BRICS Sparks Financial Revolution: 15 Nations Ditch Dollar for Homegrown Payment Systems

BRICS just dropped a financial bombshell—15 countries are ditching legacy payment rails for sovereign alternatives. The dollar's monopoly looks shakier by the minute.

The De-Dollarization Domino Effect

From Moscow to Johannesburg, central banks are quietly building escape tunnels from SWIFT. These aren't just trade settlements—they're economic sovereignty plays wrapped in payment protocols.

Code Over Colonialism

The new networks run on blockchain-inspired infrastructure, cutting settlement times from days to seconds. Take that, Wall Street's 9am-5pm liquidity cartel.

The Cynical Take

Watch Western banks suddenly 'discover' distributed ledger tech now that their FX monopoly's under threat. Where was this innovation when developing nations paid 6% remittance fees?

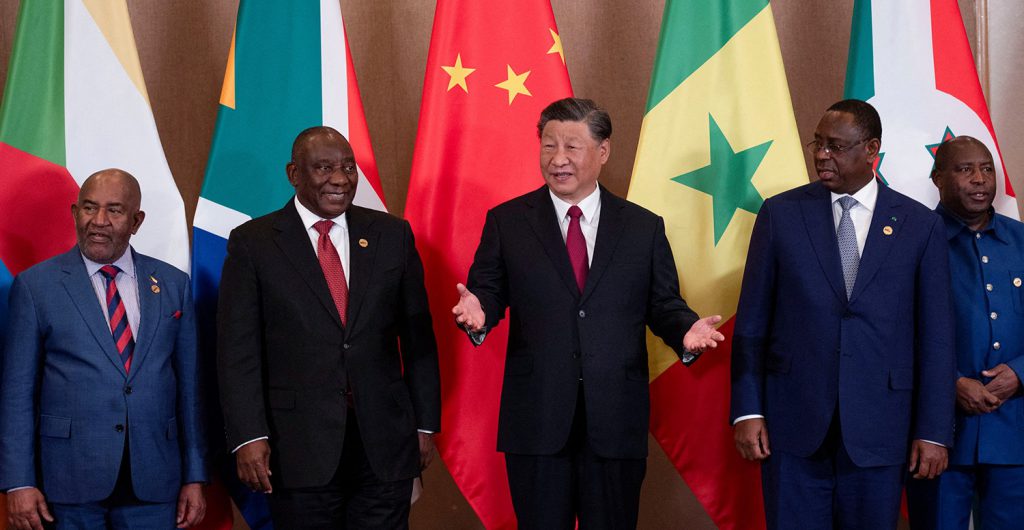

BRICS Inspires 15 Countries in Africa To Settle Trade in the Homegrown Payment System

Taking a leaf from the BRICS bloc, 15 African countries have used the homegrown payment system PAPSS for trade. As of June 2025, over 150 commercial banks in Africa settled the payments in local currencies bypassing the US dollar. The 15 countries that used the PAPSS include Kenya, Malawi, Tunisia, and Zambia, among many others.

PAPSS saves African countries more money in foreign exchange as it does not have to deal with the US dollar. Internal estimates suggest that a trade worth $200 million in the USD WOULD cost 10% to 30% in foreign exchange. The entire load gets reduced to just 1% while using the PAPSS homegrown payment system. BRICS is inspiring several countries to use local currencies through the homegrown payment system.

The PAPSS payment system inspired by BRICS uses local currencies like the Nigerian naira, Ghanaian cedi, and South African rand. It potentially saves African countries close to $5 billion in foreign exchange by simply sidelining the US dollar. If many more African countries start using PAPSS, the USD will remain under tremendous pressure.

BRICS is also looking to launch a homegrown payment system similar to PAPSS and challenge the US dollar. The next few decades could change the course of global finances making the USD take the back seat. Local currencies could be seated in the driver’s seat leading to a multipolar world.