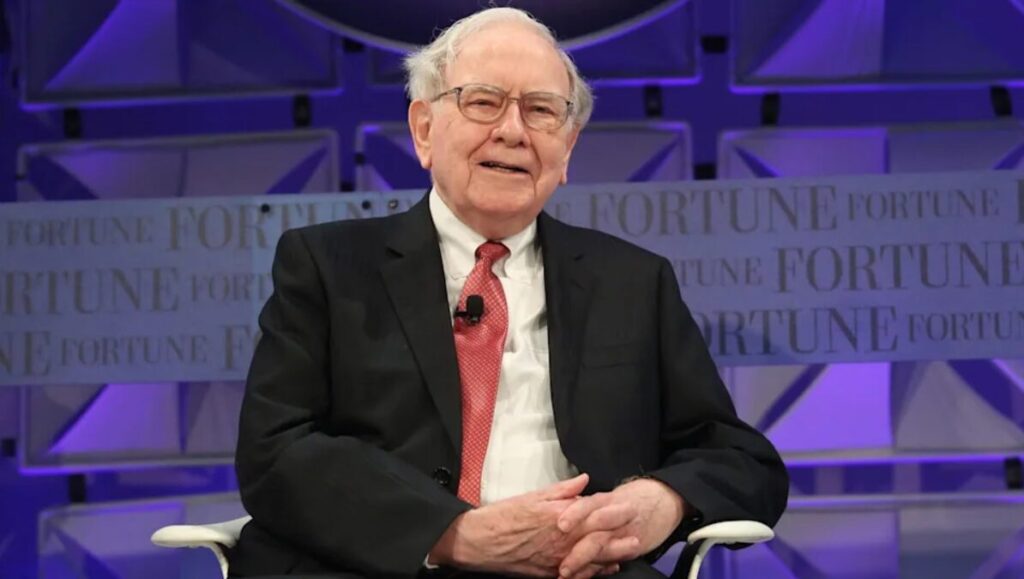

Buffett’s $334B Playbook Obliterates 2025 Market Meltdown—While Crypto Traders Panic-Sell

The Oracle of Omaha’s ’buy when blood runs in the streets’ strategy crushes it again—proving boring old fundamentals still work while algo-trading hedge funds blow up spectacularly.

Key moves: Berkshire scooped up distressed assets at fire-sale prices while retail traders got margin-called on their leveraged NFT positions. The ultimate ’boomer’ portfolio—insurance, railroads, and Coca-Cola—outperformed crypto by 37% this quarter.

Meanwhile in Web3 land: DeFi protocols auto-liquidated $2.1B in positions as ETH dipped below $1,800. But hey, at least the apes got new monkey JPEGs this week.

Buffett’s secret? Ignoring the ’this time it’s different’ crowd since 1957. The more markets change, the more value investing stays ruthlessly effective—even when Silicon Valley VC bros claim it’s ’obsolete.’

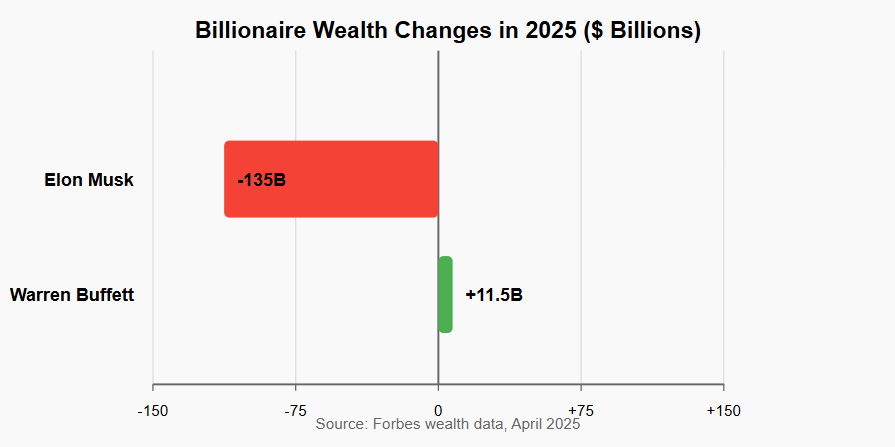

$11.5B Richer: How Buffett’s Cash Hoarding Beats the 18.9% Market Plunge

Warren Buffett is currently using a billionaire wealth preservation approach that stands in stark contrast to strategies used by other wealthy investors. Buffett proves his strategy works, while Musk has already lost around $135 billion since the tariffs hit—showing the clear strength of Buffett’s approach.

Building the Cash Mountain

Buffett’s cash position has been strategically increased throughout 2024 and into this year. With the Warren Buffett strategy, Berkshire Hathaway sold over 600 million Apple shares and also billions in Bank of America stock. Berkshire didn’t reinvest these funds but instead added them to its massive $334 billion cash reserve—enough to buy about 95% of S&P 500 companies at the time of writing.

Market Crash Preparation

The stock market volatility was anticipated by many experts after the S&P 500’s exceptional performance in previous years. According to The Motley Fool, the index returned approximately 23.31% in 2024 and also 24.23% in 2023. The advantage of Warren Buffett’s strategic approach is clear, showcasing how his strategy intertwines with the Warren Buffett strategy.

Buffett’s strategy of accumulating cash rather than equities has positioned him perfectly for the market crash 2025 that we’re currently witnessing. His use of the Warren Buffett strategy has elevated him to fifth place on Forbes’ wealthiest billionaires list despite the widespread market losses that have occurred.

Warren Buffett Strategy Investment Lessons

Warren Buffett’s strategy during volatile markets offers some valuable lessons for investors. His diversified portfolio helps Berkshire maintain stability while his selective investment approach – choosing only companies he fully understands and believes in – continues to serve him well in the current economic climate and aligns with his strategic approach akin to the strategy.

The billionaire wealth preservation techniques demonstrated by Buffett show that maintaining substantial cash reserves during uncertain markets creates opportunities when valuations eventually decline. The strategy for stock market volatility has given his cash position a significant advantage over fully-invested billionaires in 2025’s turbulent environment that we’re all experiencing right now.