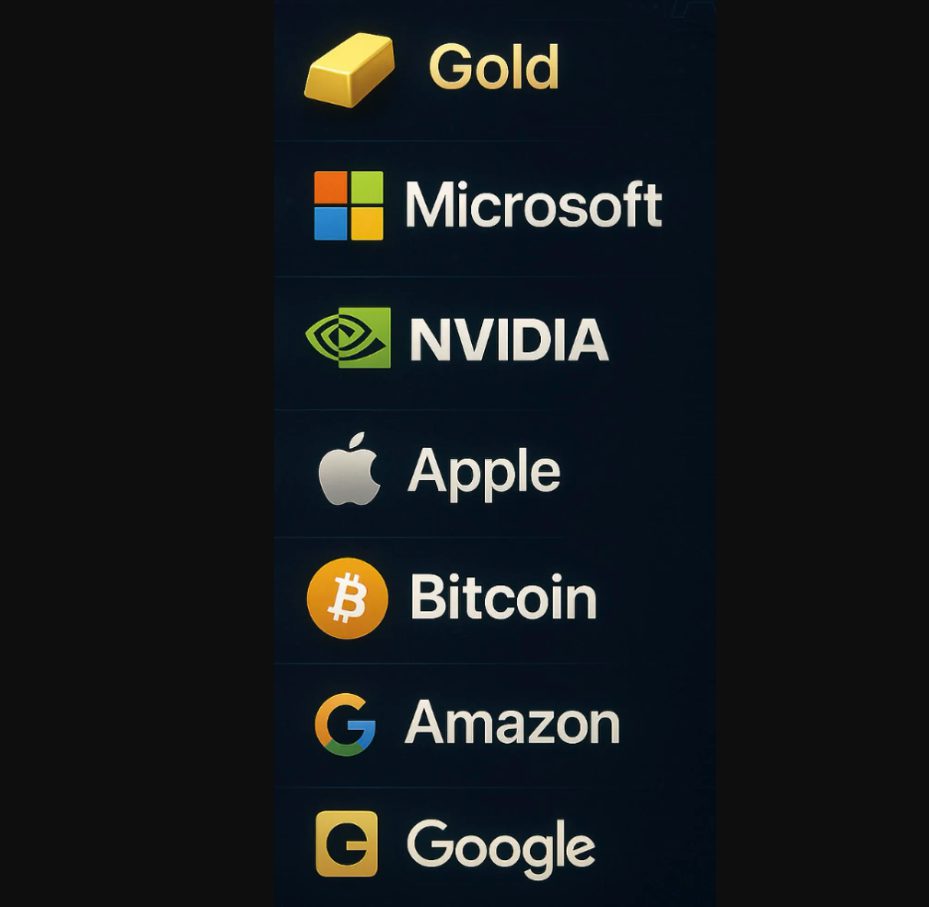

Bitcoin Flexes Market Dominance: $2.3T Valuation Leaves Amazon and Google in the Dust

Move over, tech giants—Bitcoin just rewrote the playbook. With a staggering $2.3 trillion market cap, the original crypto has outpaced legacy titans Amazon and Google. Not bad for an asset Wall Street once dismissed as ’digital tulips.’

The New Heavyweight Champion

BTC’s valuation now eclipses both AMZN and GOOG, proving crypto’s staying power isn’t just hype. While traditional finance scrambles to keep up, Bitcoin’s lead widens—no corporate boardrooms or quarterly earnings calls required.

A Cynical Footnote

Meanwhile, hedge funds that missed the rally are suddenly ’long-term blockchain believers.’ Funny how a trillion-dollar asset class makes skeptics find religion.

Bitcoin Market Cap Soars: BTC Price Prediction & Institutional Adoption Insights

Historic Market Cap Milestone

The Bitcoin market cap has officially reached $2.16 trillion, overtaking Amazon’s $2.15 trillion valuation and cementing Bitcoin adoption among mainstream investors. The digital currency now trails only gold, Microsoft, NVIDIA, and Apple in global asset rankings. This Bitcoin market cap achievement represents a fundamental shift in how institutional Bitcoin investors view cryptocurrency’s role in modern portfolios.

Caroline Bowler, CEO at BTC Markets, said:

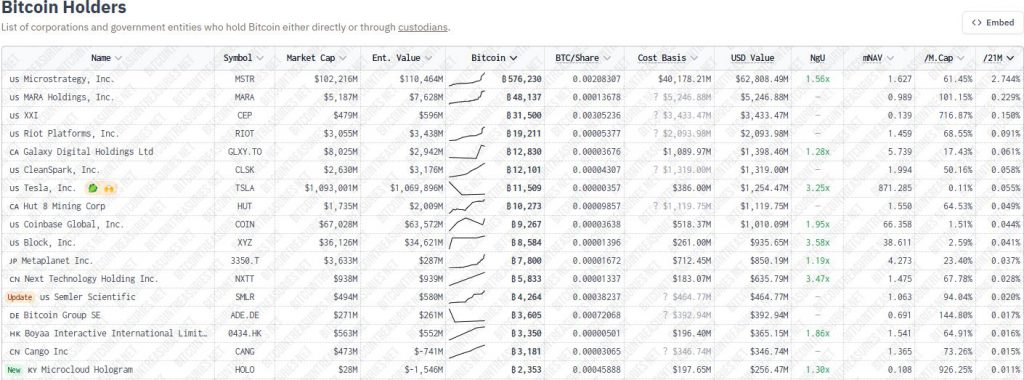

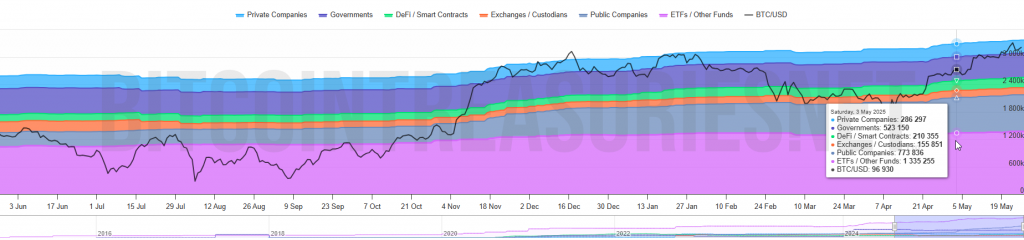

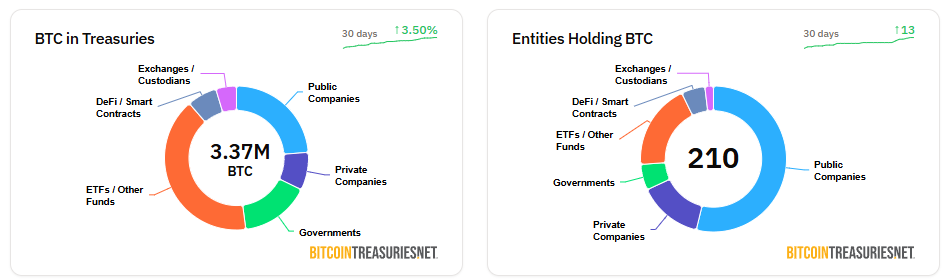

Institutional Bitcoin Demand Drives Growth

Institutional Bitcoin adoption has also accelerated dramatically, with Bitcoin price movements reflecting some unprecedented levels of demand. Bitwise projects Bitcoin inflows could reach $420 billion by 2026, driven by corporate treasury adoption and spot ETF accumulations. The Bitcoin market cap expansion showcases growing confidence in digital assets as inflation hedges.

Ulli Spankowski, chief digital officer at Boerse Stuttgart Group, noted:

According to Geoff Kendrick, Standard Chartered is confident the price of bitcoin could surge to $500,000 before Trump’s four-year presidential term ends. Growing confidence among institutions and stable regulation play a big role in forecasting more people will adopt Bitcoin.