Ethereum Bulls Charge: Can ETH Smash Through $2K This Quarter?

Ethereum holders are flexing their accumulation muscles—liquidity pools thicken, whale wallets bulk up, and derivatives traders place bullish bets. But can retail FOMO meet institutional demand to catapult ETH past $2,000?

Catalysts in play: The Merge’s deflationary mechanics finally show teeth, L2 adoption slashes gas fees, and BlackRock’s ETF desk ’accidentally’ leaks an ETH filing. Meanwhile, Wall Street still thinks Proof-of-Stake involves rodeo clowns.

Timing? Watch for a breakout if Bitcoin holds $30K—ETH tends to ride BTC’s coattails before outperforming in altseason. Just don’t expect the suits to understand staking yields until 2026.

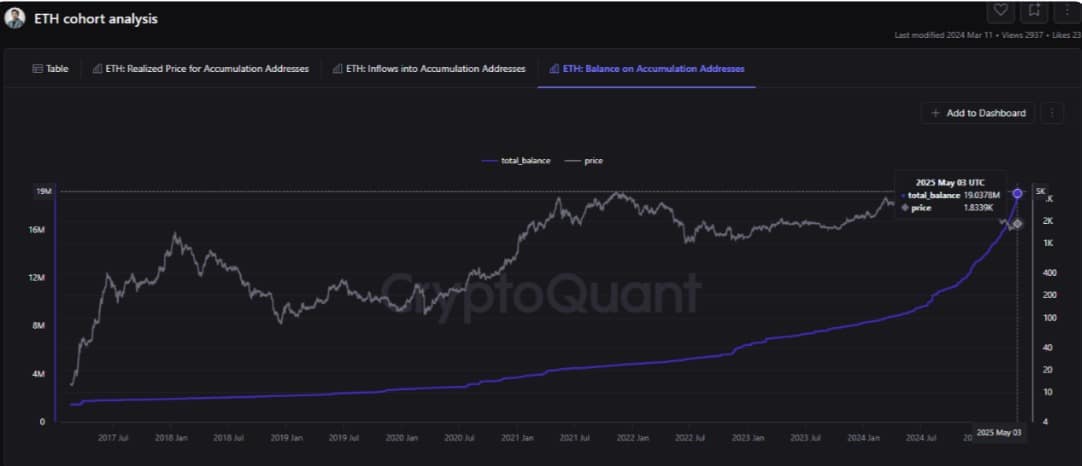

Source: CryptoQuant

This accumulation trend is more observed among whales. As this accumulation trend has continued over the past day with dormant whales waking up after four years.

As reported by OnChainLens, this whale has withdrawn 1,202 ETH worth $2.2 million from Binance.

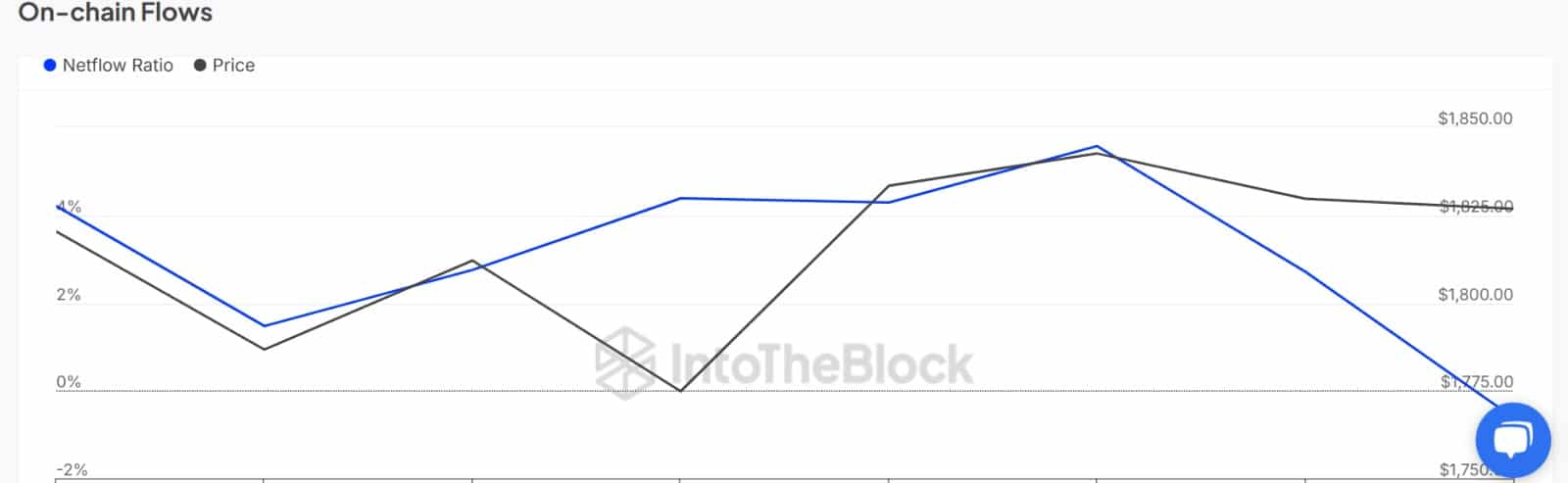

Source: IntoTheBlock

This trend is widespread among Ethereum whales, as reflected in the Large Holders’ Netflow to Exchange Netflow Ratio.

The metric shows that large holders are aggressively accumulating, with the exchange ratio dropping to -0.62%, its lowest recent level.

A negative value here indicates that whales are withdrawing more ETH from exchanges than they are depositing, signaling strong accumulation behavior.

Source: CryptoQuant

This market trend isn’t limited to large holders—it’s visible across all participant levels.

Ethereum’s Exchange Netflow has remained negative for six of the past seven days, with only one exception.

This suggests that retail investors and smaller holders are also withdrawing more ETH from exchanges than they are depositing. Such behavior signals growing confidence in Ethereum’s future price potential.

Source: Santiment

The growing cumulative addresses have pushed Ethereum’s scarcity to recent highs. As such, stock to Flow ratio has spiked to a yearly high of 374. A spike in SFR reflects growing scarcity, with less ETH readily available to sell.

Often, a high scarcity while demand remains strong drives prices higher.

What does it mean for ETH

Despite ETH’s price struggles, accumulation continues, signaling strong belief in its asset value, project, and ecosystem.

This trend reflects structural conviction and clear expectations for short-term price appreciation.

Put simply, Ethereum holders are displaying bullish sentiment, positioning the altcoin for potential price gains.

If accumulation persists and outpaces selling pressure, ETH could break out of consolidation and push toward $2,000. However, if the tug-of-war between holders and speculative bears continues, ETH may remain range-bound for a longer period.

Take a Survey: Chance to Win $500 USDT