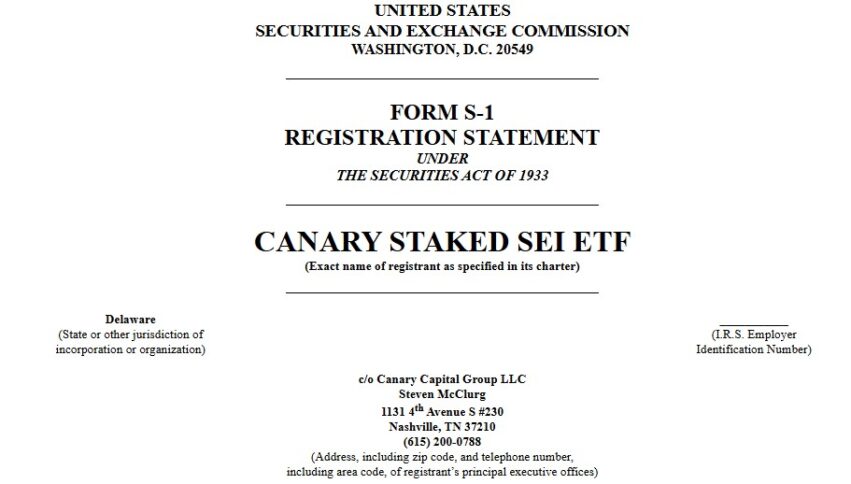

Wall Street Plays Catch-Up: Canary Capital Bets Big With First-Ever Staked SEI ETF Filing

Move over, Bitcoin ETFs—Canary Capital just lobbed a grenade into traditional finance with its SEC filing for the first staked SEI exchange-traded fund. The move signals institutional appetite for yield-bearing crypto strategies, even as regulators scramble to keep pace.

Why it matters: This isn’t your grandpa’s income fund. By combining ETF accessibility with staking rewards, Canary’s product could open floodgates for retail investors chasing crypto yields—assuming the SEC doesn’t slow-walk approval until the next market cycle.

The fine print: While the filing shows Wall Street’s grudging acceptance of crypto’s staying power, remember this is the same industry that needed a 10,000% Bitcoin rally before taking digital assets seriously. Some innovation just can’t be shorted into oblivion.

Source: U.S. Securities and Exchange Commission

Source: U.S. Securities and Exchange Commission

The two custodians for the ETF will be BitGo Trust Company and Coinbase Custody Trust Company to hold SEI tokens safely. These are not insured by the FDIC but they have insurance policies to minimize risks of losses.

The ETF is an efficient means of investing in SEI through a regular brokerage account without the need to understand how the blockchain works or the concept of private keys.

One of the unique aspects of the Canary Staked SEI ETF is the staking process. The fund will also earn more SEI tokens through staking, which is a process of verifying transactions on the Sei Network through the proof-of-stake (PoS) consensus mechanism.

This staking reward system gives the investors the opportunity to earn additional income in addition to the possibility of benefiting from the fluctuations of the SEI price.

This ETF is part of Canary Capital’s plan to list more ETFs that track digital currencies, after submitting a similar application for TRX. The approval of the SEI ETF by the SEC is still pending, but this makes it easier for traditional investors to invest in digital assets by holding tokens and receiving staking rewards.

Also Read: Canary Capital Files for First-Ever TRX Spot ETF With SEC