BlackRock’s Bitcoin ETF Hits $1B Inflows as Gulf & Asia Capital Floods In

Wall Street’s crypto pivot accelerates as institutional money storms the gates. Abu Dhabi’s sovereign wealth funds and Hong Kong family offices are now leading the charge—because nothing screams ’hedge against inflation’ like a speculative asset backed by an ETF wrapper.

The $1 billion milestone cracks open two truths: 1) Traditional finance can’t ignore Bitcoin’s gravity anymore, and 2) Everyone wants exposure without the hassle of self-custody. BlackRock just gave them the ultimate ’hold my beer’ moment.

Meanwhile, gold ETFs weep quietly in the corner.

Source: Yahoo Finance

Source: Yahoo Finance

BlackRock Bitcoin ETF Surges With Growing Bitcoin ETF Holdings and Institutional Investments

Abu Dhabi’s $408 Million Bitcoin Position

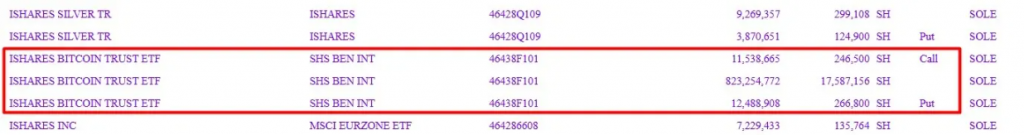

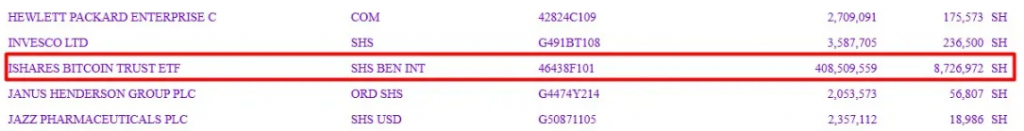

Mubadala, which is Abu Dhabi’s sovereign wealth fund, has rather significantly expanded its BlackRock Bitcoin ETF position to about 8,726,972 shares valued at approximately $408.5 million as of March 31, which is an increase from the 8,235,533 shares they reported back in December.

In a 13F filed today, Mubadala, the Abu Dhabi sovereign wealth fund, disclosed owning 8,726,972 shares of IBIT as of March 31, valued at $408.5 million.

That’s an increase from 8,235,533 shares previously reported as of December 31.

This is an important one.

Filing:…

MacroScope, a financial analyst who closely follows cryptocurrency investments, stated:

Hong Kong Firm Adds Massive Investment

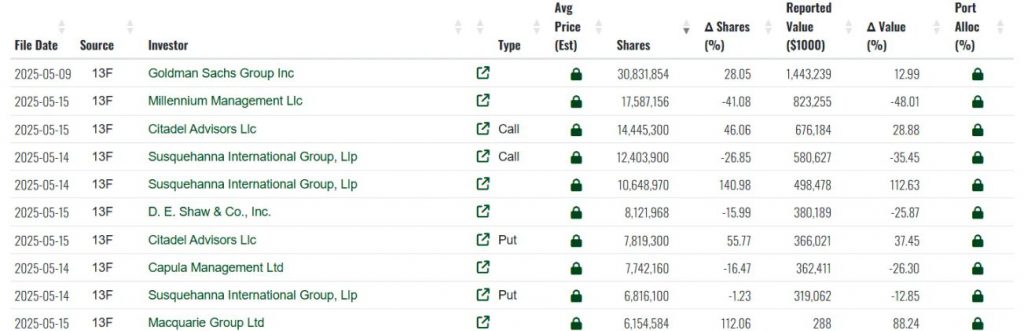

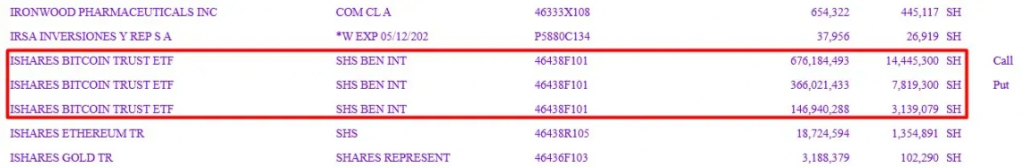

A Hong Kong investment firm has also, in recent filings, substantially boosted their BlackRock Bitcoin ETF holdings to around $688 million, which demonstrates the truly global appeal of institutional cryptocurrency investments in today’s financial landscape.

Record-Breaking ETF Inflows

The BlackRock Bitcoin ETF recorded, just recently, about $232.46 million in net inflows on May 14 alone, contributing to a total cryptocurrency market inflow of approximately $319.12 million on that particular trading day.

5/14 Bitcoin ETF Total Net Flow: $319.12 million$IBIT (BlackRock): $232.46 million$FBTC (Fidelity): $36.13 million$BITB (Bitwise): $2.82 million$ARKB (Ark Invest): $5.16 million$BTCO (Invesco): $0.00 million$EZBC (Franklin): $0.00 million$BRRR (Valkyrie): $0.00 million… https://t.co/HxSr8lZzs8 pic.twitter.com/Zg3qlyuxHR

— Trader T (@thepfund) May 15, 2025TraderT, an analyst who regularly tracks ETF flows, reported:

Performance Reflects Market Confidence

The BlackRock Bitcoin ETF has, right now, delivered some rather impressive returns with an approximately 22.89% recent gain and net assets reaching around $56.5 billion, despite the typical and ongoing cryptocurrency market volatility concerns that many investors still have.