Bitcoin Traders Eye CPI Data as BONK Fuels Memecoin Frenzy

All eyes on inflation numbers—BTC’s next move hinges on whether the Fed’s favorite economic indicator plays nice. Meanwhile, BONK’s rally proves memecoins still have legs—much to the dismay of traditional finance purists who’d rather see capital flow into ’serious’ assets like over-leveraged real estate.

Market pulse: CPI drops at 8:30 AM ET—expect volatility. Memecoin traders, however, operate on a different clock entirely (one that runs on hype cycles and Elon Musk tweets).

Closing thought: When the apes are winning, maybe the joke’s on the suits after all.

What to Watch

- Crypto:

- May 14: Neo (NEO) mainnet will undergo a hard fork network upgrade (version 3.8.0) at block height 7,300,000.

- May 14: Expected launch date for VanEck Onchain Economy ETF (ticker: NODE).

- May 16, 9:30 a.m.: Galaxy Digital Inc.’s Class A shares are set to begin trading on the Nasdaq under the ticker symbol GLXY.

- May 19: CME Group is expected to launch its cash-settled XRP futures.

- May 19: Coinbase Global (COIN) will replace Discover Financial Services (DFS) in the S&P 500, effective before the opening of trading.

- Macro

- May 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases April consumer price inflation data.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.1%

- Core Inflation Rate YoY Est. 2.8% vs. Prev. 2.8%

- Inflation Rate MoM Est. 0.3% vs. Prev. -0.1%

- Inflation Rate YoY Est. 2.4% vs. Prev. 2.4%

- May 14, 3 p.m.: Argentina’s National Institute of Statistics and Census releases April inflation data.

- Inflation Rate MoM Prev. 3.7%

- Inflation Rate YoY Prev. 55.9%

- May 15, 8 a.m.: The Brazilian Institute of Geography and Statistics releases March retail sales data.

- Retail Sales MoM Prev. 0.5%

- Retail Sales YoY Prev. 1.5%

- May 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases April producer price inflation data.

- Core PPI MoM Est. 0.3% vs. Prev. -0.1%

- Core PPI YoY Est. 3.1% vs. Prev. 3.3%

- PPI MoM Est. 0.2% vs. Prev. -0.4%

- PPI YoY Est. 2.5% vs. Prev. 2.7%

- May 15, 8:30 a.m.: The U.S. Census Bureau releases April retail sales data.

- Retail Sales MoM Est. 0% vs. Prev. 1.5%

- Retail Sales YoY Prev. 4.9%

- May 15, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended May 10.

- Initial Jobless Claims Est. 230K vs. Prev. 228K

- May 15, 8:40 a.m.: Fed Chair Jerome H. Powell will deliver a speech ("Framework Review") in Washington. Livestream link.

- May 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases April consumer price inflation data.

- Earnings (Estimates based on FactSet data)

- May 13: Semler Scientific (SMLR), post-market

- May 14: Bitfarms (BITF), pre-market

- May 14: IREN (IREN), post-market

- May 15: Bit Digital (BTBT), post-market

- May 15: Bitdeer Technologies Group (BTDR), pre-market

- May 15: Fold Holdings (FLD), post-market

- May 15: KULR Technology Group (KULR), post-market

- May 28: NVIDIA (NVDA), post-market

Token Events

- Governance votes & calls

- May 15, 10 a.m.: Moca Network to host a Discord townhall session discussing network updates.

- Unlocks

- May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating supply worth $1.2 billion.

- May 15: Starknet (STRK) to unlock 4.09% of its circulating supply worth $23.87 million.

- May 15: Sei (SEI) to unlock 1.09% of its circulating supply worth $14.91 million.

- May 16: Arbitrum (ARB) to unlock 1.95% of its circulating supply worth $39.06 million.

- Token Launches

- May 13: LOFI (LOFI) to list on Kraken.

- May 13: Cosmos Hub (ATOM) to list on Bitbank.

- May 13: Redacted (RDAC) to list on Binance Alpha.

- May 15: RIZE (RIZE) to list on Kraken.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to be delisted from Coinbase.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 2 of 2: Dubai Fintech Summit

- Day 2 of 2: Filecoin (FIL) Developer Summit (Toronto)

- Day 2 of 2: Latest in DeFi Research (TLDR) Conference (New York)

- Day 2 of 2: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum on Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk’s Consensus 2025 (Toronto)

- May 19-25: Dutch Blockchain Week (Amsterdam, Netherlands)

- May 20-22: Avalanche Summit London

- May 20-22: Seamless Middle East Fintech 2025 (Dubai)

- May 21-22: Crypto Expo Dubai

- May 21-22: Cryptoverse Conference (Warsaw, Poland)

Token Talk

By Shaurya Malwa

- Over 11,700 tokens were launched on LetsBONK.fun in the past 24 hours, nearly half the number created on Pump.fun during the same period — a sign of major user migration to the relatively new token-issuance platform on Solana.

- The platform generated 5,884 SOL in fees ($1.02 million) on Monday, pushing total fee revenue past 16,000 SOL ($2.78 million) since its late April launch, widely followed trader @theunipcs told CoinDesk in a Telegram message.

- LetsBONK.fun now controls 31% of the Solana memecoin launchpad market by volume, rapidly closing in on dominant players despite its relative youth.

- The total number of tokens created on LetsBONK.fun now exceeds 38,000, with the majority launched in the last few days.

- Many of the platform’s competitive features and catalysts have yet to go live, suggesting upside potential as planned tools and gamification roll out, @theunipcs pointed out in the X post.

- BONK prices are up more than 25% in the past week as LetsBONK’s metrics contributed to the momentum.

Derivatives Positioning

- Open interest in bitcoin perpetual futures listed on offshore exchanges dropped by $1 billion to $19 billion during the overnight BTC price pullback, which indicates that the weakness was led by profit taking. Ether data shows the same.

- Funding rates in BTC and ETH remain positive, indicating an overall bullish mood.

- BTC and ETH CME futures open interest in coin terms has jumped to the highest since early April, but the overall positioning remains light and well below the highs seen in December.

- On Deribit, BTC and ETH calls continue to trade at premiums to puts across multiple time frames, reflecting a bullish bias.

- On over-the-counter platform Paradigm, option flows have been mixed with call spreads lifted in ETH alongside put spreads in bitcoin.

Market Movements

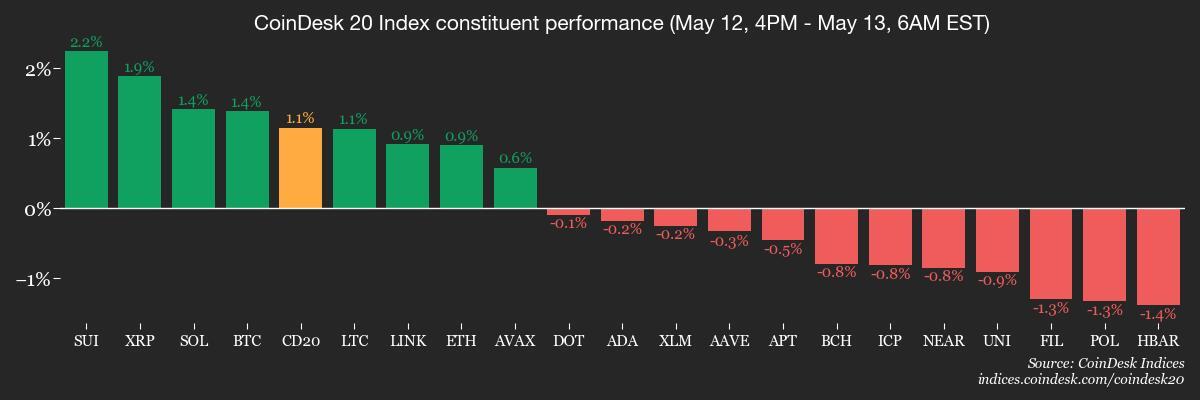

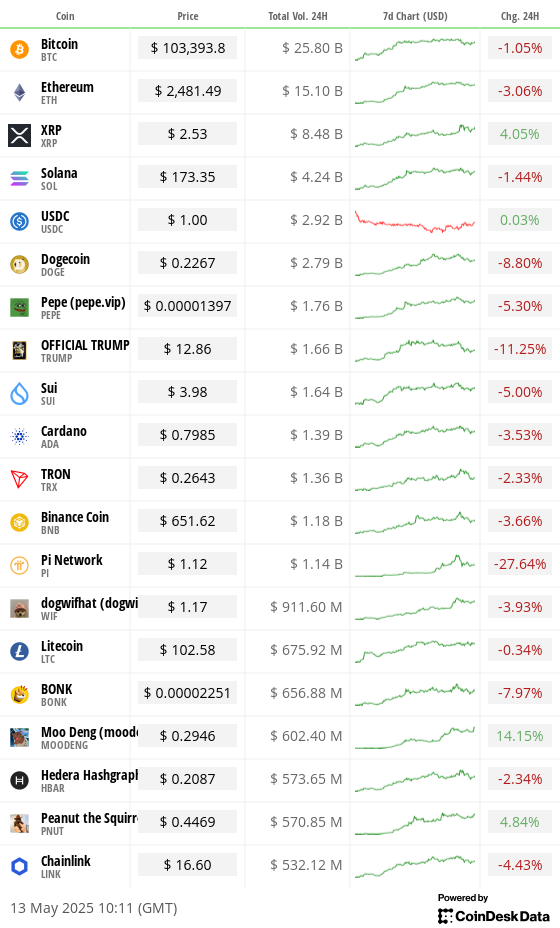

- BTC is up 1.58% from 4 p.m. ET Monday at $103,469.13 (24hrs: -0.97%)

- ETH is up 1.22% at $2,485.45 (24hrs: -2.9%)

- CoinDesk 20 is up 1% at 3,244.61 (24hrs: -0.95%)

- Ether CESR Composite Staking Rate is down 7 bps at 3.17%

- BTC funding rate is at 0.0057% (6.219% annualized) on OKX

- DXY is down 0.22% at 101.56

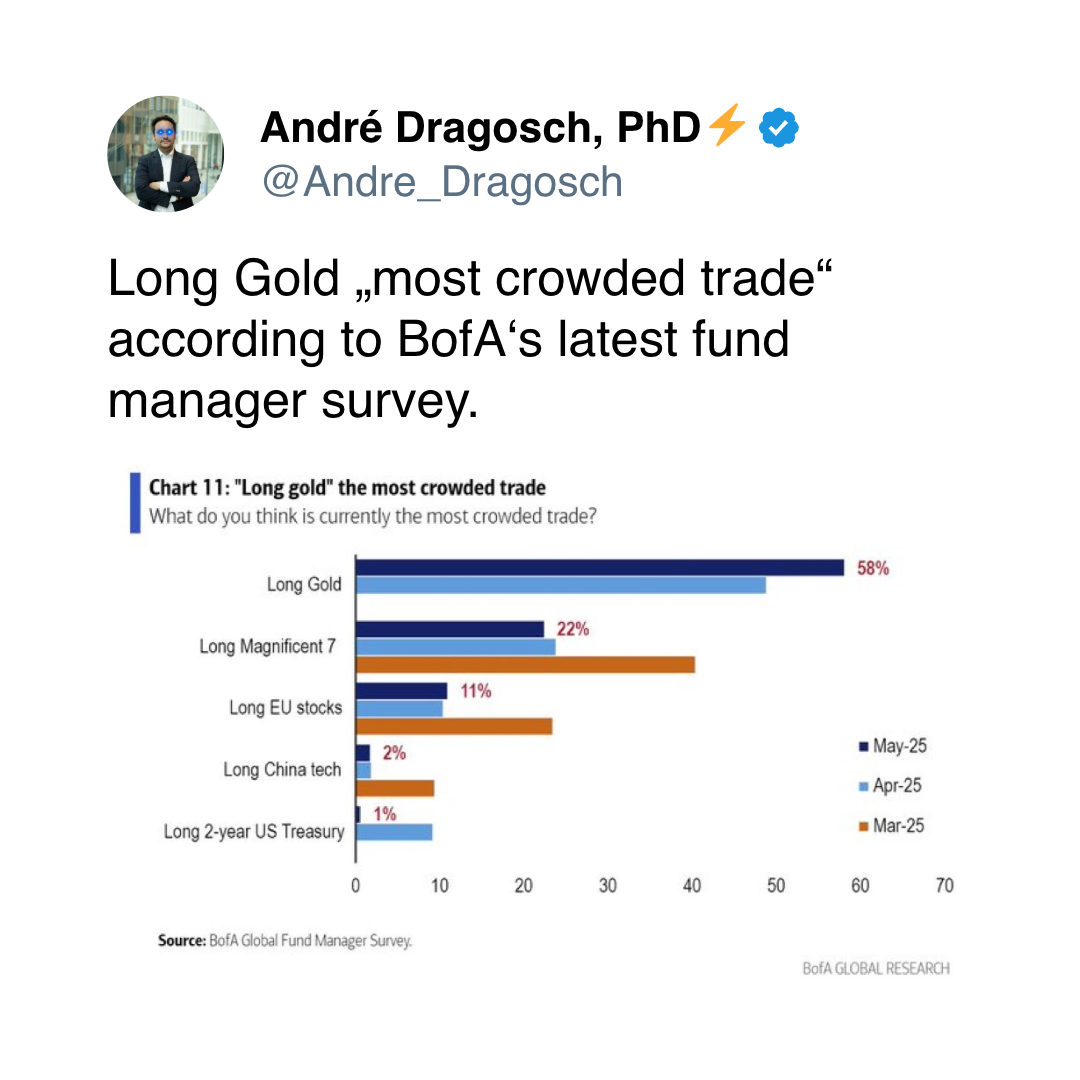

- Gold is up 3.22% at $3,251.80/oz

- Silver is up 1.85% at $33.03/oz

- Nikkei 225 closed +1.43% at 38,183.26

- Hang Seng closed -1.87% at 23,108.27

- FTSE is unchanged at 8,605.82

- Euro Stoxx 50 is unchanged at 5,394.23

- DJIA closed on Monday +2.81% at 42,410.10

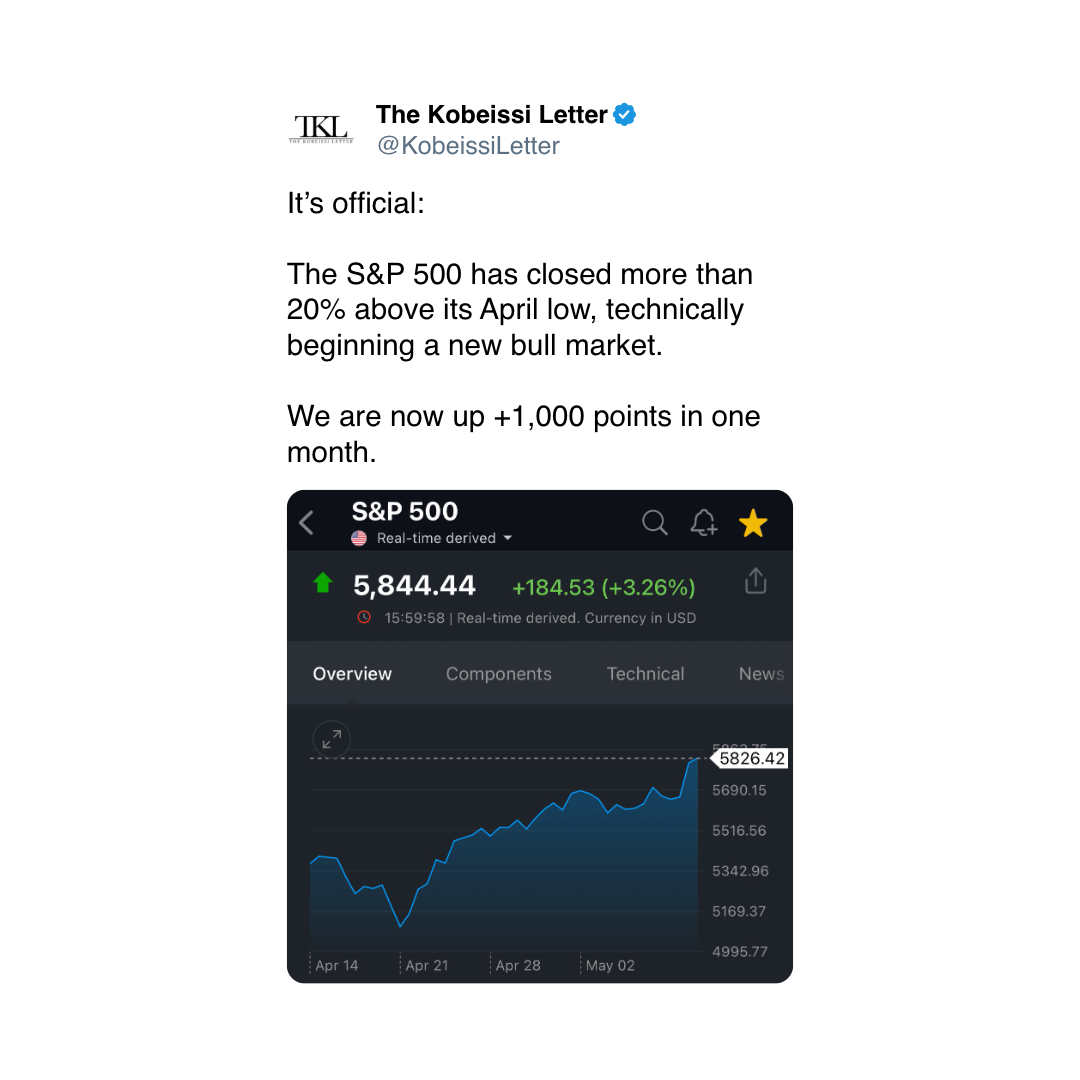

- S&P 500 closed +3.26% at 5,844.19

- Nasdaq closed +4.35% at 18,708.34

- S&P/TSX Composite Index closed +0.69% at 25,532.18

- S&P 40 Latin America closed unchanged at 2,578.53

- U.S. 10-year Treasury rate is down 2 bps at 4.46%

- E-mini S&P 500 futures are down 0.31% at 5846.75

- E-mini Nasdaq-100 futures are down 0.41% at 20,862.75

- E-mini Dow Jones Industrial Average Index futures are down 0.11% at 42,445.00

Bitcoin Stats

- BTC Dominance: 62.95 (+0.51%)

- Ethereum to bitcoin ratio: 0.02394 (-1.36%)

- Hashrate (seven-day moving average): 875 EH/s

- Hashprice (spot): $56.15

- Total Fees: 12.946 BTC / $1.33 million

- CME Futures Open Interest: 146,020 BTC

- BTC priced in gold: 31.7 oz

- BTC vs gold market cap: 9.98%

Technical Analysis

- The dollar index is probing the trendline that characterizes the sell-off from February highs.

- A breakout would confirm the end of the downtrend, potentially drawing momentum traders to market.

Crypto Equities

Strategy (MSTR): closed on Monday at $404.9 (-2.68%), up 1.07% at $409.22 in pre-market

Coinbase Global (COIN): closed at $207.22 (+3.96%), up 9.55% at $226.88

Galaxy Digital Holdings (GLXY): closed at $28.39 (+6.37%)

MARA Holdings (MARA): closed at $15.95 (+1.21%), up 0.94% at $16.10

Riot Platforms (RIOT): closed at $8.7 (+2.59%), up 0.69% at $8.76

Core Scientific (CORZ): closed at $9.88 (+6.01%), up 1.92% at $10.07

CleanSpark (CLSK): closed at $9.62 (+4.57%), up 0.83% at $9.70

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $16.34 (+5.08%)

Semler Scientific (SMLR): closed at $34.84 (+0.14%), down 0.46% at $34.68

Exodus Movement (EXOD): closed at $54.3 (+8.32%), down 10.22% at $48.75

ETF Flows

- Daily net flows: $5.2 million

- Cumulative net flows: $41.13 billion

- Total BTC holdings ~ 1.17 million

- Daily net flows: -$17.6 million

- Cumulative net flows: $2.47 billion

- Total ETH holdings ~ 3.45 million

Source: Farside Investors

Overnight Flows

Chart of the Day

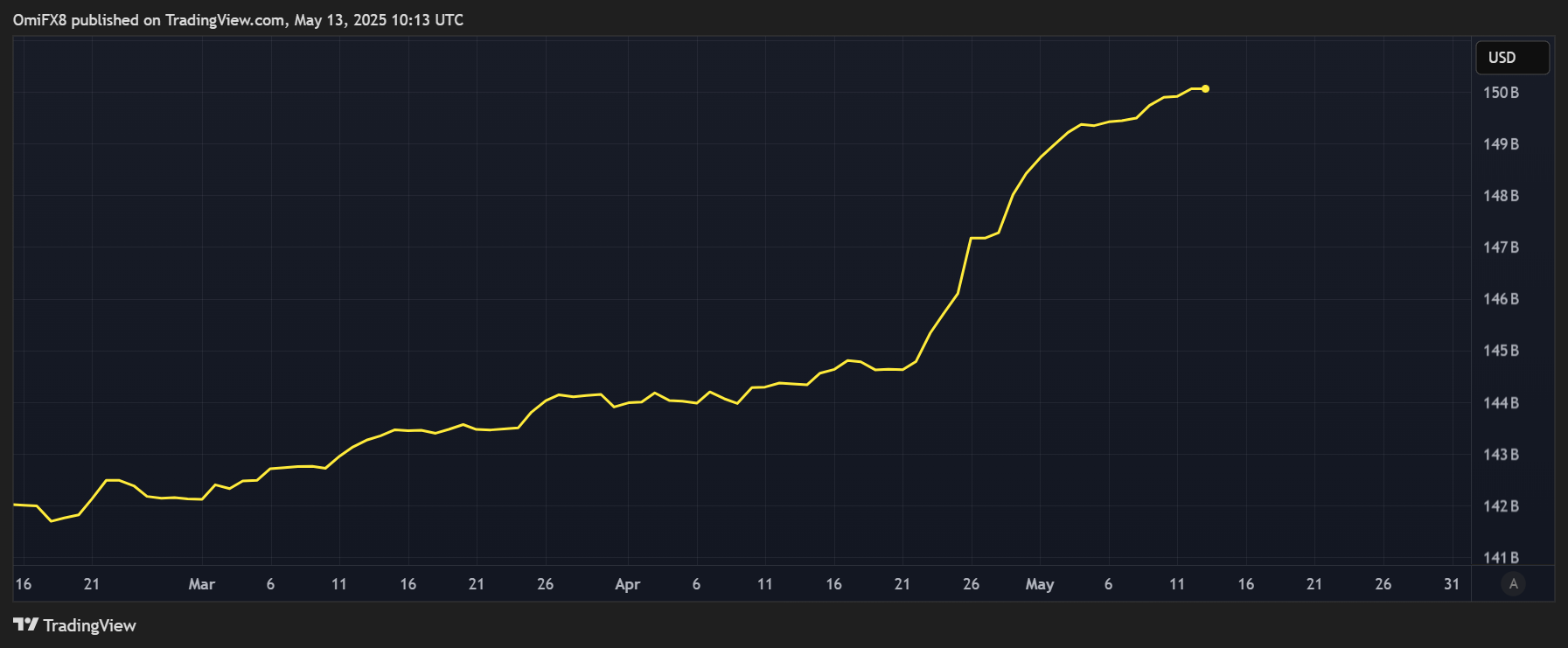

- The market cap of stablecoin tether (USDT) has hit a record high of $150 billion, climbing 4% in less than a month.

- The ever-increasing supply could keep the market well supported on dips, if any.

While You Were Sleeping

- Bitcoin Crossing $2T in Market Cap Triggers Wave of New Buyers, but Key Players Tread Cautiously, On-Chain Data Show (CoinDesk): While first-time buyers are showing strong interest, momentum buyers remain weak, suggesting there’s potential for price consolidation.

- Hong Kong Crypto Investor Animoca Plans U.S. Listing as Trump Lures More Groups (Financial Times): Animoca, which has backed OpenSea, Kraken and Consensys, sees the crypto-friendly U.S. regulatory regime as a chance to pursue a listing in the country.

- Goldman Raises S&P 500 Targets on Lower Tariff, Recession Risks (Bloomberg): Strategists raised their 12-month target for the S&P 500 index to 6,500 from 6,200, citing easing recession and tariff risks. Higher duties could still erode corporate margins, they said.

- Investment Banks Lift China Growth Outlook After Surprise Trade Deal With U.S. (CNBC): UBS raised its 2025 China growth forecast to as high as 4% from 3.4%, while Nomura upgraded Chinese equities and trimmed Indian exposure in favor of China.

- EU Readies Capital Controls and Tariffs to Safeguard Russia Sanctions (Financial Times): Brussels is weighing alternative legal tools to renew sanctions on Russia beyond July if Hungary follows through on threats to veto an extension.

- Pump.fun Launches Revenue Sharing for Coin Creators in Push to Incentivize Long-Term Activity (CoinDesk): Pump.fun launched a revenue-sharing model that pays coin creators 5 basis points of trading volume, aiming to curb pump-and-dumps and reward credible developers with recurring income.

In the Ether