AAPL Taps $211 After Trump Blocks Cook’s India Expansion—Wall Street Shrugs

Apple’s stock claws to $211 as political headwinds hit global plans—because nothing says ’free market’ like a presidential veto on factory locations.

Tim Cook’s supply-chain chess move meets Trump’s protectionist wall. Investors yawn and buy the dip—after all, what’s another geopolitical hurdle when you’re sitting on $200B in cash?

Bonus cynicism: If this were a crypto project, the SEC would’ve already sued it for ’operating an unregistered manufacturing facility.’

How Trump-India Tensions Impact Apple Stock, Currency Risks

Apple CEO Tim Cook is now stuck in the middle because President TRUMP wants Apple to make its products in America, but Apple is also working to spread out its manufacturing around the world. The Trump India situation has certainly created additional uncertainty for Apple stock and various currency markets.

Tim Cook is convinced by the fact that:

Market Volatility Grows

President Trump’s recent warning against Apple building in India has, in fact, increased market volatility quite significantly. The strengthening United States dollar also complicates Apple’s international revenue streams in several key markets.

Daniel Ives, global head of technology research at Wedbush Securities, noted:“

Currency Substitution Impacts

Right now, Apple stock performance seems to reflect growing concerns about currency substitution risks in various markets. Cook’s ongoing supply chain restructuring apparently aims to mitigate Trump-India tariff impacts and the effects of cryptocurrency market fluctuations on the company’s bottom line.

Tim Cook confirmed:

Future Outlook

Despite these tensions and challenges, Apple has reported rather solid Q1 results with revenue rising about 5% to approximately $95.4 billion. The United States dollar trends and cryptocurrency movements will likely continue influencing Apple stock in the coming months, according to several market observers.

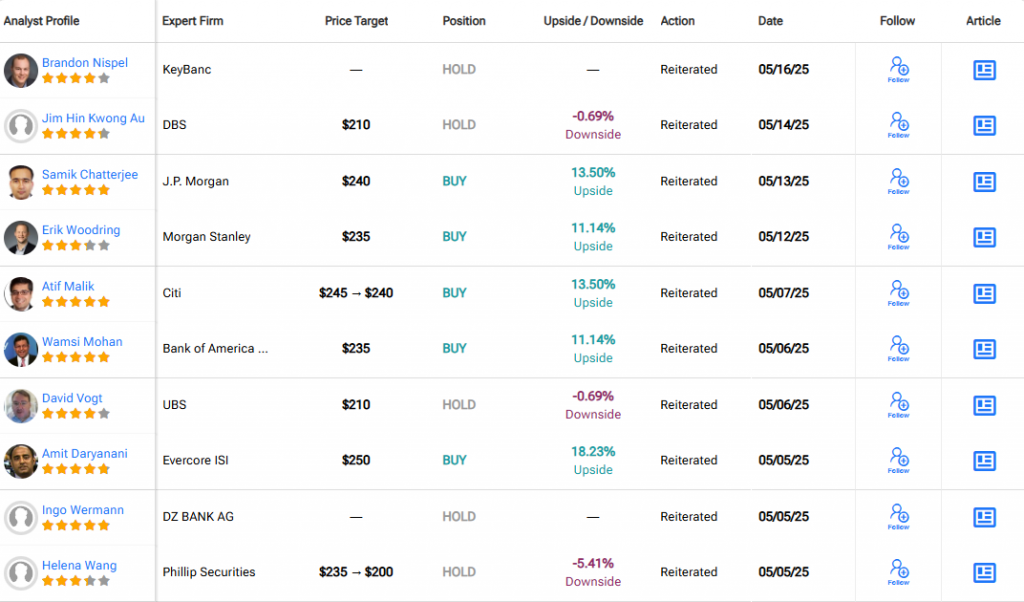

Erik Woodring of Morgan Stanley maintained his “” rating:

Right now, analysts are still fairly optimistic about Apple, especially since most have given the company a “” rating with a price target of around $228.65 for the next coming year.