Michael Saylor’s Bitcoin Playbook: How MicroStrategy Aims for 100x BTC Returns

MicroStrategy’s CEO just doubled down on his billion-dollar bet—here’s the ruthless math behind his all-in Bitcoin strategy.

Leverage, Hodling, and Tax Tricks

The 100x Roadmap

One hedge fund manager sniffed: ’If this works, we’ll all be filing our taxes in Satoshis by 2030.’

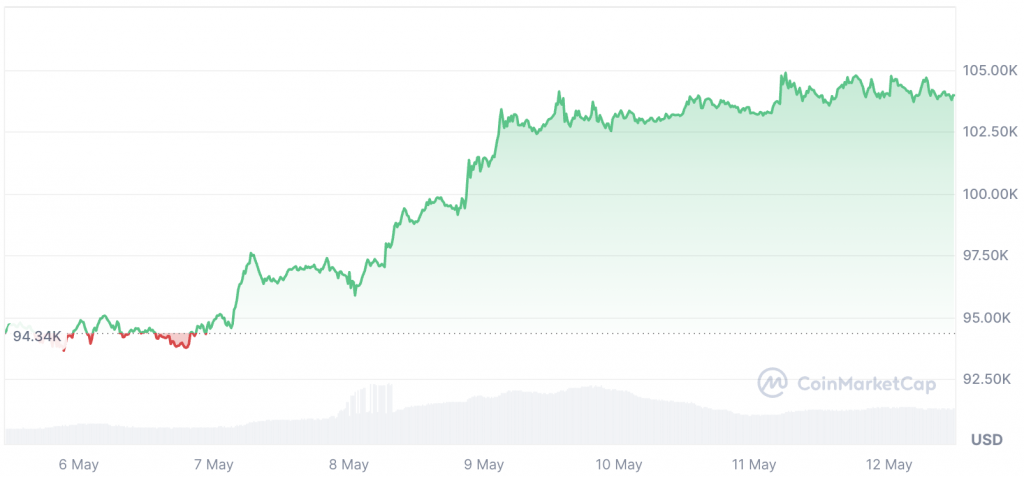

Source: CoinMarketCap

Source: CoinMarketCap

Amidst this notable price recovery of Bitcoin, prominent BTC bull Michael Saylor was sharing a rather important message. Appearing in a recent interview, the former CEO of Strategy revealed how the average Joe could 100x their money with Bitcoin.

Can An Investor 100x Their Bitcoin Investment?

Saylor predicts that Bitcoin might be worth a staggering $13 million by the year 2045. Therefore, buying the king coin at its current price could be a major bargain. He urged the average investor to rethink spending habits and focus on accumulating Bitcoin over other luxury purchases. The American entrepreneur pointed out how a Ferrari that costs 6 BTC today could eventually cost $100 million in the future. As a result, instead of splurging, he advises using low-interest, long-term mortgage financing to purchase Bitcoin.

This kind of loan offers steady, affordable financing, is frequently government-subsidized, and is not marked to market. Saylor’s plan is to invest in bitcoin using the proceeds from a mortgage that is between 10 and 30 years old. He advises avoiding buying pricey liabilities like yachts or sports vehicles, quitting your work, or paying off mortgage early. Instead, invest all of the non-mark-to-market money in Bitcoin, which he predicts will increase by 30% a year over the next 20 years. His advice was to postpone pleasure now in order to accumulate money later.