Buffett Ditches Bank of America for Crypto Rocket That Skyrocketed 7,700%

Warren Buffett—the Oracle of Omaha and longtime crypto skeptic—just made a move that’s shaking Wall Street. He’s dumped Bank of America shares and piled into an asset that’s surged 7,700%. Guess even traditionalists can’t ignore those returns.

From BoA to Blockchain

The billionaire investor’s pivot signals a tectonic shift. While he hasn’t embraced Bitcoin (yet), this play reveals how institutional money is chasing decentralized assets—even if they’ll never admit it at shareholder meetings.

The 77x Factor

That eye-popping gain isn’t some meme coin fluke. It’s a calculated bet on infrastructure—the kind of boring-but-essential tech Buffett usually loves. Just wrapped in a crypto package this time.

Funny how ’irrational exuberance’ suddenly looks rational when the commas start stacking up. Maybe those ’rat poison squared’ comments aged like milk in the Nevada sun.

Bank of America stock chart showing recent performance decline – Source: The Motley Fool

Bank of America stock chart showing recent performance decline – Source: The Motley Fool

Buffett’s Shift: From Bank of America to Pizza Stock Surge

The pattern where Buffett dumps BOA holdings has become increasingly clear through recent SEC filings, and also shows Berkshire Hathaway reducing its position from over 1.03 billion shares by more than 401 million shares right now. At the time of writing, Bank of America has fallen to No. 4 in Berkshire’s $276 billion portfolio, and also demonstrates how even Core holdings can lose favor when valuations become stretched, particularly in today’s market environment.

This systematic reduction began on July 17, 2024, when Berkshire held more than 10% of Bank of America’s outstanding shares at that point. Since then, Buffett dumps BOA shares consistently each quarter, with the stock now trading at a 20% to 30% premium to book value compared to the 62% discount when Buffett first invested in 2011, and also creating concerns about valuation levels.

The 7,700% Winner That Caught Buffett’s Eye

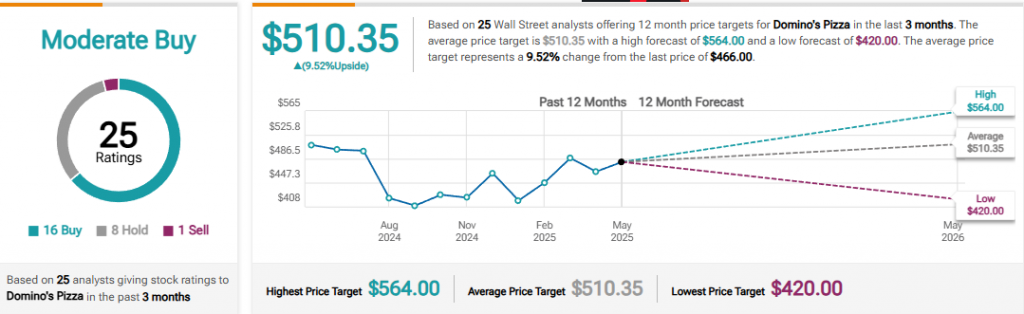

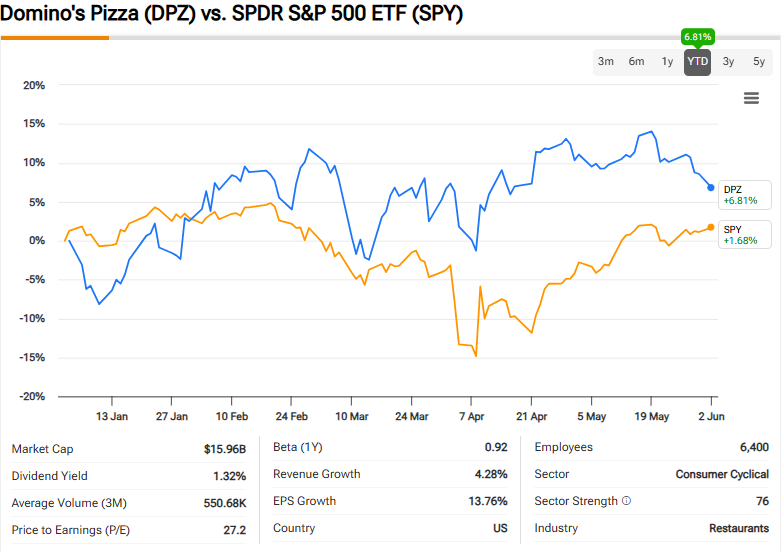

While Buffett dumps BOA positions, he’s been building a substantial stake in Domino’s Pizza, worth more than $1.2 billion as of March 31, 2025, and also showing his confidence in the consumer brand sector right now. The pizza chain has delivered returns nearing 7,700% since its July 2004 IPO, and also represents the type of consumer brand that aligns with Berkshire Hathaway’s investment philosophy at the time of writing.

Berkshire Hathaway now holds 2,620,613 shares of Domino’s Pizza, representing a 7.7% stake in the company, and also demonstrating sustained accumulation. The accumulation occurred over three consecutive quarters, with purchases totaling 1,277,256 shares in Q3, 1,104,744 shares in Q4, and an additional 238,613 shares in the most recent quarter right now.

Why Banking Faces Headwinds

Bank of America faces particular vulnerability as the most interest-sensitive of all money-center banks, and with the Federal Reserve in a rate-easing cycle, net interest income could be hit hardest at this point in time. Bank of America is no longer the screaming bargain it once was, trading NEAR its priciest valuation relative to book value since before the Great Recession, and also making it less attractive for value investors right now.

Domino’s Pizza represents the opposite investment thesis, with management consistently delivering on multiyear growth strategies and also maintaining 31 consecutive years of international same-store sales growth at the time of writing. The company’s track record shows an ability to execute plans effectively, and also build consumer trust through transparent marketing campaigns.