Goldman’s Stock Tanks 15% in Q1 as Traders Flee to Crypto

Wall Street’s golden child stumbles while Bitcoin hodlers laugh all the way to the blockchain.

Three brutal months have stripped $15B from Goldman’s market cap—just as retail traders pile into decentralized alternatives. Guess those ’bubble’ warnings weren’t for crypto after all.

Meanwhile in digital asset land: Bitcoin’s up 27% year-to-date. But sure, keep shorting those ’risky’ tokens, Jamie.

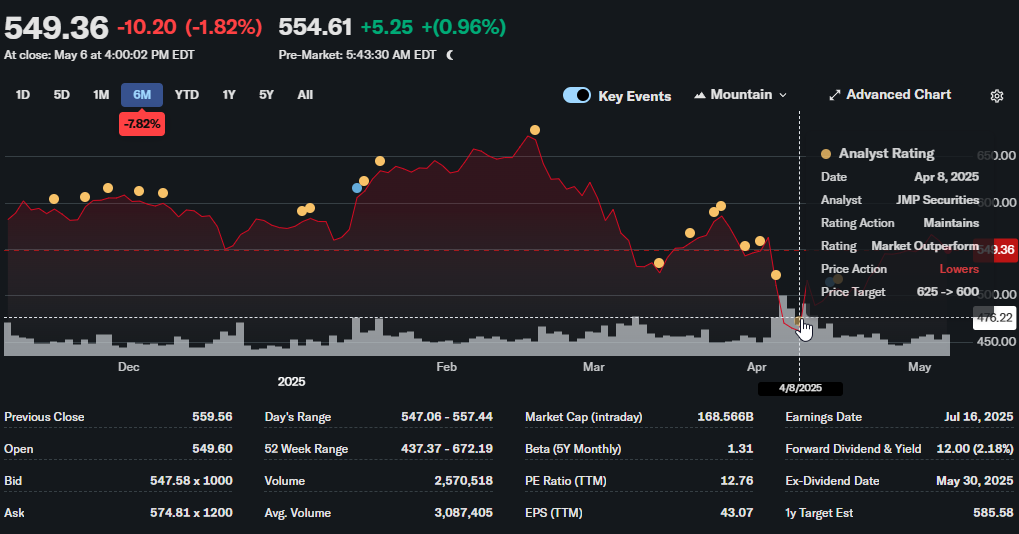

Source: Yahoo Finance

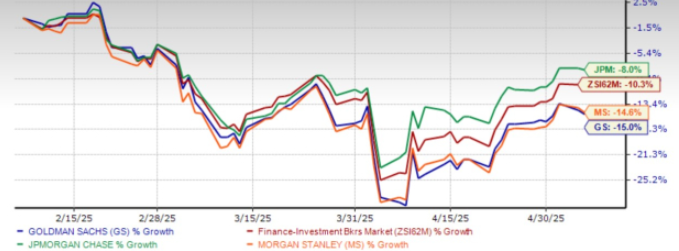

Source: Yahoo Finance

Navigating Market Volatility: Expert Analysis on Goldman Shares Performance

Bank Problems Hurt Goldman Stock

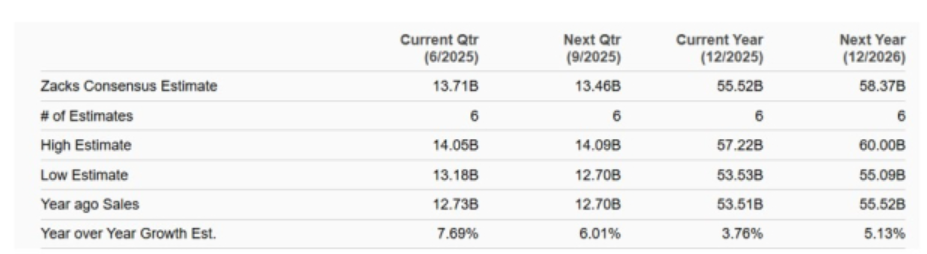

Right now, Goldman Sachs stock is facing some serious headwinds as its investment banking revenues fell about 8% year-over-year in the first quarter of 2025. The current market volatility, which is largely caused by President Trump’s tariff plans, has essentially delayed the expected M&A revival until the second half of 2025, and this is affecting GS stock price in a pretty significant way.

Goldman Shifts Focus for Better Results

Goldman Sachs stock may, in the long run, benefit from the company’s ongoing exit from consumer banking and such. The firm is currently refocusing on its CORE strengths in investment banking, trading, and also asset management, where its Wall Street outlook remains somewhat positive despite the current challenges and market uncertainty.

Financial Strength Supports Investment Bank Performance

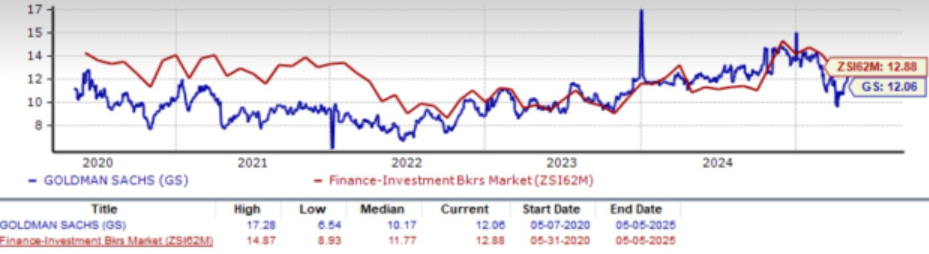

The Goldman Sachs stock functions on solid foundational elements because the investment bank maintains strong Tier 1 capital ratios and holds approximately $167 billion in cash throughout March 2025. Goldman Sachs shareholders also benefit from two key metrics we need to look at: a 2.14% dividend yield along with a very attractive P/E ratio of 12.06X that is also exceeding the industry averages of 12.88X.

Goldman Sachs Stock: Conclusion

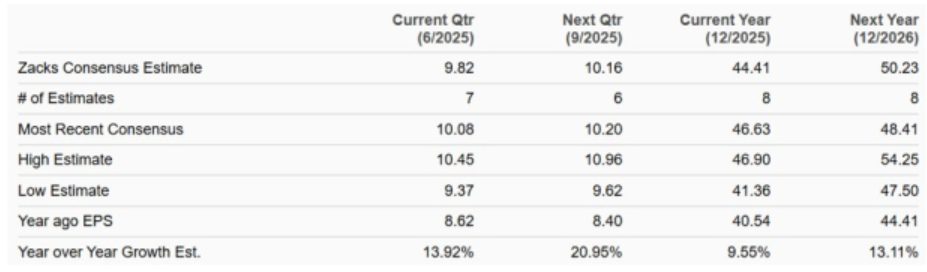

Analysts maintain a somewhat cautious but generally positive stance on Goldman Sachs stock.

Zacks Investment Research were certain that:

The investment bank’s leading position in deal-making, diversified business model, and also global presence provide Sachs’s stock with significant long-term advantages despite the current market volatility and economic uncertainty.