VanEck Bets Big on Binance: Spot BNB ETF Filing Shakes Crypto Markets

Wall Street’s latest crypto play just dropped—and it’s targeting Binance’s native token. VanEck’s surprise BNB ETF filing signals institutional appetite for exchange tokens, regulatory headaches be damned.

Why this matters: A spot BNB ETF would give traditional investors exposure without the hassle of self-custody or dodging SEC scrutiny. The move comes as Binance continues its delicate dance with global regulators—because nothing says ’trust us’ like a $4.3 billion settlement.

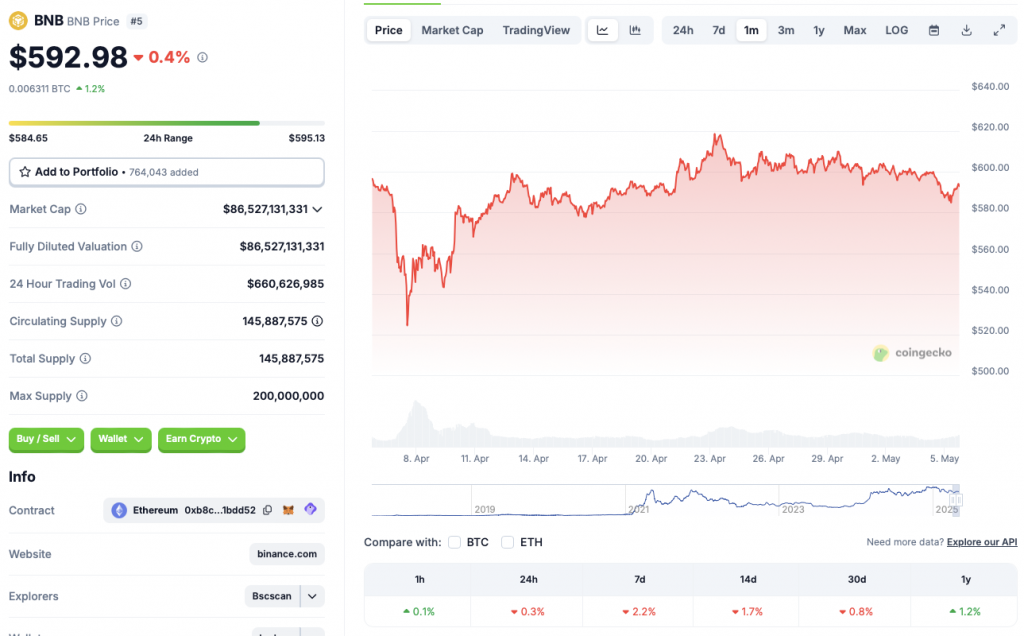

Market impact: BNB price surged 8% on the news, flirting with its ATH. Traders are clearly pricing in the ’grayscale effect’—that magical moment when institutional money meets illiquid crypto markets.

The cynical take: Another day, another ETF filing. At this rate, we’ll have a meme coin ETF before the SEC finishes its coffee.

Source: CoinGecko

Source: CoinGecko

Will The SEC Approve A BNB ETF?

The SEC recently welcomed Paul Atkins as its new head. Atkins is popular in the crypto community for his pro-Bitcoin stance. Many anticipate him to take a more lenient approach to the crypto industry, compared to outgoing SEC head Gary Gensler. There is a high probability that the SEC will greenlight VanEck’s BNB ETF filing.

President Trump has stated that he wants the crypto industry to thrive in the US. Bitcoin (BTC) hit an all-time high on President Trump’s inauguration day, Jan. 20. While BTC has already gotten a few ETFs last year, there is a high probability that we will see multiple crypto-based ETFs this year, including BNB.

Will The Asset Hit a New All-Time High?

BTC hit a new peak after the SEC approved 11 spot BTC ETFs last year. We may see a similar pattern for Binance’s BNB token. The asset hit a peak of $788.84 in December of last year. BNB’s price has dipped by nearly 25% since its December high.

BNB has seen incredible growth over the last few years. The crypto industry is expected to grow at an astronomical rate over the coming years. If the Federal Reserve cuts interest rates and the SEC approves a spot BNB ETF, the asset could climb to a new all-time high. If market conditions are favorable, BNB could even breach the $1000 mark.