Nvidia Defies Export Curbs as CEO Huang Bets Big—Stock Jumps 5.8% to Break $200

Nvidia’s chips may face trade barriers, but its stock just smashed through another ceiling—because when has logic ever applied to tech valuations?

CEO Jensen Huang shrugs off geopolitical tensions, doubling down on growth while Wall Street cheers. NVDA surges past $200 as the AI gold rush shows no signs of slowing.

Another day, another disconnect between fundamentals and euphoria. But hey—if the market says ’buy,’ who are we to argue with free money?

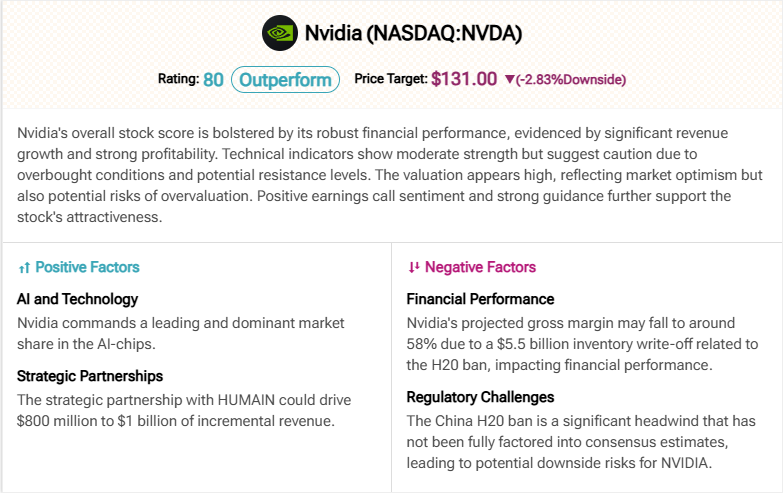

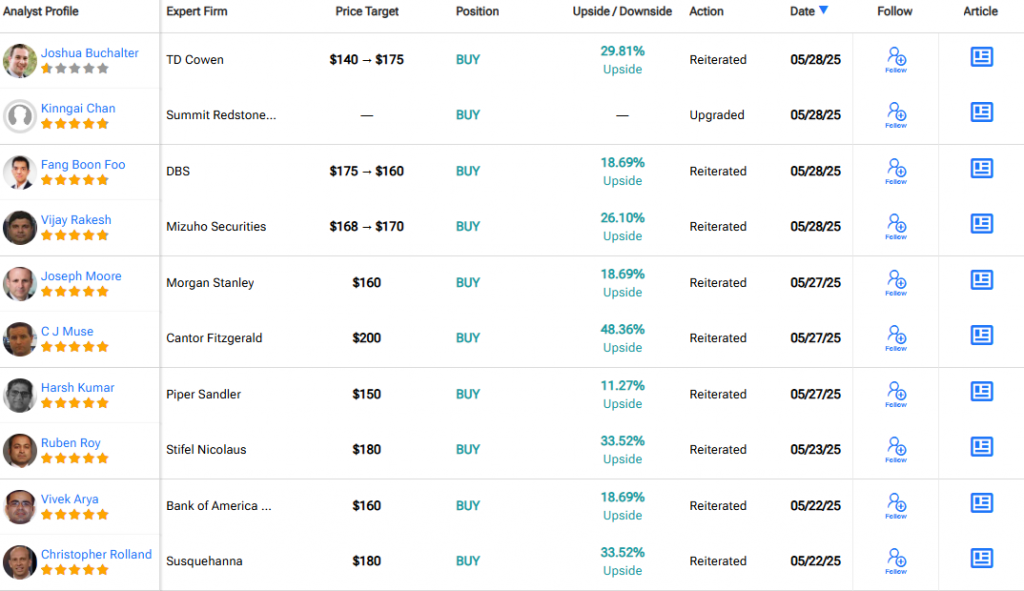

NVDA analyst ratings showing Strong Buy consensus with 38 ratings and $165.29 average price target – Source: TipRanks

NVDA analyst ratings showing Strong Buy consensus with 38 ratings and $165.29 average price target – Source: TipRanks

Exploring Nvidia’s Stock Surge, AI Chip Demand, and Global Market Expansion

Record Financial Performance Drives Nvidia Stock Higher

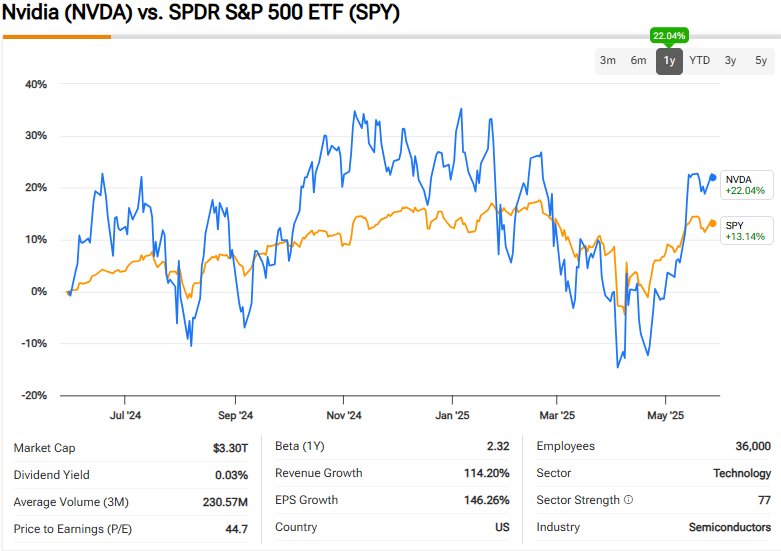

At the time of writing, Nvidia stock increased due to the exceptional performance of the company in the semiconductor industry. There was a 69% increase in total revenue to $44.1 billion and data center revenue went up by 73% to $39.1 billion. The company reported earnings per share of $0.81, going above the expected value of $0.74 due to strong demand for AI chips.

Jensen Huang had this to say about market conditions:

Export Curbs Challenge NVDA Growth Trajectory

Despite some strong Nvidia stock momentum taking place right now, export restrictions have created some significant headwinds for the company. A $4.5 billion charge had to be taken by Nvidia for chips that were not sold and the company also missed sales targeting $2.5 billion. People are still buying Nvidia stock because they trust the company’s managers to navigate these problems by expanding into different areas.

Future Technology Developments Support Long-Term Outlook

Huang noted that reasoning models are considered the next important stage in AI, because they now need far more computing power. Such advanced techniques may use 100 times more resources than existing models which WOULD be a large source of opportunities for AI chip producers.

Huang stated regarding future demand:

Wall Street maintains strong confidence in NVDA prospects right now, with analysts also assigning a consensusrating. The average price target of $164.21 suggests continued upside potential for Nvidia share price despite current market volatility.

Nvidia stock positioning in emerging technologies like agentic AI and physical AI provides multiple growth avenues beyond traditional data center applications, and also supports long-term value creation for shareholders.