Dollar Dominance Crumbles as Asian Markets Pivot Away – Devere CEO Sounds Alarm

The greenback’s reign faces an existential threat as Asian economies accelerate their de-dollarization moves. Devere Group’s CEO Nigel Green warns of structural cracks in USD supremacy—while somehow keeping a straight face as bankers pretend this wasn’t entirely predictable.

Asia’s dollar dump goes mainstream

Central banks across the region are quietly offloading US Treasuries faster than a hot NFT project. China’s yuan internationalization push now comes with actual muscle, not just press releases.

Crypto’s open goal

Bitcoin and stablecoins are eating dollar liquidity during Asian trading hours. Smart money’s already treating crypto rails as the new offshore dollar system—just without the sanctions risk.

The financial establishment still won’t admit it: the dollar’s exorbitant privilege now comes with an expiration date. Gold bugs and crypto maximalists suddenly have something to agree on.

Navigate Global Reserve Currency Shifts as Dollar Erosion Deepens Financial Security

Dollar Supremacy Cracking

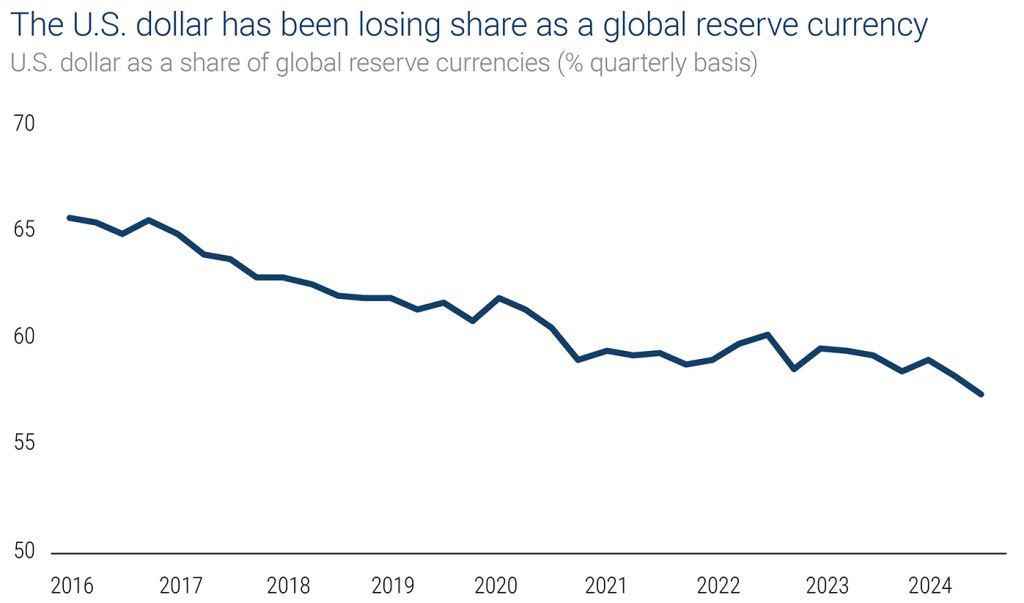

Recent years show some significant decline in the US dollar holdings in world reserve assets which also creates some widespread fear about the potential end of dollar dominance. The global de-dollarization trend threatens investors who fail to prepare against any upcoming market instability.

Nigel Green, CEO of Devere Group, stated:

Green also emphasized the nature of this decline in his assessment:

Asia Dumps USD

Asia has witnessed a crucial transformation in dollar currency preferences which represents a central component of today’s currency reform efforts. The economic sanctions drove countries to establish new financial systems because sanctions accelerated these alternative economic transitions.

Green also explained the shifting currency landscape in his analysis, by saying that:

Regarding the future currency system, Green additionally noted:

Global Reserve Currency Shifts

De-dollarization is absolutely reshaping global reserve currency shifts in many ways, and this is creating both challenges and also opportunities for investors who are trying to navigate this changing landscape.

Green warned investors about outdated assumptions in his recent statements:

On monetary policy implications, Green further explained:

Green concluded with this particular assessment of the situation: