Nvidia Dodges US Sanctions With China-Specific AI Chips—Will Investors Bite?

Silicon Valley’s golden child pulls a regulatory Houdini act—again. Just as Washington tightens export controls, Nvidia unveils custom AI processors tailored for the Chinese market. Clever loophole or dangerous gamble?

Wall Street analysts already smell blood in the water. ’Compliance theater meets profit motive,’ quips one hedge fund manager while adjusting his algorithmic trading parameters. The stock’s pre-market activity suggests traders are betting on history repeating itself—remember when Nvidia’s last workaround sent shares soaring 22% in a week?

Meanwhile in Shenzhen, tech execs whisper about ’special modifications’ to the chips’ architecture. Exactly how neutered are these export-compliant GPUs? Benchmark tests expected next week might reveal whether these chips pack enough punch to satisfy China’s AI ambitions—or if they’re just expensive paperweights.

Funny how semiconductor geopolitics always circles back to one truth: where there’s a will (and a $7 trillion market), there’s a Chinese fabless workaround. The real question—will this band-aid solution hold until Nvidia’s next earnings call, or will regulators call their bluff?

Cheaper Blackwell GPUs, Export Limits, Market Shift & Huawei Threat

Technical Specifications and Manufacturing Strategy

The new Nvidia Blackwell chip for China will use conventional GDDR7 memory instead of the more advanced high bandwidth memory, and it also won’t require Taiwan Semiconductor’s complex CoWoS packaging technology. This approach allows for simpler manufacturing while staying within the boundaries of us export bans, and it’s clearly a strategic move to keep costs down.

Investment bank Jefferies has estimated that the new regulations cap memory bandwidth at around 1.7 to 1.8 terabytes per second, which is a significant reduction from the H20’s 4 terabytes per second capability. The new processor will achieve approximately 1.7 terabytes per second, and this positions it just within the export control limits.

An Nvidia spokesperson said:

Market Share Decline and Competitive Pressure

Before 2022, Nvidia accounted for an incredible 95% of China’s GPU market, but now it stands at just 50%. This rating change reflects Nvidia’s third set of processors designed to comply with our export laws. The April ban of the H20 drove Nvidia to write off $5.5 billion in products which is a huge loss for any business.

CEO Jensen Huang was clear about the fact that:

The main rival of Huawei’s Ascend 910B comes from its domestic rival, plus Chinese companies are quickly building up their AI skills. But thanks to its existing CUDA ai cluster, the China-specific Blackwell chip maintains an advantage that adds to the difficulty for developers to switch.

Strategic Implications and Future Outlook

The pricing strategy for this new Nvidia Blackwell chip for China reflects the company’s willingness to sacrifice profit margins in order to preserve market access, and sources indicate that another Blackwell-architecture chip will begin production as early as September. This H20 downgrade situation has accelerated Chinese customers’ evaluation of alternatives like Huawei Ascend 910B processors, and the competitive pressure is intensifying.

The CUDA AI cluster tech ecosystem creates substantial switching costs for developers who are already invested in Nvidia’s platform, but us export bans continue to pressure the company’s Chinese operations. Chinese brokerage GF Securities suggests they might call the chip either the 6000D or the B20, though the company hasn’t confirmed the official naming yet.

Huang also revealed on the Stratechery podcast:

The release of this chip in China responds to pressure from China’s government and is an effort to strike a balance between what China requires and keeping ahead in the industry. If problems with the H20 downgrade continue, Nvidia will need the new processor to compete with Huawei and many domestic rivals who use AI cluster-based technologies including CUDA from Nvidia.

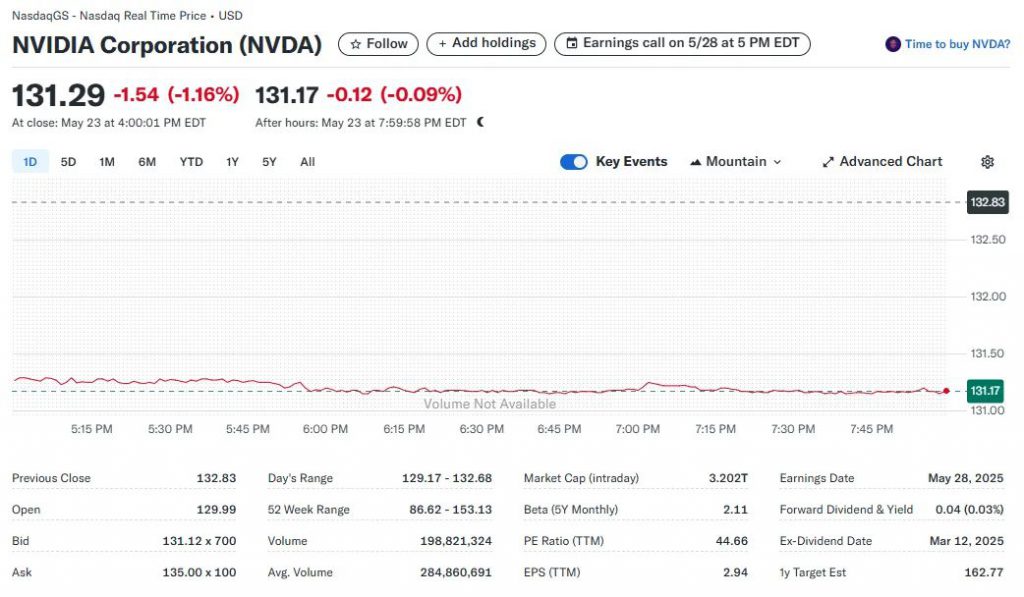

At the time of writing, Nvidia stock is trading at $131.29, down 1.54% from the previous close. However, with the potential to recapture significant market share in China’s massive AI market through this new Nvidia Blackwell chip for China strategy, analysts suggest the stock could be set to surge as investors anticipate improved revenue prospects from the world’s second-largest economy.