Ryanair (RYAAY) Braces for Tariff War Fallout—Analysts Slap $60 Target on ’Growth Killer’

Ryanair’s growth engine sputters as tariff threats loom—because nothing fuels aviation like trade wars and Wall Street’s crystal-ball math.

Low-cost carrier Ryanair (RYAAY) just flagged tariffs as its ’top threat,’ sparking analyst bets that the stock could nosedive to $60. Because when geopolitics gets messy, airlines always win—said no one ever.

Cue the usual chorus of ’macro headwinds’—because blaming governments beats admitting your hedging strategy backfired. Stay tuned for the next episode of ’Airlines vs. The World.’

Tariff Risks, China-US Tensions, And Analyst Targets Explained

Tariff War Concerns Dominate Outlook

Lately, Ryanair CEOs have been drawing investor attention to tariff wars. According to the airline, disagreements among nations in international trade make it most challenging to realize their future plans.

Ryanair CEO Michael O’Leary stated:

It was mentioned by top-ranking officials of the airline that China-US discussions on tariff exemptions could negatively influence their business. Still, since negotiations about the deal are ongoing between top economies, the situation is not yet certain.

Analyst Optimism Despite Challenges

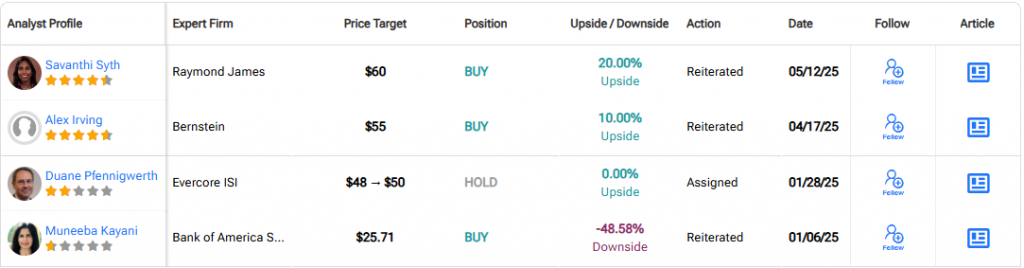

Despite these hurdles, Wall Street analysts remain relatively confident in Ryanair’s prospects. The NASDAQ: RYAAY stock has a consensus ofrating as we speak. The price targets are showing important upside potential for investors. About time, right?

Raymond James analyst Savanthi Syth said:

Currency fluctuations represent another key concern for the airline, which operates across multiple economic zones. These Ryanair tariff war and currency risks are being closely monitored by investors who are tracking the stock’s performance against broader market indices.

Financial Position Remains Stable

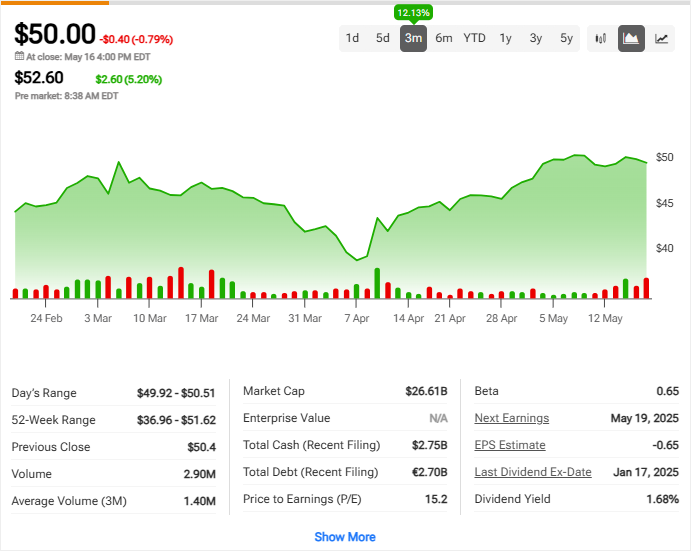

Despite facing some difficult times, Ryanair remains robust still, and has a value of about $26.61 billion. By paying a dividend of 1.68%, the airline awards its shareholders an earning potential at its present P/E ratio of 15.2.

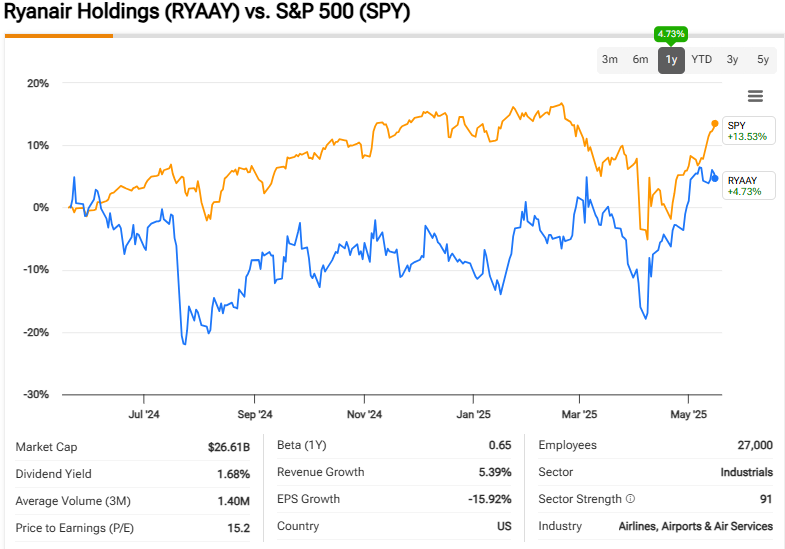

China US tariff exemptions discussions and United States news regarding trade policy continue to influence the stock’s trajectory. The NASDAQ: RYAAY shares have recently recovered some ground after periods of underperformance compared to the S&P 500 index.

The company’s ability to navigate these Ryanair tariff war concerns while maintaining its growth trajectory will likely determine whether analyst targets around $60 prove accurate in the coming months.