SWIFT Makes a CBDC Power Grab—But Ripple’s XRPL Is Already Circling the Throne

SWIFT’s late-stage pivot to central bank digital currencies reeks of legacy finance scrambling to stay relevant. Meanwhile, Ripple’s XRPL—leaner, faster, and already battle-tested—is quietly eating their lunch.

The old guard’s playbook? Throw weight around and hope the market bows. XRPL’s move? Just works. No committees, no multi-year "feasibility studies"—just rails that settle cross-border payments before SWIFT’s memo hits the printer.

Here’s the kicker: banks love talking about innovation… right up until it threatens their 47% markup on correspondent banking. XRPL doesn’t ask permission to undercut that. It just does.

BREAKING: SWIFT CONFIRMS crypto GOES LIVE 11/2025

BREAKING: SWIFT CONFIRMS crypto GOES LIVE 11/2025SWIFT processes $150T+/yr.

Settlement Place = DLT Wallet

Settlement Place = DLT Wallet Cash Account = DLT Wallet

Cash Account = DLT Wallet Network Fees = Gas

Network Fees = Gas Oracles = Trusted Pricing

Oracles = Trusted Pricing UTI = Tokenized Tx Sequencing

UTI = Tokenized Tx SequencingImplications for $XRP / $HBAR & Utility Networks pic.twitter.com/Fdbvg4tGWk — King Solomon (@IOV_OWL) May 12, 2025

How SWIFT & Ripple’s XRP Ledger (XRPL) Are Shaping the CBDC Market, Cryptocurrency Growth, and De-dollarization

SWIFT’s CBDC Market Timeline and Strategy

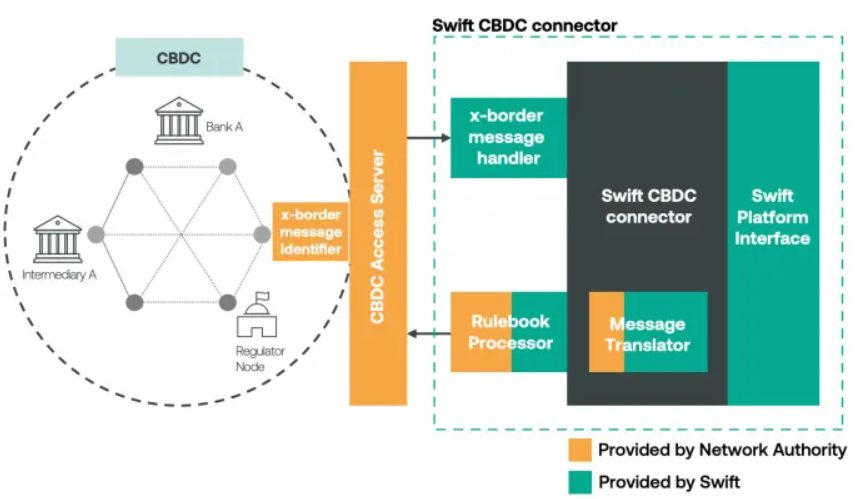

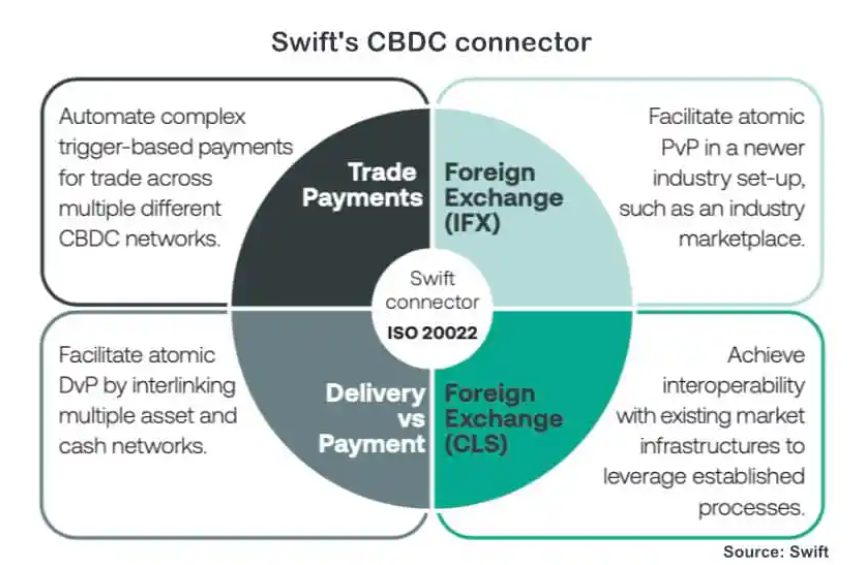

SWIFT’s head of innovation Nick Kerigan confirmed the SWIFT CBDC market timeline, announcing ambitious plans to productize their platform. The trials involved 38 global institutions over six months, and also proved the system’s capacity for complex digital currency operations right now.

Nick Kerigan stated:

The platform demonstrated interoperability between different countries’ CBDCs regardless of underlying technologies, processing over 750 transactions across various use cases including digital trade and also foreign exchange payments.

Ripple’s XRP Ledger (XRPL) Leading Cryptocurrency Innovation

Ripple launched its CBDC Platform in May 2023, built on XRP Ledger (XRPL) technology that handles tens of thousands of transactions per second. The platform provides central banks complete sovereignty over their digital currencies while also leveraging XRPL’s energy-efficient consensus protocol.

The Ripple CBDC platform operates on a private ledger based on XRPL’s core technology, offering enhanced functionality for cryptocurrency management. Colombia’s central bank selected Ripple for pilot projects, demonstrating real-world CBDC implementation success at the time of writing.

De-dollarization and SWIFT CBDC Market Competition

They are working to de-dollarize their economies by using blockchain and cryptocurrency technology at this time. BRICS Pay is meant to challenge old financial systems by helping member countries use CBDCs to settle cross-border trades without relying on the US dollar.

Russian President Vladimir Putin addressed the dollar’s political weaponization:

As countries try to use other currencies, the SWIFT CBDC market competition is heavily affected. At present, the cryptocurrency field provides alternatives to traditional international trade through correspondent banking.

Whether SWIFT or Ripple’s XRP Ledger (XRPL) wins will decide which standard the international CBDC system adopts. While SWIFT relies on past banking links, Ripple currently provides the especially valuable ability to allow various types of digital payments.

Both services must handle problems caused by market ups and downs, security challenges and changing regulations while showing why they are better than what is currently used. SWIFT CBDCs will be successful if technological development is matched by compliance with rules and trust in the institutional environment.