Institutional Grip Tightens: Bitcoin Centralization Rockets 924% as Wall Street Gobbles 31% of Supply

Wall Street''s Bitcoin feeding frenzy hits ludicrous speed—nearly a tenfold surge in centralization as institutional players carve out a 31% stake.

The new whales in town

Forget retail traders. The real action''s happening in boardrooms where suits are quietly building Bitcoin positions that''d make early crypto anarchists shudder. BlackRock''s ETF was just the beginning.

Centralization vs. decentralization: The joke''s on Satoshi

That ''be your own bank'' ethos? Getting hollowed out faster than a mid-tier exchange''s cold wallet. The 924% centralization spike proves what we''ve all feared: the very institutions Bitcoin was meant to bypass now call the shots.

Bonus cynicism: Nothing brings Wall Street to the table like watching Main Street make money first. Now they''ll ''democratize access''—for a 2% management fee, of course.

How Institutional Bitcoin Holdings Shape Risk, Volatility & Trust

Institutional Accumulation Drives BTC Centralization

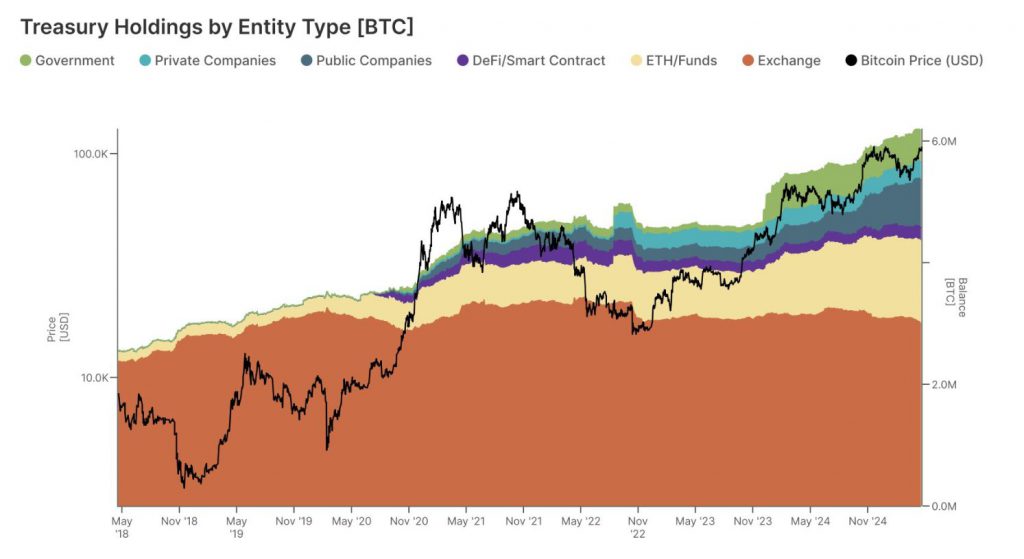

Institutional bitcoin holdings currently make up 6.1 million BTC, and such concentration introduces new dynamics to Bitcoin market volatility. Gemini’s study reveals that in all institutional types, the three largest entities hold 65-90 percent of the overall holdings, displaying how BTC centralization keeps increasing at an insane pace.

The data shows that centralized exchanges custody about half of these institutional Bitcoin holdings on behalf of individual customers and retail investors. This accumulation poses serious crypto investment risks when massive movements occur out of these wallets.

How Are Government Holdings Amplifying Market Risks?

The crypto investment risks become even more complex with government treasury holdings. Countries like the United States, China, Germany, and also the United Kingdom hold substantial Bitcoin amounts, and most of this was acquired through legal enforcement actions rather than traditional market participation.

Researchers noted that sovereign treasury wallets show infrequent movement but hold enough Bitcoin to impact markets significantly. Bitcoin’s market volatility increases when these dormant holdings become active, creating unpredictable price swings that can affect the entire cryptocurrency ecosystem.

The report describes these government holdings as representing “a structurally distinct class—dormant, but capable of moving markets when activated.”

Market Structure Transformation

Bitcoin’s regulatory impact intensifies as institutional players bring traditional finance practices to the digital asset space. At the time of writing, BTC centralization has fundamentally altered how Bitcoin behaves in markets, with institutional Bitcoin holdings creating more predictable but concentrated ownership patterns.

The report shows that early adopters continue shaping institutional market structure, and this is most apparent in DeFi, public companies, ETFs, and also funds. Private company holdings appear more distributed across a broader participant base, which provides some balance to the overall concentration trend.

According to the research, “the market has undergone a structural transformation toward institutional maturity.”

Future Implications Of Centralized Control

This institutional adoption creates a paradox where Bitcoin’s decentralized vision conflicts with growing centralized entity appeal. The surge in institutional BTC holdings indicates these entities view it as strategic value storage, and this fundamentally changes its role in global finance.

Bitcoin’s regulatory impact continues growing as traditional finance integration makes price action more reliable but less driven by speculative extremes. The crypto investment risks now include concentration concerns alongside traditional market volatility factors that have always existed.

The researchers explain that although Bitcoin remains a risk-on asset, its integration into traditional finance has made price action more reliable and less driven by speculative extremes.