The Dollar’s Iron Grip: How US Power Fuels Its Currency Dominance—And Vice Versa

The greenback isn’t just money—it’s a geopolitical weapon. Here’s how America’s economic might and dollar supremacy feed each other in a self-reinforcing loop.

Petrodollars, sanctions, and the Fed’s printing press: The unholy trinity keeping the system alive.

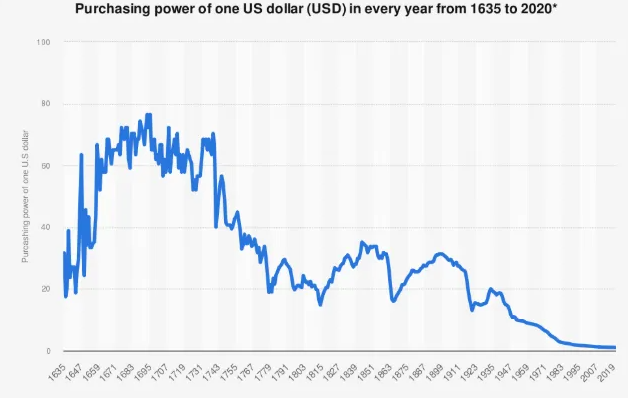

Meanwhile, Bitcoiners smirk as the world’s reserve currency plays musical chairs with inflation rates. Some things never change—except your purchasing power.

How Trump Tariffs And De-Dollarization Threaten US Dominance

Market Crisis Reveals Dollar Weaknesses

Recent market turbulence has exposed fundamental flaws in US dollar dominance. The currency fell over 1% against major currencies, reaching three-year lows as investors questioned America’s financial stability.

George Saravelos, the head of foreign exchange research at Deutsche Bank, said:

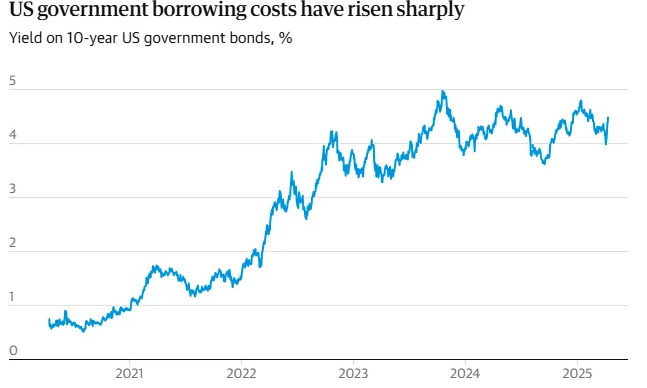

Treasury markets experienced their sharpest weekly movement since 1982, with bond yields jumping from about 4.4% to 4.8%. This shift represents a crisis of confidence rather than temporary volatility.

Historical Foundation Of Currency Power

US dollar dominance emerged after World War II when America established military and economic supremacy. The dollar currently accounts for some 60% of global reserves despite the US contributing only around a quarter of global GDP.

Currency power has historically followed military strength throughout history. Sterling dominated during British empire rule, while Roman coins controlled commerce during Roman power.

The persistence of US dollar dominance stems from what economists call network effects – widespread usage creates self-reinforcing cycles making alternatives costly. This status has been reinforced by reliable legal systems, DEEP capital markets, and also global cultural influence.

Weaponization Accelerates Alternatives

The weaponization of the dollar through sanctions has become a significant threat to its continued dominance. The freezing of Russian reserves in February 2022 represented the most aggressive use of financial weapons to date.

Raghuram Rajan, a former governor of the Reserve Bank of India and an ex-chief economist at the International Monetary Fund, said:

Mark Sobel, a former top US Treasury official who is now the US chair of the Official Monetary and Financial Institutions Forum, stated:

Limited Alternatives Support Dollar Position

Despite growing concerns about US dollar dominance, viable alternatives remain scarce, right now. The euro serves as a distant second at about 20% of global reserves, followed by the Japanese yen at almost 6%.

The Chinese yuan, backed by a communist government with an economy relatively closed to the wider world, still lacks global favour. The renminbi accounts for only 2% of global reserves despite China’s economic growth. Capital controls and limited convertibility continue hampering international adoption, though renminbi trade settlement increased from 17% to 27% of China’s total trade by mid-2024.

José Luis Escrivá, the governor of the Bank of Spain and a member of the European Central Bank’s governing council, told the Financial Times:

Pascal Lamy, the former EU trade commissioner and ex-head of the World Trade Organization, also said:

The relationship between US power and US dollar dominance continues evolving as global financial power architecture adapts to new realities. While immediate alternatives remain limited, at the time of writing, accelerating de-dollarization efforts suggest that American financial hegemony faces its most serious challenge since the Bretton Woods era.