IBM Stock Just Proved Boomer Investments Can Still Moon—$1K Turns Into a Windfall

Who said legacy tech was dead? A five-year bet on Big Blue just paid off in ways that’d make even crypto degens double-take.

While your ape-brain was chasing memecoins, IBM quietly stacked gains like a Wall Street grandmaster. That $1,000 position from 2020? Now worth enough to buy a whole Bitcoin—and still have lunch money left over.

Funny how the ’boring’ stocks keep printing while half the crypto market gets rekt by ’institutional adoption.’ Maybe the real Web3 was dividends all along?

Source: TipRanks

Source: TipRanks

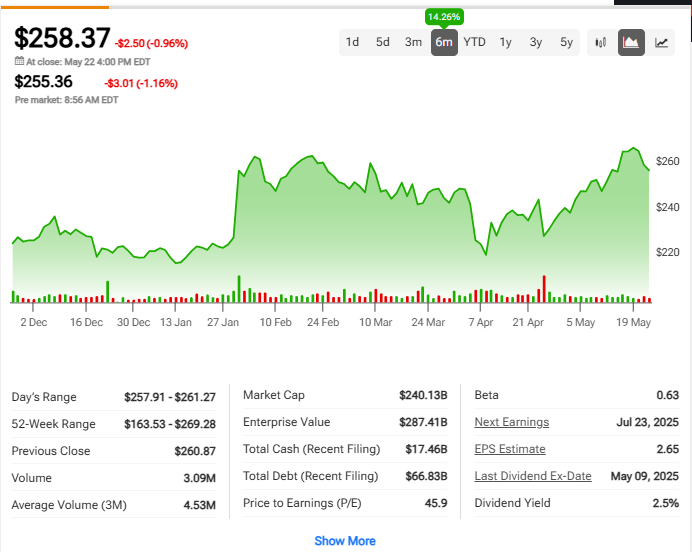

IBM Share Price Rises as AI and Tech Stocks Rebound

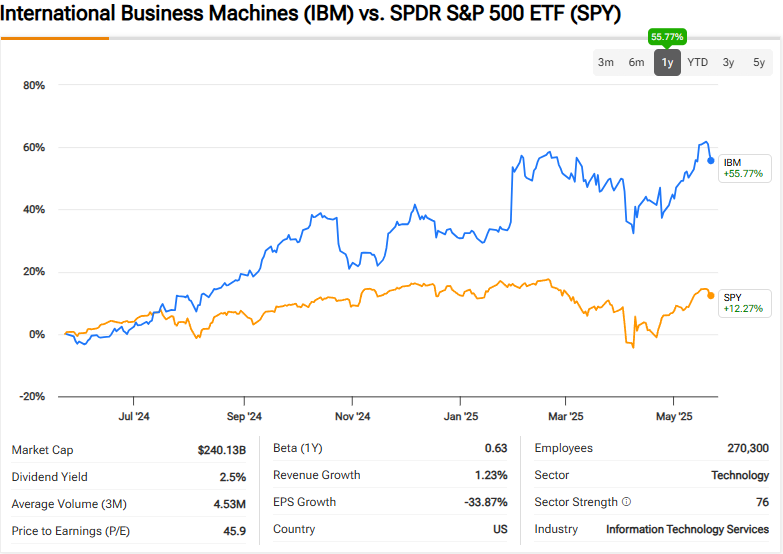

The transformation of IBM stock from a declining legacy technology company into an artificial intelligence powerhouse has been remarkable. IBM share price gains have outperformed the market over the past 5 years by 3.02% on an annualized basis, producing an average annual return of 17.31%. This puts the company’s stock among the top-performing tech stocks, with AI stocks driving much of the recent momentum.

IBM’s CEO Arvind Krishna had this to say:

Strong IBM Earnings Drive Market Confidence

IBM earnings have consistently beaten analyst expectations, with the software segment recording its biggest revenue jump in five years. The company’s focus on artificial intelligence has transformed the company’s stock into one of the standout AI stocks in the market. Find more insights on IBM stock earnings, which showed software revenue rising 7%, while IBM share price benefited from strong demand for enterprise AI solutions.

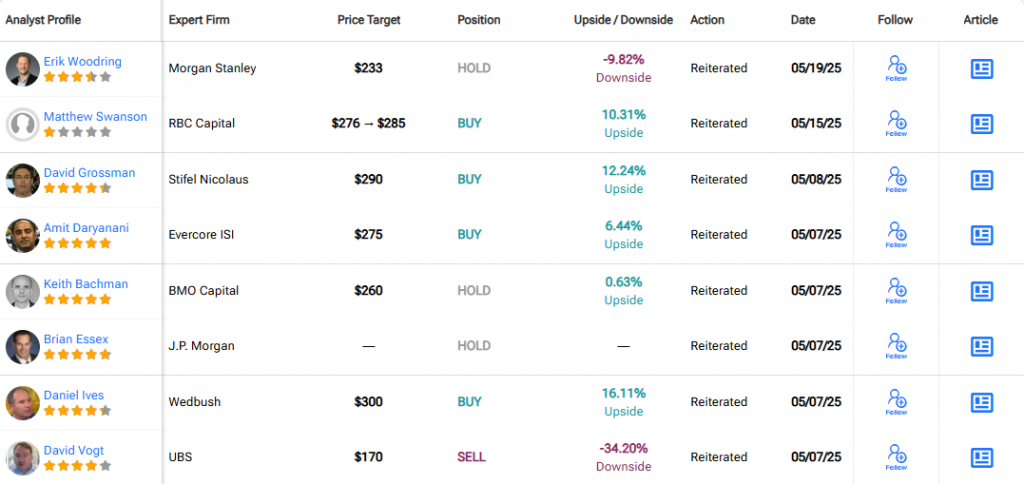

Matt Swanson from RBC Capital Markets stated:

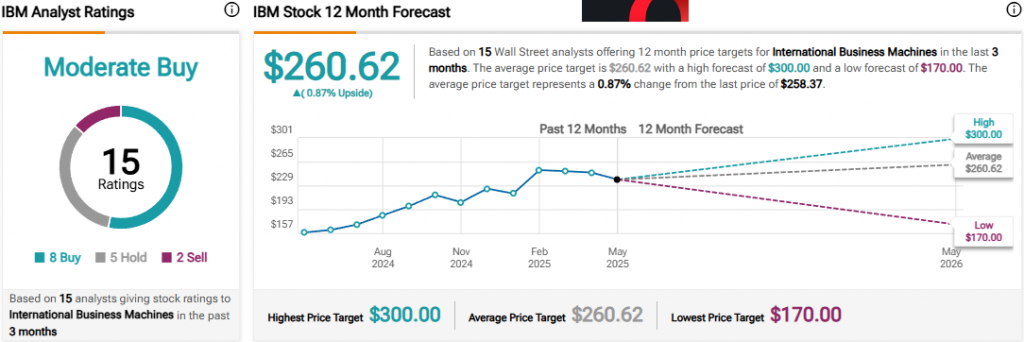

IBM Stock Outlook Remains Strong

Looking ahead, IBM stock continues to benefit from the growing demand for AI stocks and enterprise technology solutions. IBM share price targets from analysts remain optimistic, with many viewing the company’s stock as undervalued relative to other tech stocks. The success of the company’s stock demonstrates how traditional tech stocks can reinvest themselves in the AI era and solidly impacts the outlook for company’s stock.

Michael Schulman from Running Point Capital commented: