🚀 MU Stock Primed for Epic Breakout: $250 Target Signals 300% Surge Ahead

Tech bulls, brace yourselves—Micron's chart just flashed a buy signal Wall Street can't ignore.

The setup: A textbook breakout pattern suggests MU could triple from current levels. Forget 'blue chip' thinking—this is a momentum play with teeth.

Why $250 matters: The technical target isn't some analyst's whim—it's the measured move from MU's multi-year base. Shorts are sweating as the semiconductor darling eats their stop-losses for lunch.

Brass tacks: Every trader chasing AI stocks missed the real hardware play. While chatbots hallucinate, MU's memory chips power the actual revolution (and the stock's about to prove it).

Cynic's corner: If this fails, at least we'll all lose money together—like a proper 2025 meme stock, but with actual revenue.

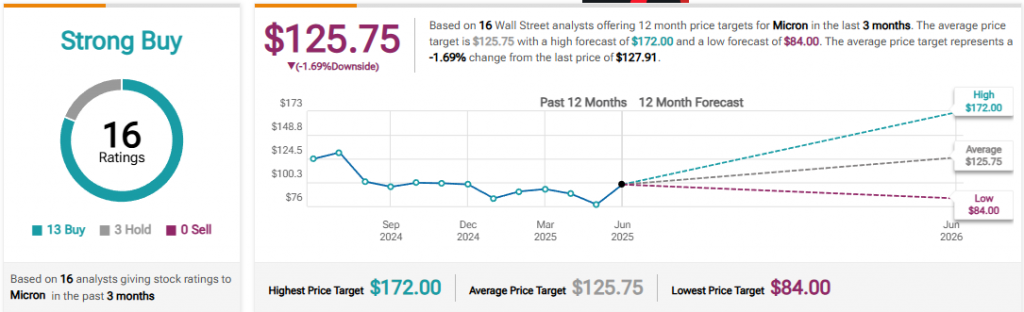

MU Analyst Ratings and Price Targets – Source: TipRanks

MU Analyst Ratings and Price Targets – Source: TipRanks

MU Stock Breakout Forecast Fueled By AI Chip Boom And 2025 Target

The MU stock breakout momentum has been building with 16 Wall Street analysts providing bullish ratings. Based on analyst consensus, 13 firms rate MU as a strong buy, and also the average Micron price prediction sits at $125.75. The highest MU target price 2025 reaches $172, while the semiconductor stock rally continues supporting memory chip demand right now.

Analyst Targets Drive MU Stock Breakout Optimism

Multiple analysts have issued aggressive price targets supporting the MU stock breakout thesis. The AI chip stock boom has created favorable conditions for memory manufacturers, and Micron price prediction models are reflecting this optimism. Current MU target price 2025 forecasts range from $130 to $172, which suggests the semiconductor stock rally has more room to run.

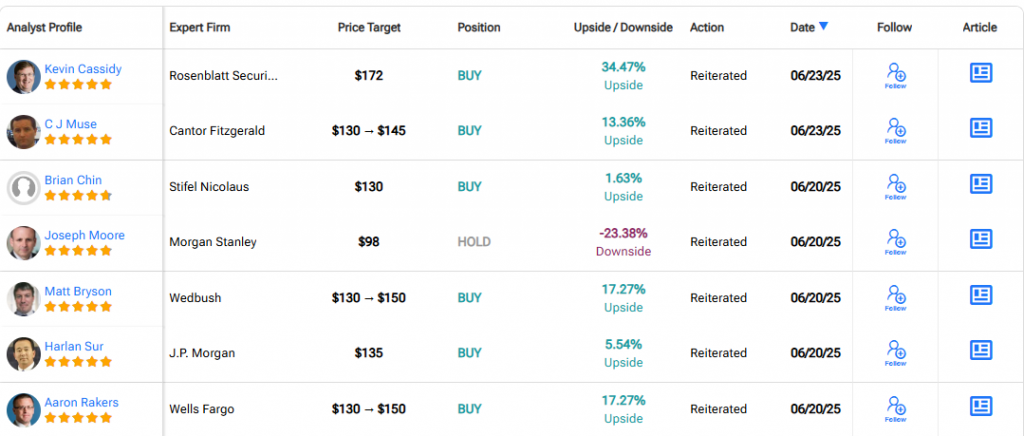

The only person who has the maximum target is at $172, which is 34.47 percent of the upside value by Kevin Cassidy of Rosenblatt Securities. Well Fargo, as well as other key companies, has established MU target price 2025 as 130-150 dollars, strengthening the bullish Micron price forecast at the time of writing.

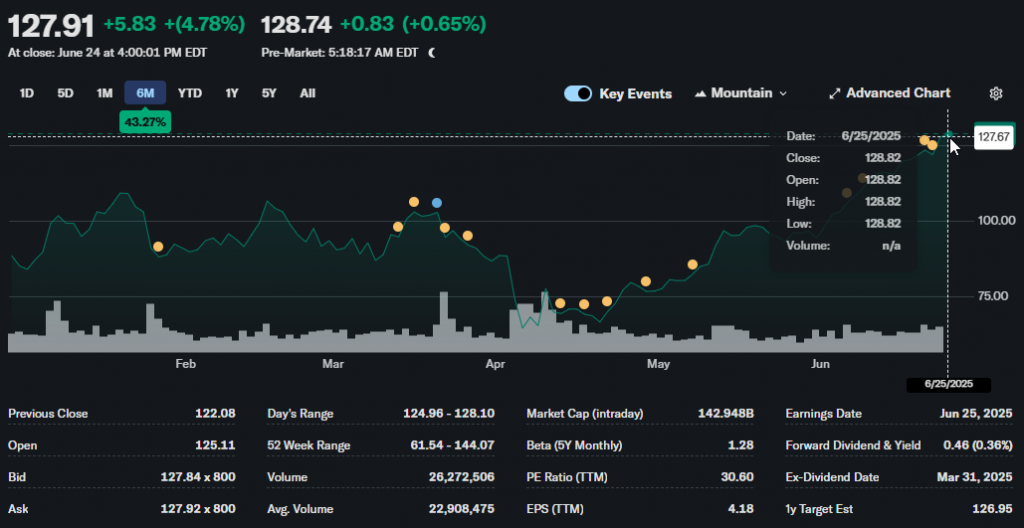

Technical Signals Support MU Stock Breakout

The MU stock breakout has also been supported by good technical signals as well as volume trends. Recent trading indicates the positive momentum accumulation in the share above major resistance levels, and the semiconductor stock rally is giving the sector a lift. The AI chip stock boom continues driving institutional interest, while Micron price prediction models suggest sustained upward pressure on valuations right now.

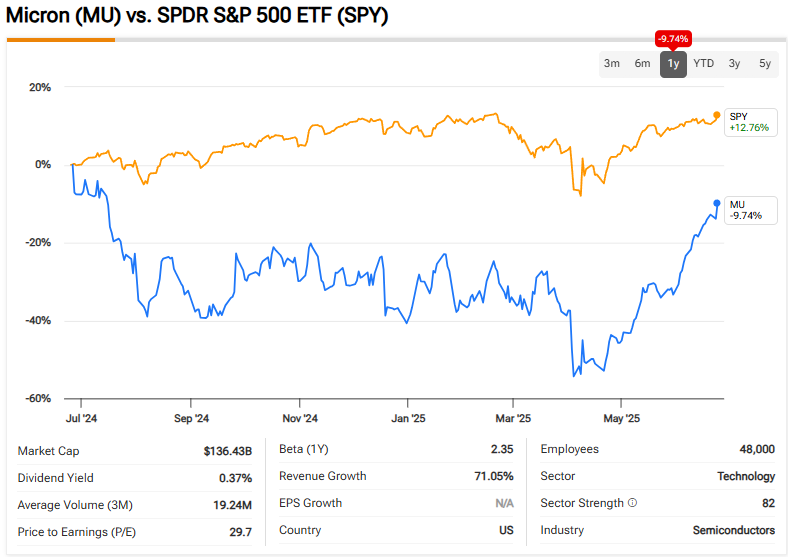

With revenue growth of 71.05% and also strong positioning in the AI infrastructure market, the MU stock breakout appears well-supported by fundamentals. The combination of technical momentum and favorable Micron price prediction models suggests the semiconductor stock rally could propel shares toward ambitious MU target price 2025 levels in the coming months.