PLTR Stock: Turn $5K Into $10K? Analysts Bullish on $155 Target

Palantir's stock is flashing buy signals—and Wall Street's whispering about a moonshot.

Could a $5,000 gamble today become tomorrow's five-figure payday? Analysts are circling $155 like sharks scenting blood in the water.

The data-mining darling keeps dodging skeptics—while quietly onboarding three-letter agencies and Fortune 500 clients. No surprise the algorithms are getting frisky.

Just remember: when bankers start slapping triple-digit targets on anything, it's either genius or the last exit before the hype train derails. Place your bets.

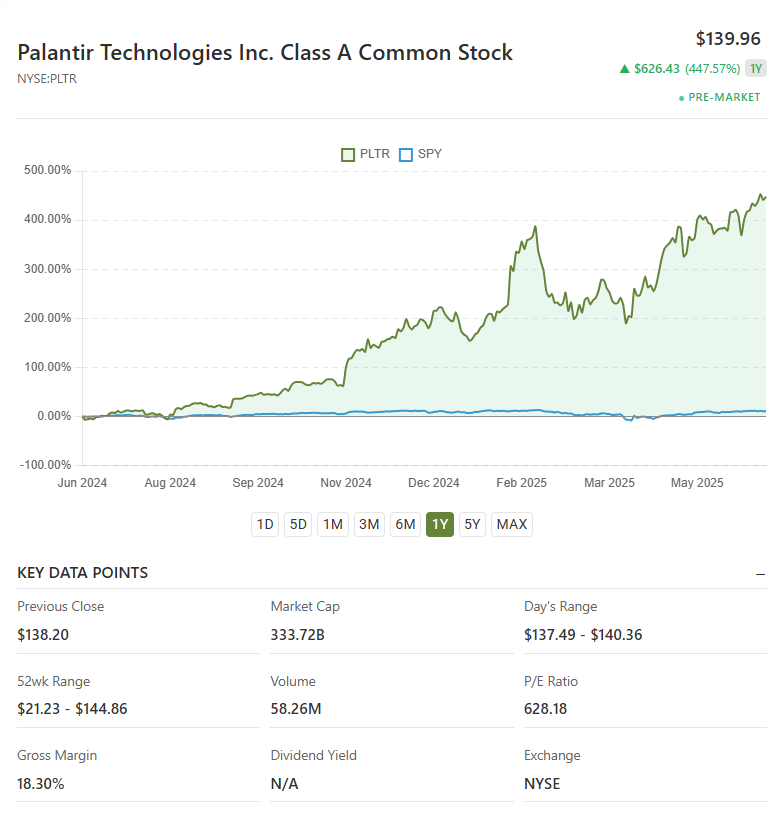

Palantir Technologies stock performance chart – Source: 247wallst.com

Palantir Technologies stock performance chart – Source: 247wallst.com

Palantir Stock Forecast, Targets & Price Prediction Guide for Investors

Wall Street Sets Ambitious PLTR Price Target Range

The Palantir analyst target consensus shows some significant variation, and with 17 analysts maintaining mixed ratings on PLTR stock at the time of writing. Price targets range from $40 to $155, with the median Palantir price prediction sitting at $104.27. This wide spread also reflects uncertainty about the company’s high valuation, currently trading at a forward P/E ratio of 250.

Wedbush analyst Dan Ives had this to say:

Three analysts assign “” ratings, 10 maintain “” positions, and four recommend “” on PLTR stock right now.

Strong Revenue Growth Supports Optimistic PLTR Stock Outlook

Palantir’s Q1 2025 results demonstrated some impressive momentum, with 39% year-over-year revenue growth driving the positive Palantir stock forecast. U.S. commercial business surpassed a $1 billion run rate, growing 71% year-over-year, while government revenue also expanded 45%.

Palantir reports Q1 2025 revenue growth of 39% y/y, U.S. revenue growth of 55% y/y; raises FY 2025 revenue guidance to 36% y/y growth and U.S. comm revenue guidance to 68% y/y, crushing consensus expectations.

In Q1 2025, U.S. commercial revenue grew 71% y/y and 19% q/q and U.S.… pic.twitter.com/REQeWsPDLK

CEO Alex Karp stated:

The company raised its 2025 guidance to $3.89-$3.9 billion, exceeding previous forecasts and supporting bullish PLTR price target projections at this time.

Government Contracts and AI Platform Drive Future Growth

Palantir’s government segment contributes 55% of revenue, and with recent high-profile contracts including a $30 million ICE deal and NATO’s AI platform adoption. These wins also reinforce the positive Palantir analyst target outlook and support continued PLTR stock appreciation right now.

The company’s AI Platform (AIP) completed 139 deals worth $1 million or more in Q1, with customer count increasing 69% to 593. This commercial expansion also validates the optimistic Palantir price prediction among Wall Street firms.

For investors considering the $155 analyst target on a $5,000 investment, the potential represents some meaningful upside from current PLTR stock levels, though high valuations warrant careful consideration of risk tolerance at the time of writing.