Elon’s Meme Coin Massacre: How Dogecoin (DOGE) Turned $1K Into Pocket Change

When hype meets reality—and gravity wins.

From ’currency of the internet’ to bagholder bait in three tweets flat. Elon Musk’s favorite joke asset proves crypto’s first law: memes don’t have fundamentals.

The autopsy: A 92% plunge from ATH, vaporizing portfolios faster than a Tesla battery fire. Retail ’investors’ left holding the doge bag while whales cashed out during SNL pump-and-dump theater.

Bonus finance jab: At least Wall Street’s pump-and-dumps come with prospectuses—and prison sentences.

How D.O.G.E. (Department of Government Efficiency) and Musk’s Influence Led to the $1K Disaster

When Elon Musk had created D.O.G.E, investors erroneously took this to mean that they should purchase Dogecoin. This Musk Dogecoin investment connection triggered temporary price gains before reality set in.

The Investment Fallout

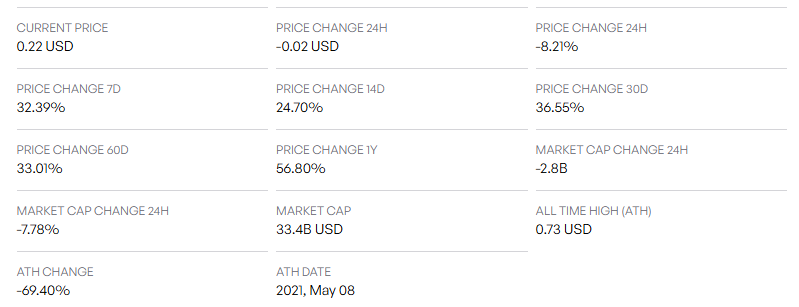

The Dogecoin price crash has been severe. DOGE returns in 2025 look bleak after dropping from $0.31 to around $0.23, devastating anyone who made a Musk Dogecoin investment during the initial excitement.

Market Response

Elon Musk DOGE bet implications continue affecting markets as his attention to the cryptocurrency decreased. The crypto investment risk was underestimated by many retail investors.

According to Finbold analysis:

Future Outlook

The 50% price crash of dogecoin is an illustration of how Musk Dogecoin investment speculation can lead to massive losses. There continues to be uncertainty on the DOGE 2025 predictions given the rethinking the Elon Musk DOGE bet implication by investors.

Lessons Learned

The Doge disaster shows the crypto investment risk of following celebrity-adjacent events. Many of the individuals who had invested in a Musk DOGE for some sense of rapid profitability losses had suffered severely as awareness of the volatility of cryptocurrency markets.