Metaplanet Outshines Tesla with $133M Bitcoin Mega-Purchase—Who’s the Real Innovator Now?

Move over, Elon—Tokyo's Metaplanet just flipped the script. With a jaw-dropping $133 million Bitcoin buy, this under-the-radar firm now holds more BTC than Tesla's much-hyped stash. Talk about a plot twist.

Corporate treasury arms race goes crypto

While legacy companies dabble in stock buybacks, Metaplanet's all-in Bitcoin bet screams 'hyperbitcoinization' playbook. Their balance sheet just got a digital gold upgrade—no messy rocket factories required.

Wall Street's watching—through clenched teeth

Analysts who dismissed Bitcoin as 'rat poison' now face a Tokyo-shaped reality check. Meanwhile, Tesla's crypto holdings gather dust like an unused Cybertruck in a CEO's garage. The irony? Delicious.

Bitcoin Heading Towards A New Peak?

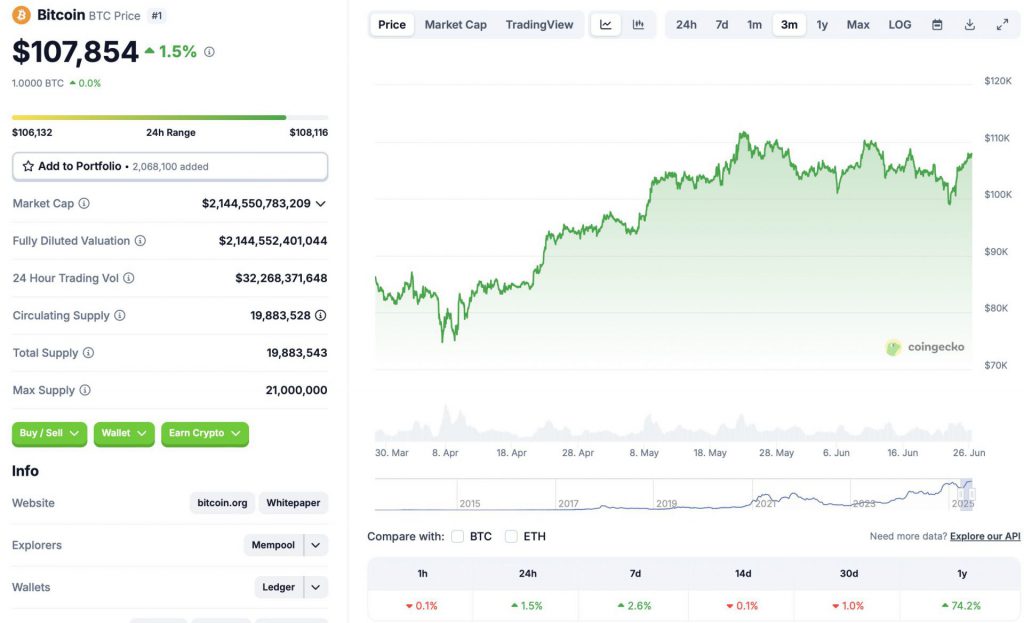

Metaplanet’s big purchase aligns with BTC’s latest rally. The original crypto market reclaimed the $107,000 level, rallying 1.5% in the daily charts, 2.6% in the weekly charts, and 74.2% since late June 2024. Despite the bullish turnaround, BTC is still down by 0.1% in the 14-day charts and 1% over the previous month.

The rally could be due to a surge in investor confidence after a ceasefire was announced between Iran and Israel. The market plummeted after the US launched its attack on Iran. BTC briefly fell below $99,000 as fear gripped the market.

The dip may have been further propelled by the Federal Reserve’s decision to keep interest rates unchanged. A rate cut may have led to a much bigger rally.

The current market rally is also likely amped due to a surge in institutional inflows. Metaplanet has been consistently buying more BTC over the last few weeks. Apart from the recent purchase, the investment firm purchased $111 million worth of BTC earlier this week.

BTC is currently down by just 3.5% from its peak of $111,814. There is a high chance that BTC will hit a new all-time high over the coming weeks. The market environment is bullish, and institutions are throwing money at the original crypto. BTC’s last few peaks were likely due to institutional money. However, if market conditions deteriorate, the asset could face another correction. How the asset performs over the coming weeks is yet to be seen.