Morgan Stanley’s XRP Forecast: Banking Giant Dives Into Ripple’s Turbulent Waters

Wall Street meets crypto—again. Morgan Stanley just dropped its take on Ripple’s embattled XRP, and the verdict’s got the token’s army of retail bagholders holding their breath.

The big question: Can XRP actually deliver on its promise to revolutionize cross-border payments, or is it just another ’blockchain solution’ collecting dust in a banker’s PowerPoint deck?

One thing’s clear: When traditional finance starts sniffing around a crypto project, things get interesting—or messy. Just ask the SEC.

(Bonus jab: At least this time the institutional interest isn’t another Bitcoin ETF filing.)

Morgan Stanley & XRP: What’s Happening?

SMQKE, a leading research portal, recently uploaded a few snippets of an article outlining Morgan Stanley’s stance towards XRP. The article consisted of content on Ripple and how its usage in mainstream finance can help bring a new revolution. The snippet uploaded by SMQKE comprised a similar narrative, adding that Morgan Stanley considers XRP an able alternative to the SWIFT payment system.

The snippet uploaded by the research platform further outlined how the financial giant believes XRP can help reduce settlement periods and speed up transactions.

BREAKING: Morgan Stanley Considers #XRP As Leading Alternative to SWIFT! pic.twitter.com/zunf6iZHKT

BREAKING: Morgan Stanley Considers #XRP As Leading Alternative to SWIFT! pic.twitter.com/zunf6iZHKT

The Token’s Price Analysis

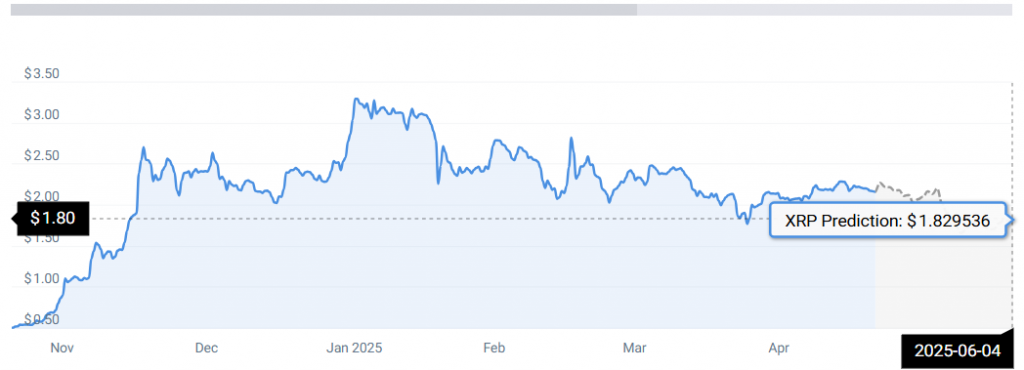

As per CoinCodex, Ripple may soon hit the $1.80 price mark by the end of May 2025.