MicroStrategy’s $2.1B Bitcoin Gamble Could Send Valuation Soaring to $10 Trillion

Wall Street’s favorite crypto-corporate hybrid is doubling down—again. MicroStrategy (MSTR) just dropped another $2.1 billion into Bitcoin, a move that analysts claim could theoretically catapult its market cap to a ludicrous $10 trillion. Because nothing says ’sound financial strategy’ like betting the farm on volatile digital assets.

The math works if you squint: Bitcoin’s scarcity model plus institutional FOMO equals moon math. Meanwhile, traditional finance bros are still trying to short this rally with their spreadsheet models from 2013.

One thing’s clear—while banks fiddle with fractional reserves, MicroStrategy’s playing a different game entirely. Whether that game ends in lambos or liquidations remains to be seen.

Source: TipRanks

Source: TipRanks

How Strategy’s Bold Bitcoin Bet May Disrupt Cryptocurrency Trends

Strategy’s ambitious Bitcoin investment approach has positioned the company as the world’s largest corporate Bitcoin holder at the time of writing. The firm currently holds 576,230 BTC worth over $64.25 billion, and these were acquired at an average price of $103,500. This Strategy Bitcoin investment represents the most aggressive cryptocurrency treasury strategy in corporate history right now.

Michael Saylor stated:

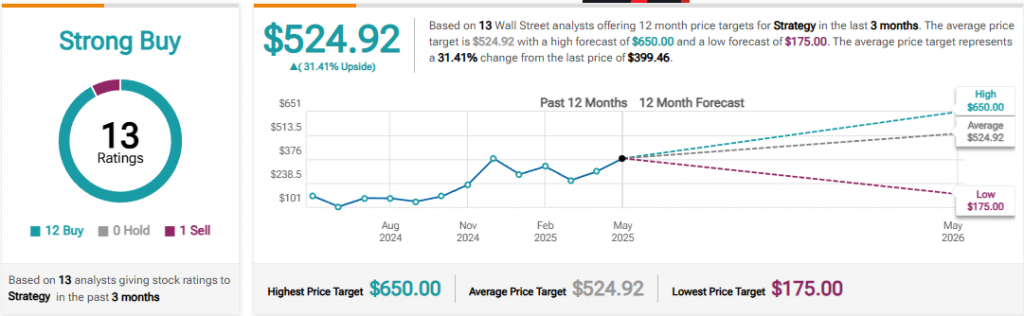

The company’s $2.1 billion funding initiative through preferred stock offerings demonstrates Strategy’s commitment to expanding its bitcoin investment further, and Wall Street’s MSTR stock forecast reflects strong confidence in this approach. Also, 12 out of 13 analysts are rating it a Strong Buy.

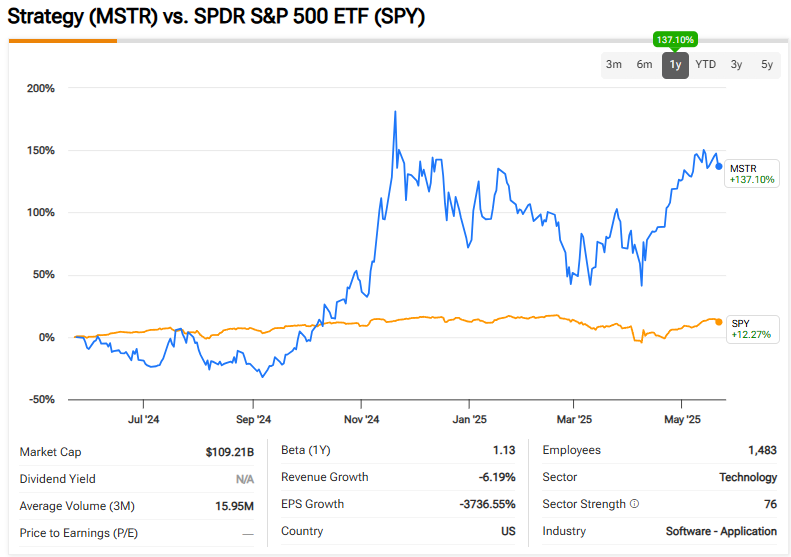

Strategy Bitcoin Investment Drives Market Performance

Strategy’s Bitcoin investment strategy has generated impressive returns for shareholders right now. The stock has gained 15.54% in the past month, and it’s trading at $399.46 at the time of writing. This performance also coincides with Bitcoin reaching record highs of $111,861.22 on May 22, which validates Strategy’s Bitcoin investment thesis.

The company’s preferred stock offerings have attracted significant interest as well. STRF stock trades at $99.40, up 9.13% monthly, and STRK preferred shares have surged 17.93% to $100.91. These instruments provide additional exposure to Strategy’s Bitcoin investment strategy through different risk profiles.

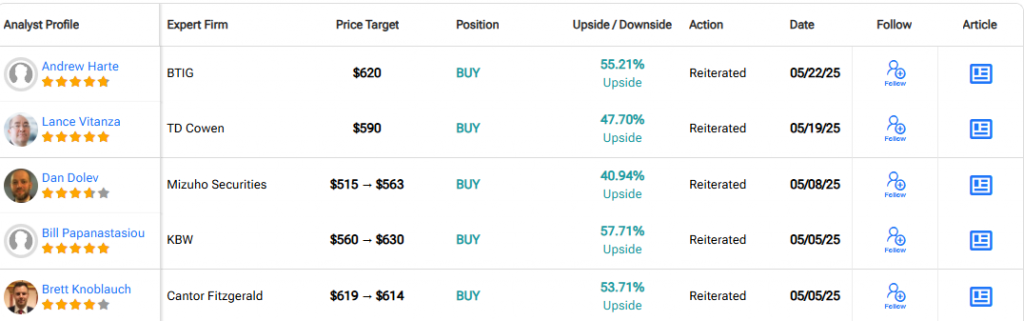

MSTR Stock Forecast Points to Massive Upside

Analysts’ MSTR stock forecast suggests substantial growth potential ahead right now. The average price target of $524.92 implies 30.41% upside from current levels, and this bullish MSTR stock forecast reflects confidence in Strategy’s Bitcoin investment model and the broader cryptocurrency market outlook.

Michael Saylor had this to say about Bitcoin’s future:

This prediction underpins Strategy’s long-term Bitcoin investment strategy and also supports the aggressive MSTR stock forecast targets. Those involved in crypto consider this a special opportunity, as the company has moved from being a software developer to overseeing a large Bitcoin treasury.

Cryptocurrency Market Dynamics and Bitcoin Halving Countdown

The approaching Bitcoin halving countdown adds another LAYER to Strategy’s Bitcoin investment thesis at the time of writing. Historically, halving events have preceded significant cryptocurrency price increases, and this could potentially benefit Strategy’s massive Bitcoin holdings. The United States dollar’s monetary policy environment also supports the cryptocurrency investment narrative.

Saylor stated regarding Strategy’s financial engineering:

This approach has enabled Strategy to raise approximately $33 billion for Bitcoin acquisitions, and it’s making the company the dominant corporate player in the cryptocurrency market right now.

Is Saylor’s Strategy (MSTR) a Buy Right Now?

Current market conditions support a positive outlook for Strategy’s Bitcoin investment approach at the time of writing. The company’s stock has outperformed traditional markets, and it’s benefiting from both Bitcoin’s price appreciation and growing institutional cryptocurrency adoption. Strategy’s financial engineering has created what Saylor describes as an

Saylor had this to say about Strategy’s resilience:

The United States dollar environment and potential regulatory clarity for cryptocurrency investments could further support Strategy’s Bitcoin investment strategy right now. With Bitcoin maintaining levels NEAR all-time highs and the Bitcoin halving countdown creating additional momentum, Strategy’s concentrated cryptocurrency exposure positions it uniquely for potential market expansion.

Strategy’s approach represents a paradigm shift in corporate treasury management, and its Bitcoin investment strategy is serving as a template for other institutions considering cryptocurrency allocations.