MicroStrategy Doubles Down on Bitcoin Bet—Snaps Up 7,390 BTC Amid Legal Heat, Still Eyes $1,800 Price Target

Michael Saylor’s crypto gambit just got bolder. MicroStrategy (MSTR) scooped up another 7,390 BTC this week—because apparently ’risk management’ means YOLO-ing into volatile assets while shareholders file lawsuits.

Legal troubles? Pfft. The company’s still laser-focused on that $1,800 price target, proving once again that in crypto-land, fundamentals are optional and hopium is eternal.

Wall Street analysts remain ’cautiously optimistic’—which is banker-speak for ’we have no idea what’s happening but don’t want to miss the ride.’

Strategy Stock Faces Michael Saylor Lawsuit, Bitcoin Accumulation & Regulatory Uncertainty Amid Market Volatility

Legal Challenges Impact Strategy Stock Performance

Strategy stock has been negatively affected by a class action lawsuit that was just recently filed against CEO Michael Saylor, which actually alleges insider trading related to the company’s Bitcoin purchases. This legal challenge, which is still developing, comes right at a time when Strategy continues its somewhat aggressive cryptocurrency accumulation strategy despite all of the regulatory uncertainty in the market right now.

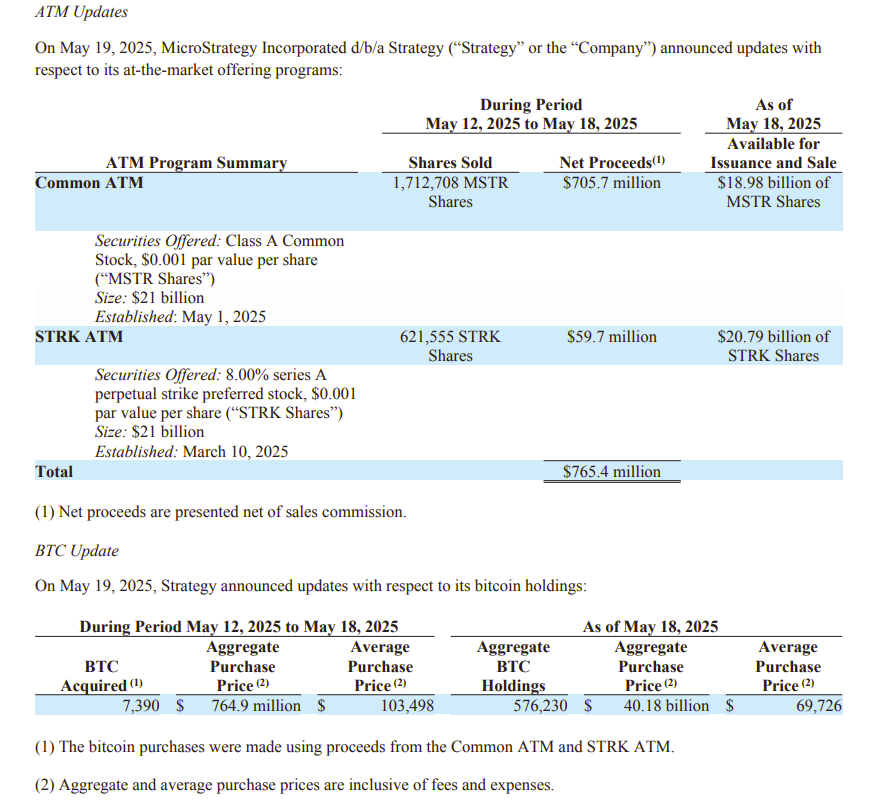

Strategy’s Recent Bitcoin Acquisition

The recent SEC filings for Strategy stock confirm that the company has purchased an additional 7,390 BTC at an aggregate price of about $764.9 million, which brings their total holdings to approximately 276,230 bitcoin as of today. These purchases were financed through the company’s ATM programs, which managed to generate around $765.4 million in net proceeds during the reporting period.

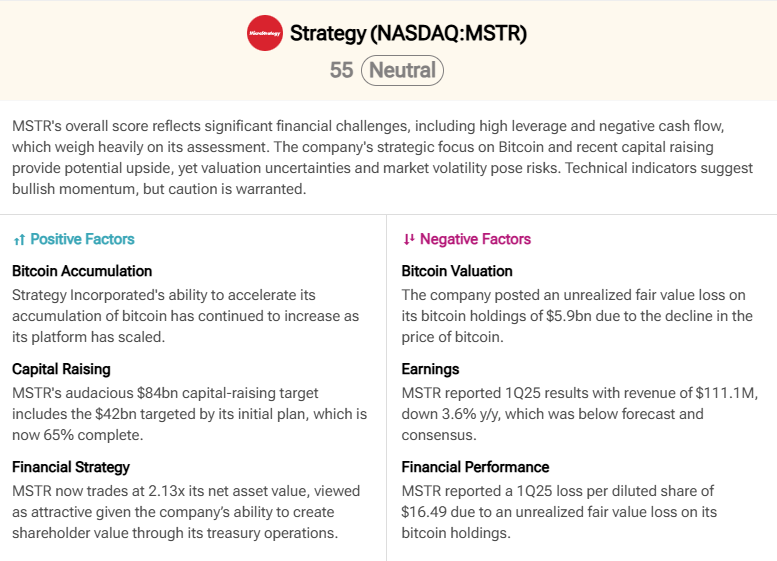

A recent financial analysis report stated:

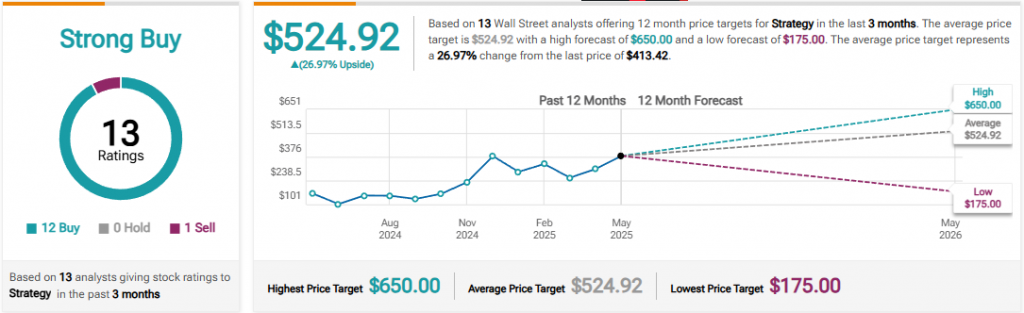

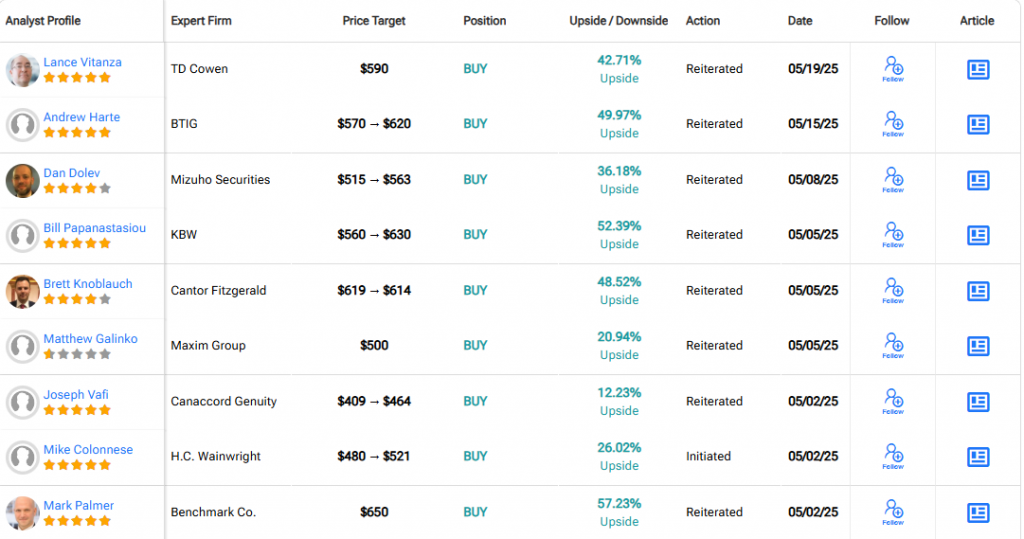

Analyst Outlook Remains Positive Despite Challenges

Strategy stock still maintains strong analyst support despite all of the recent volatility and uncertainty. Based on the opinions of about 13 Wall Street analysts, the company currently carries arecommendation with an average price target of roughly $524.92, which actually represents a potential 26.97% upside from where we are today.

Andrew Harte from BTIG stated:

Financial Performance Amid Bitcoin Volatility

Right now, Strategy stock is facing some challenges as the company just recently reported their Q1 2025 results with revenue of about $111.1M, which is down approximately 3.6% year-over-year. The company has also posted a loss of around $16.49 per diluted share due to Bitcoin’s rather unpredictable price fluctuations during this period.

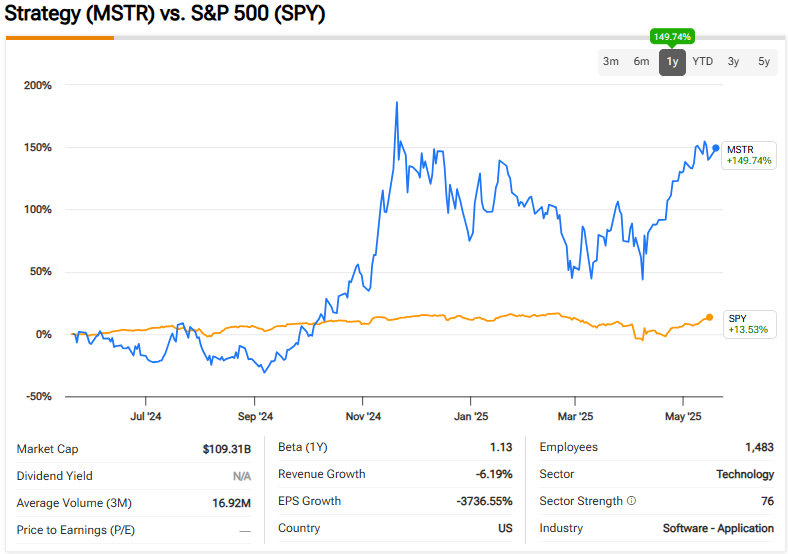

Market Performance vs. Broader Indices

Even with all of the recent challenges and setbacks, Strategy stock has actually delivered some exceptional returns for investors, outperforming many major indices with a remarkable 149.74% gain compared to the S&P 500’s modest 13.53% over the past year. The market volatility remains a significant concern for Strategy stock investors as regulatory uncertainty continues to affect cryptocurrency markets in general.

While the regulatory and legal headwinds do persist today, Strategy stock’s Bitcoin accumulation strategy and the strong analyst support that we’re seeing right now suggest that the ambitious $1,800 price target might still remain attainable for long-term investors who are willing to tolerate the significant market volatility that comes with this investment.