Japan’s $1.1T Treasury Time Bomb—How Tokyo Could Reshape Global Finance Overnight

Forget trade wars—Japan’s mountain of U.S. debt is the ultimate financial weapon. With $1.1 trillion in Treasuries, Tokyo could send shockwaves through markets faster than a crypto flash crash.

The nuclear option: What happens when the world’s most disciplined creditors get restless? Dollar dominance faces its ultimate stress test as Japan’s pension tsunami meets America’s spending addiction.

Wall Street’s worst nightmare: A silent sell-off where ’risk management’ means watching your reserve currency unravel before morning coffee. (Bonus jab: At least Treasuries still yield more than your average Japanese savings account—for now.)

Exploring How Japan’s Massive US Debt Holdings Create Economic Leverage Amid Rising Trade Tensions

A Significant Financial Relationship

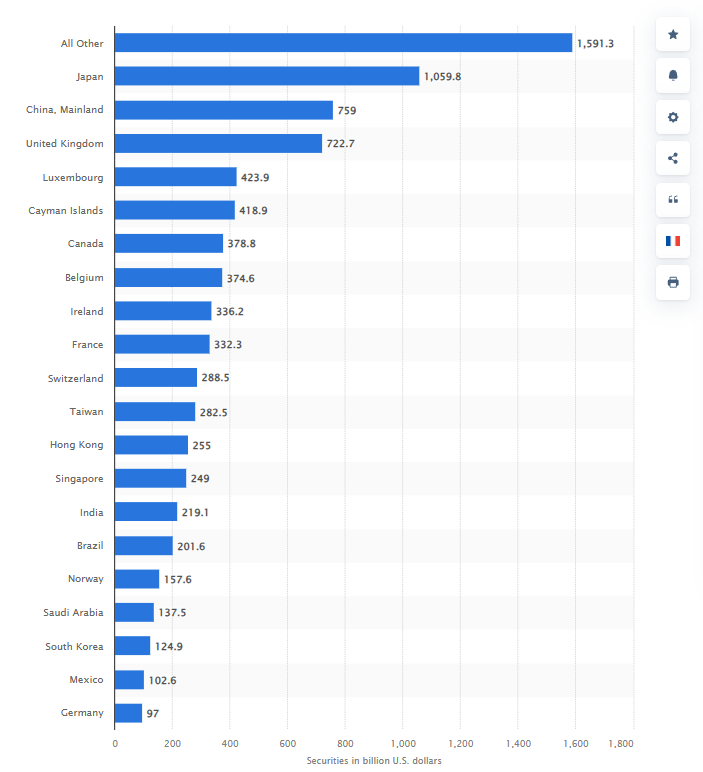

Japan’s US treasury holdings currently amount to approximately $1.13 trillion, and this makes Japan America’s largest foreign creditor. The Trump administration has, in recent months, imposed some significant tariffs on Japanese exports, including a 24 percent ‘reciprocal’ duty that it has currently paused, and these tariffs are now affecting Japan’s vital automotive sector and other industries.

Japan’s Finance Minister Kato has also said that:

Strategic Implications

The Japan’s US treasury holdings represent, in many ways, a powerful financial tool that could potentially influence the trade dynamics between the two nations. While Japanese officials had previously ruled out using Treasury holdings as leverage, Kato’s recent comments appear to signal a possible strategic shift in their approach.

The Balancing Act

Japan’s US treasury holdings create a rather complex economic relationship where both nations have, frankly, a lot to lose from any drastic actions. A large-scale sell-off could potentially spike US interest rates while also causing the yen to appreciate, which would likely harm Japan’s export-driven economy in various ways.

Takeshi Niinami, senior economic advisor to Japan’s prime minister, is convinced by the fact that:

Finance Minister Kato emphasized this idea by saying that:

Looking Forward

The holding position of Japan’s U.S. Treasury assets has achieved an important diplomatic power relocation. Japan maintains its delicate approach to managing US Treasury holdings while signaling its comprehensive geopolitical plan because it stands as a direct US ally amid Trump-era trade tensions against Chinese economic activities.