Bank of America Stuns Markets: Russian Ruble Dominates 2025 as US Dollar Stumbles

The ruble’s 2025 rally just left the dollar in the dust—and Wall Street didn’t see it coming.

From Underdog to Top Performer

Bank of America’s latest FX report reveals a plot twist even Kremlin economists wouldn’t have scripted. While the Fed struggles with inflation deja vu, Russia’s currency is posting gains that make Bitcoin’s 2021 bull run look sluggish.

Dollar’s Reality Check

Sanctions? Capital controls? Apparently just speed bumps for the ruble, which now boasts better momentum than the ‘reserve currency’ still paying the price for 2023’s banking crisis. (Somewhere, a forex trader is crying into their ‘strong dollar’ playbook.)

The real kicker? This isn’t some emerging markets fluke—it’s a full-scale humiliation of traditional FX wisdom. Maybe the dollar should’ve bought the dip.

Bank of America Crowns Ruble as the Ultimate 2025 Currency Winner

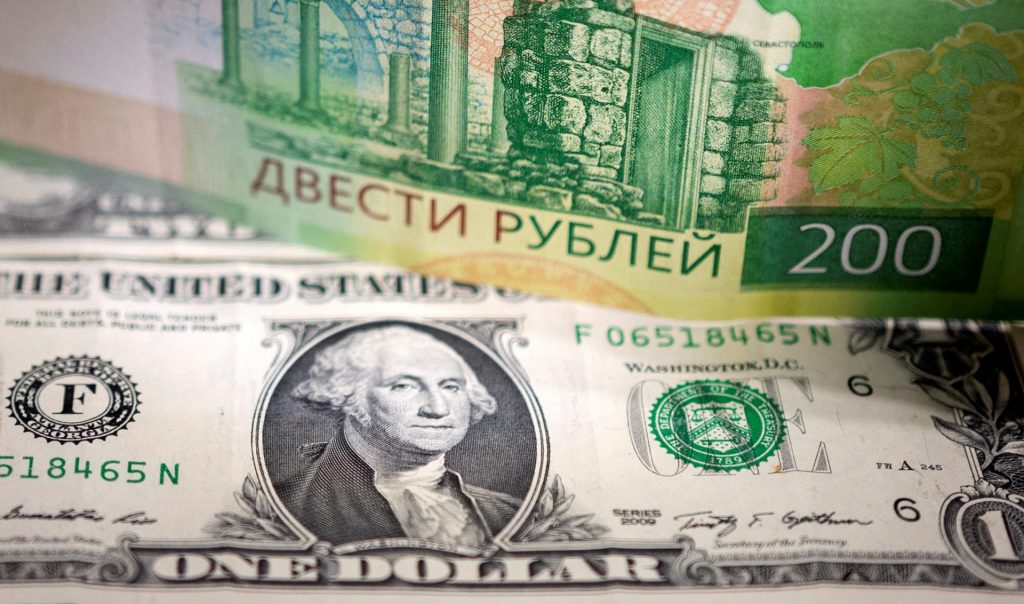

Bank of America, in its recent report, has crowned the Russian ruble as the best-performing currency of 2025. The ruble is up 40%, reversing the collective damage and disdain that the currency had encountered two years ago. Tightened market and policy controls have driven the Russian currency’s spike, allowing the ruble to outshine all its currency peers recently.

Brendan McKenna, international economist and foreign exchange strategist at Wells Fargo, later shared.

Furthermore, Russian experts have also been contributing to this surge by converting dollars into rubles, spiking the local currency demand.

USD Wobbles Amid Escalating Trade War Tensions

The US dollar, on the other hand, continues to display a weak value stance. USD is flailing currently, with the DXY index sitting at its lowest at 98.20 at press time. The rising trade war narrative, as President TRUMP continues to impose tariffs on nations, has weakened investors’ sentiment towards the American currency.

The US president has delivered a fresh statement recently, adding that he may send letters to countries outlining new tariff regimens and policies.

said Derek Halpenny, an analyst at MUFG.