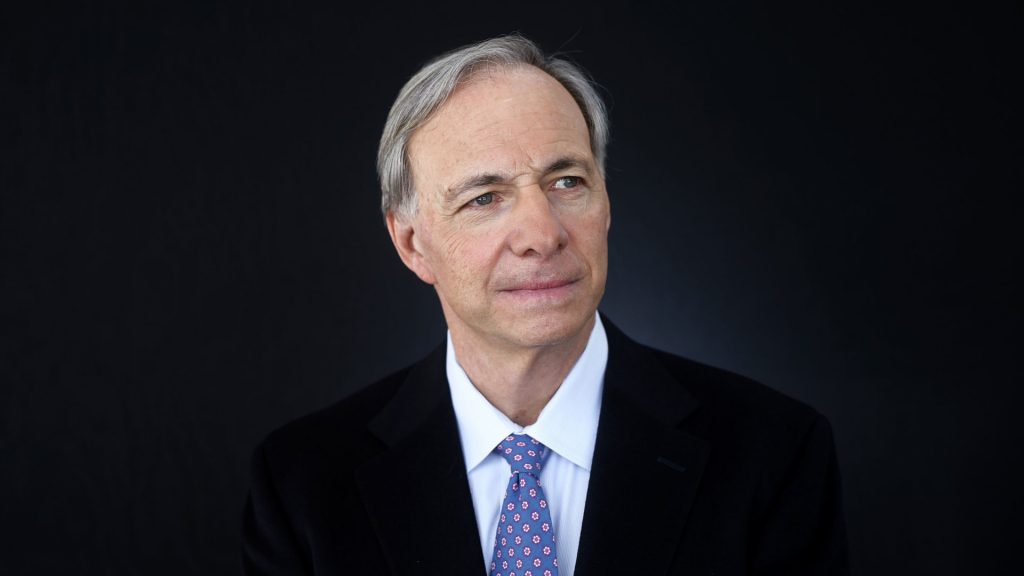

Ray Dalio Drops Bombshell: Trump’s Dollar Devaluation Play Isn’t an Accident—It’s Strategy

Bridgewater’s billionaire founder pulls back the curtain on Washington’s currency chess game.

Why weaker greenbacks could mean stronger crypto—and why Wall Street won’t admit it.

The dollar’s decline isn’t policy drift—it’s deliberate financial warfare. And Bitcoin’s ATH run might just be collateral damage.

(Bonus jab: Treasury secretaries love weak dollar policies—until their hedge fund buddies start missing yacht payments.)

Ray Dalio Floats A New Compelling Theory

Ray Dalio, in his recent post on X, presented a brief yet compelling analysis of currency dynamics and trends. His post outlined the idea of currency devaluation as one of the methods to reduce debt issues.

Dalio took to X to share how, sometimes, when nations are grappling with intense debt crises and the debt is denominated in their own currency, in such a case, these nations opt to devalue their currencies to stabilize rising debt issues.

He later shared how this is one of the primary reasons why the US dollar has been weak against the majority of other currencies, taking the investors by sweet surprise.

When countries have big debt problems and the debt is denominated in their currency, they inevitably devalue the currency. As explained in my upcoming book How Countries Go Broke: The Big Debt Cycle, "debt is currency and currency is debt." In other words, since a debt asset is…

— Ray Dalio (@RayDalio) May 6, 2025Trump Wants a Weaker Dollar: Why?

Trump’s intent to push the US dollar further down has now become a reality. According to several experts, a weaker dollar is good for exports, helping the US boost its manufacturing, which in turn will help reduce US deficits.

Lubin shared

At the same time, Trump seems to have succeeded in devaluing the dollar, as giants like Goldman Sachs have predicted how the USD is on a path for further decay and erosion.

Cahill writes.