US Slaps Sanctions on 30+ Chinese Firms—Supply Chain Chaos Looms for Tech Stocks

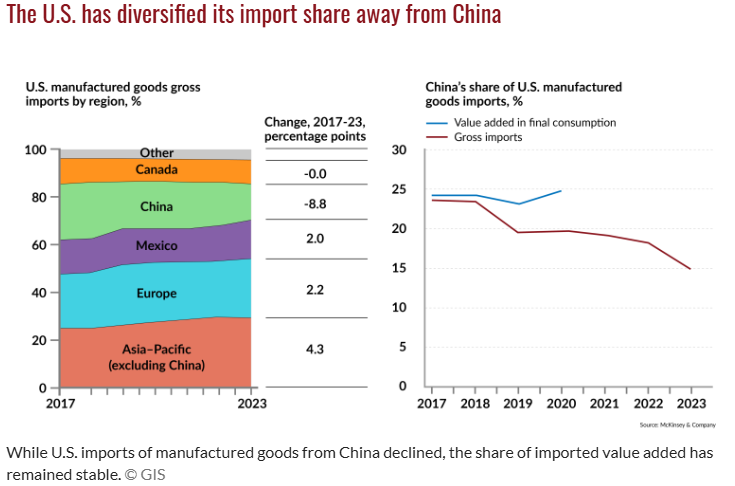

Wall Street’s supply chain nightmares just got worse. Fresh US sanctions target over 30 Chinese companies—including key semiconductor and AI players—throwing wrench into global tech pipelines.

Chips down:

The move directly hits critical hardware suppliers, with ripple effects across consumer electronics, cloud infrastructure, and yes—even your precious crypto mining rigs.

Portfolio tremors:

Analysts predict 5-15% downside for exposed tech stocks. Meanwhile, hedge funds quietly rotate into ’sanction-proof’ crypto assets—because nothing says financial sovereignty like dodging geopolitical landmines with decentralized ledgers.

Another day, another reason to question why we still pretend traditional finance isn’t a glorified game of geopolitical Jenga.

Chinese Companies Sanctioned Over Iran, Risks for Supply Chains

In the official announcement, Treasury Secretary Scott Bessent stated:

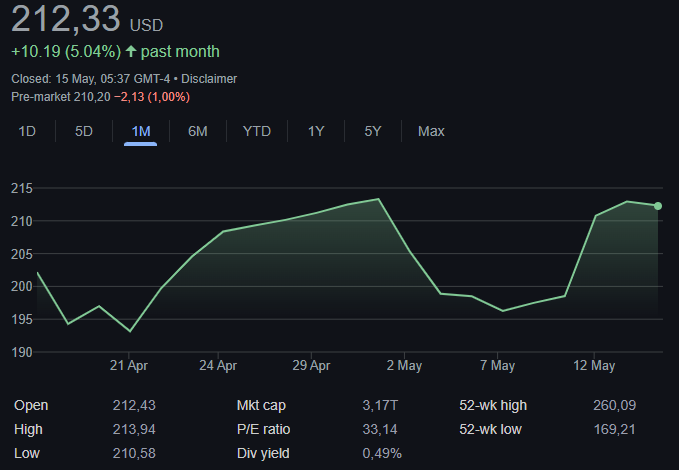

Key Stocks Affected by US-China Sanctions

At the time of writing, four major stocks are experiencing some significant impacts from these Chinese companies sanctions:

1. Apple.Inc (AAPL)

AAPL, which relies heavily on Hong Kong firms and mainland suppliers for various parts, might need to find alternative sourcing that could potentially take months or even longer to fully implement.

2. Nvidia Corporation (NVDA)

NVDA typically requires components from various Chinese suppliers for its graphics processing units, which is creating a certain vulnerability to the export controls that are being imposed.

3. Semiconductor Manufacturing International Corporation (SMIC)

SMIC is currently facing potential disruptions to their chip manufacturing as the US-China sanctions essentially limit their access to American technology and components.

4. Yangtze Memory Technologies Co. (YMTC)

YMTC‘s production of NAND flash memory chips is being threatened right now, which is further complicating its global supply chain risks and manufacturing capabilities.

Legal Expert Assessment

An expert on sanctions law, Jeremy Paner, who is a partner at Hughes Hubbard & Reed and also a former Treasury Department sanctions investigator, had this to say:

These US-China sanctions are in many ways connected to Iran’s missile program, which is adding an extra LAYER of complexity to the already strained relations between the global superpowers and their economic partnerships.

The sanctions on Chinese companies specifically target firms such as CCIC Singapore PTE for concealing the Iranian oil origins, and this is creating significant supply chain risks for technology manufacturers who are dependent on various components from the sanctioned entities and their business partners.