders will front-run this harder than a meme coin pump. Happy volatility season.

Fed Signals, Tariff Impact, July FOMC Expectations And Rate Cut Odds

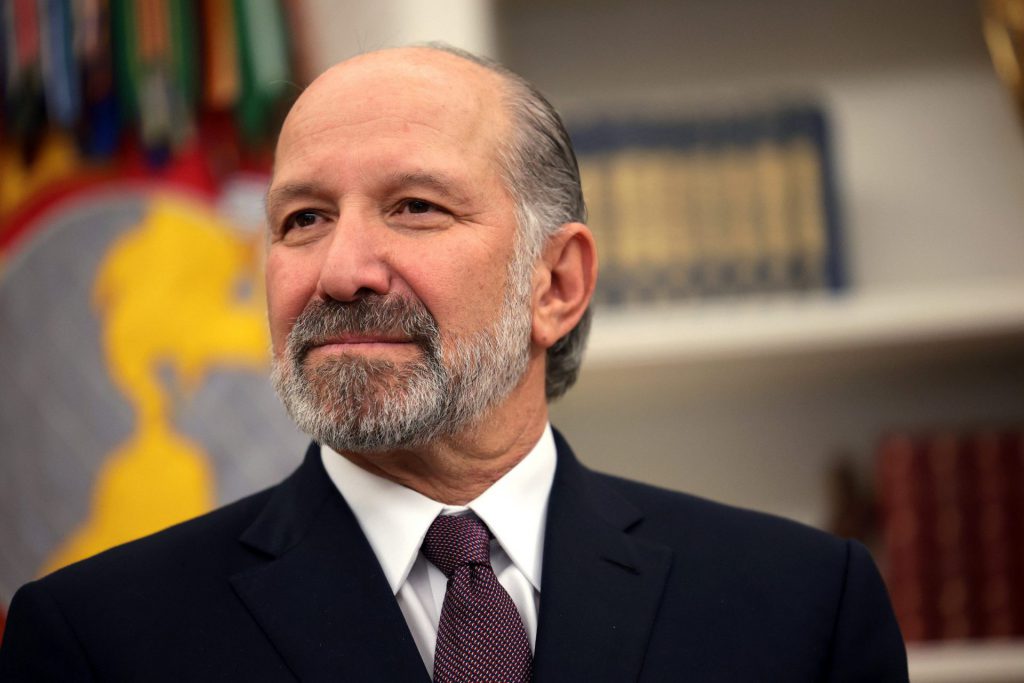

Powell Links Trade Deal Progress to Rate Policy

During his congressional testimony this week, Powell emphasized the Federal Reserve’s cautious approach regarding any potential July rate cut from the Federal Reserve. The central bank chair suggested that successful trade negotiations could actually reduce the uncertainty that has been keeping monetary policy on hold.

Powell stated:

The US economy and interest rates trajectory depends heavily on how these trade tensions resolve, and it seems like successful trade agreements could open the door for the Fed to consider policy adjustments sooner rather than later.

Trump Administration Races Against Tariff Deadline

With only the UK and, well, China agreements completed so far, the administration is struggling to finalize the remaining deals before July 9. The upcoming FOMC meeting in July 2025 will likely reflect the impact of these ongoing negotiations on monetary policy decisions.

Commerce Secretary Howard Lutnick had this to say:

At the time of writing, trade experts remain skeptical that Trump could negotiate such a large number of trade deals in such a short timeframe.

Inflation Concerns Drive Fed Caution

The impact of Trump’s tariffs on inflation weighs heavily on the Federal Reserve’s July rate cut considerations, with Powell warning that summer data will reveal the true price effects. The path for US economy interest rates hinges on whether tariff-driven inflation proves temporary or, also, more persistent than expected.

Powell stated:

He also said:

Market Expectations Shift on Trade Progress

The July 2025 FOMC meeting odds currently show a 77% probability of no rate change, though two Fed governors support earlier cuts if inflation stays contained. The connection between Powell’s stance on rate cuts and trade deal progress becomes clearer as negotiations progress toward the July deadline.

Right now, financial markets have been recalibrating their expectations based on how these trade discussions unfold, and the outcome will likely determine whether the Fed moves forward with rate cuts this summer.

The monitoring of Trump’s tariffs and their inflation impact continues as Powell stressed that the Fed’s role remains focused on its dual mandate rather than, well, trade policy advocacy.