MAG7 Stocks Crumble to 7-Year Lows—AI Hype Fades as Regulators Circle

Goldman’s latest report confirms what traders feared: The once-unstoppable MAG7 cohort—Microsoft, Apple, Alphabet, Amazon, Meta, Nvidia, Tesla—just hit its worst valuation slump since 2018.

AI fatigue sets in as antitrust probes multiply and trade wars disrupt supply chains. Nvidia’s 40% Q1 drop leads the bloodbath, while Tesla’s ’full self-driving’ promises stall harder than a Cybertruck off-road.

Wall Street’s new mantra? ’Innovate first, monetize never’—another masterclass in burning cash while VCs cheer from the sidelines.

Magnificent 7 Stocks Face Pressure from AI, Trade, and Litigation

Record Low Valuations Reported

The Magnificent 7 stocks are, at present, trading at their cheapest levels relative to the broader market in about seven years or so. Goldman Sachs strategist David Kostin actually highlighted that these tech companies now show an aggregate forward price-to-earnings ratio of around 28, compared to maybe 20 for the remainder of the S&P 500.

David Kostin stated:

Contrasting Fortunes Within MAG7

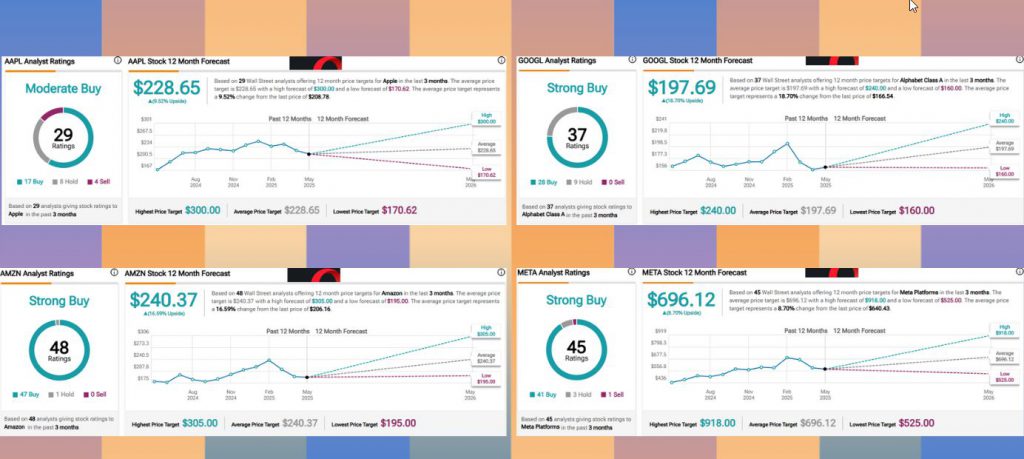

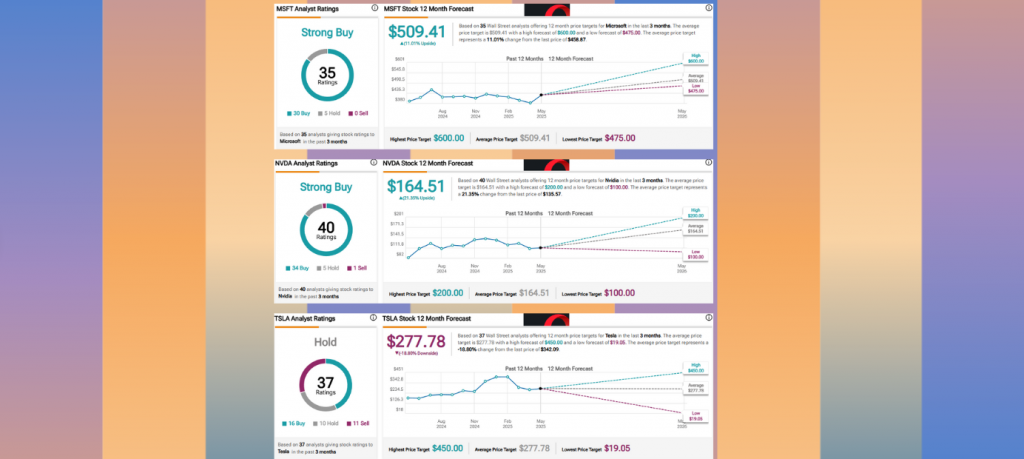

Shares of Nvidia have a strong upward trajectory, as supported by many analysts suggesting a buy, but analysts suggest a more wait-and-see approach for Tesla. Since stocks in the Magnificent 7 were judged differently by Goldman, it seems that there are major differences in how each is performing at the moment.

Potential Recovery Catalysts

Despite the current pressure, Goldman Sachs believes that upcoming earnings reports could possibly provide some relief for the struggling Magnificent 7 stocks. Nasdaq: NVDA remains somewhat positioned at the forefront of the AI hardware market, while AAPL continues to try and navigate through the complicated trade tensions.

Goldman Sachs noted:

The valuation compression may perhaps represent a cyclical adjustment rather than a fundamental shift for these industry leaders. The aggregate forward P/E ratio, while still indicating a premium, has definitely narrowed considerably from previous levels, potentially creating what some analysts kind of view as a buying opportunity for Magnificent 7 stocks in the NEAR term.