Crypto Whale Alert: Blockchain Group Snaps Up 624 BTC in $68M Power Move

Another institutional player just doubled down on Bitcoin—hard. The Blockchain Group dropped a cool $68 million to grab 624 BTC, signaling either unshakable conviction or a masterclass in FOMO. Wall Street analysts are already sharpening their ’digital gold’ PowerPoints.

Who needs diversification when you’ve got a laser-eyed bet on the OG crypto? Meanwhile, traditional finance bros are still waiting for that ’regulated ETF approval’ to dip their toes in. Timing is everything.

Publicly traded The Blockchain Group buys 624 Bitcoin worth $60 million.

— Watcher.Guru (@WatcherGuru) June 3, 2025

Publicly traded The Blockchain Group buys 624 Bitcoin worth $60 million.

— Watcher.Guru (@WatcherGuru) June 3, 2025

Bitcoin Gains Traction Amid Big Buy

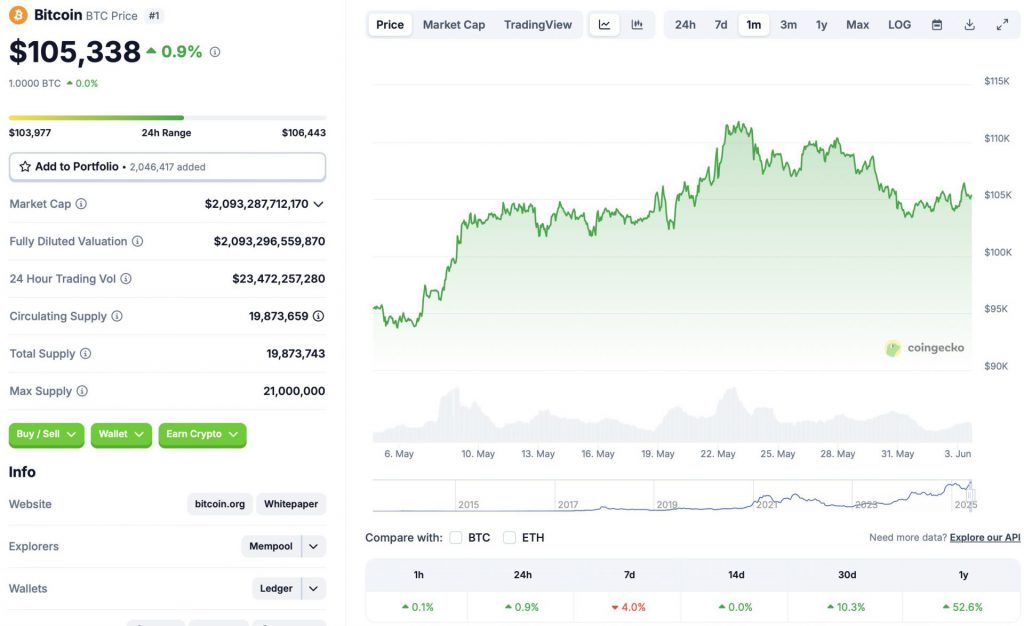

The Blockchain Group’s $68 million BTC purchase comes amid a slight market rebound. BTC climbed to a peak of $111,814 on May 22. BTC’s price has faced a correction since its May peak. The larger crypto market followed BTC’s downward trajectory, with the global market cap dipping 0.3% in the last 24 hours to $3.44 trillion.

BTC’s price has risen 0.9% in the daily chart, 10.3% in the monthly chart, and 52.6% since June 2024. Despite the rally, the original crypto has fallen 4% over the previous week and has seen no changes in the 14-day chart.

Price Spike Incoming?

The Blockchain Group may be buying the current dip in anticipation of a price rally. BTC’s May price surge was likely due to increased institutional investments. BlackRock alone bought more than $3 billion worth of BTC for its spot ETF.

Bitcoin (BTC) may be gearing up for another bullish phase over the coming weeks. According to Binance founder Changpeng Zhao (CZ), BTC could hit somewhere between $500,000 to $1 million this cycle. CZ is not alone in this regard. Many industry experts anticipate BTC to breach the $1 million mark by the end of this decade.

According to CoinCodex analysts, BTC could experience another rally over this week. The platform anticipates the asset to hit a new peak of $138,598 on June 9. BTC’s price will face a 31.58% rally if it hits the $138,598 target. CoinCodex does not anticipate BTC’s price to hold at the $138,000 level. The platform anticipates a correction to around $113,000 by June end.