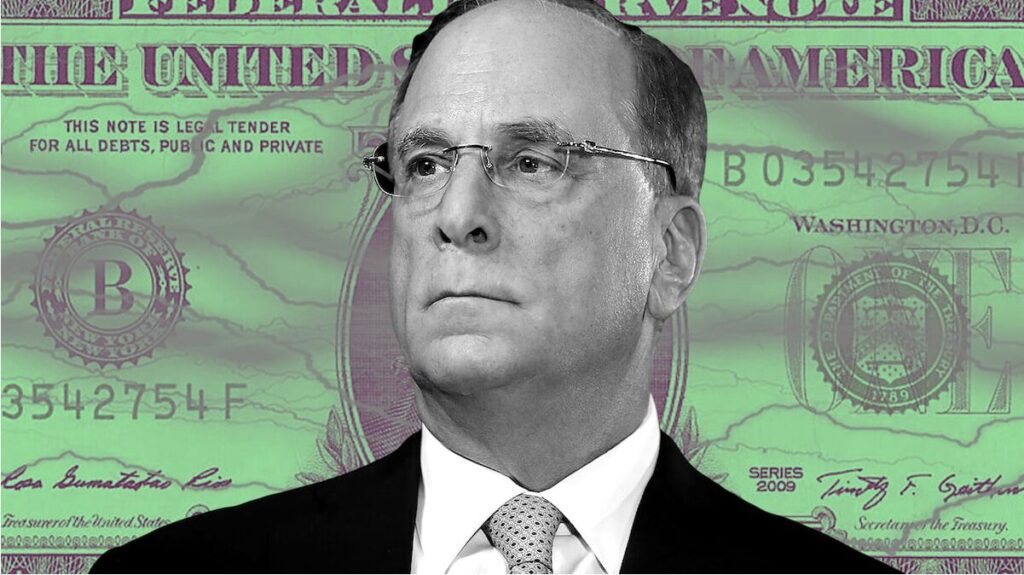

BlackRock CEO Drops Bombshell: Gold, Bitcoin, or Yuan—Who Kills the Dollar?

The USD’s dominance is on life support—and Larry Fink just handed Wall Street a brutal triage list. Gold’s the old guard, Bitcoin’s the anarchist, and the Yuan’s the political wildcard. Place your bets.

Meanwhile, traditional finance clings to its spreadsheets like a security blanket. Spoiler: the market’s already voting with its wallet.

BlackRock CEO Picks US Dollar Replacement

While China has made considerable advances for the de-dollarization agenda, the yuan may not be the currency that dethrones the almighty US dollar. According to BlackRock CEO Larry Fink, it’s not the yuan or gold that may replace the US dollar as the global reserve currency, but Bitcoin (BTC).

In a recent letter to shareholders, Fink explained why the US dollar’s dominance may not last forever. One central reason for Fink’s growing distrust of the US dollar is the growing American debt. Fink stated, ““

Fink added, ““

Will The USD Be Replaced By Bitcoin For Global Trade?

Fink’s reasoning is quite sound. The glowing American debt will likely pose a considerable threat to the US dollar’s dominance, unless something is done about it. President Trump has used tariffs to threaten countries into new trade deals. These measures aim to increase the US’s income.

While the growing dissidence against the dollar is real, it is difficult to say if Bitcoin (BTC) will be a realistic replacement. Crypto adoption is still at a nascent stage. The de-dollarization fight will most likely see the euro or yuan as a more realistic contender.