Bitcoin ETF Inflows Hit 7-Day Streak: $591 Million Floods In

Wall Street’s latest crypto obsession shows no signs of slowing down as Bitcoin ETFs notch another week of bullish momentum. Institutional money keeps pouring in—because nothing says ’contrarian play’ like chasing 2024’s hottest financial product at all-time highs.

The $591 million influx marks a decisive shift in capital flows, proving even traditional finance can’t resist crypto’s siren song when fees are low and FOMO runs high. Will this sustainable demand finally push BTC past $100K? Traders aren’t holding their breath, but the trend speaks for itself.

Will Trump’s Crypto Speech Push Bitcoin Toward a $100K Breakout?

BTC Rallies as Markets Watch Trump’s Address

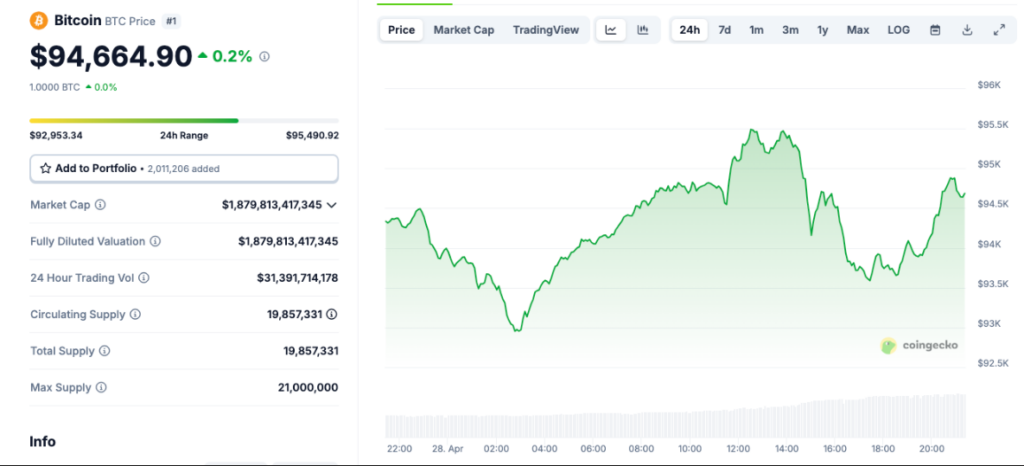

Bitcoin price prediction models are being updated as BTC rose about 0.8% to approximately $95,490 on Monday. The leading cryptocurrency, at the time of writing, has traded between $92,953 and $95,490, and is showing remarkable resilience amid broader market uncertainty. BTC’s nearly 15% monthly gain has certainly turned Bitcoin 2025 forecast discussions toward the $100K target that seemed rather distant just weeks ago.

Trump Policies Drive Crypto Market Reaction

Crypto market reaction remains intensely focused on Trump’s potential Bitcoin strategic reserve announcement. Bitcoin price prediction experts and analysts suggest such news could possibly trigger an immediate run toward the $100K target.

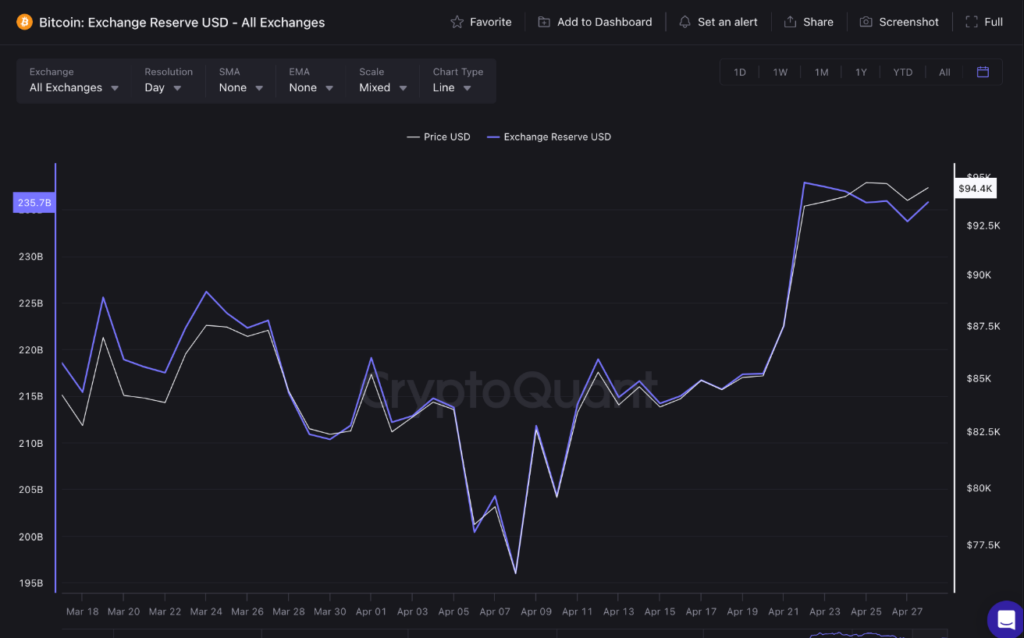

The latest CryptoQuant data actually shows that investors withdrew well over $4 billion worth of Bitcoin from exchanges since Trump’s somewhat controversial rate cut comments. Exchange deposits fell from approximately $237.8 billion to around $233.8 billion within just a week.

BTC Outperforms Tech Stocks

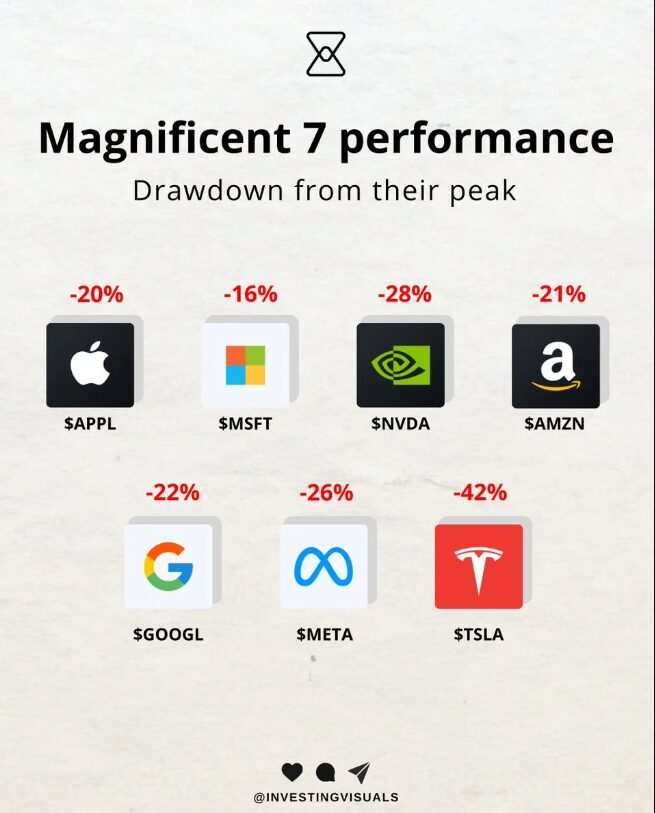

Bitcoin price prediction sentiments continue to improve as BTC posts about 5.6% year-to-date gains while tech stocks are struggling quite a bit. The “Magnificent 7” tech companies show really significant declines from their peaks, with Tesla down a whopping 42% and Apple down roughly 20%.

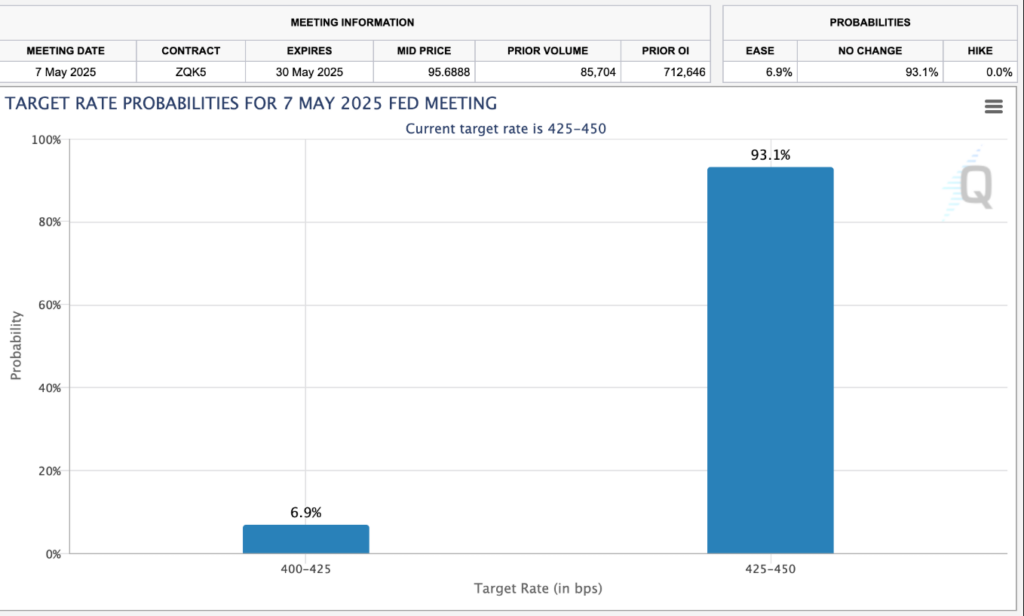

Despite Trump’s repeated calls for rate cuts, the market actually shows minimal expectation of policy changes. The latest CME FedWatch data indicates an overwhelming 93.1% likelihood of no rate change at the upcoming May 7 FOMC meeting.

Path to Six-Figure BTC

Bitcoin price prediction models are strengthening as the crypto market reaction to ongoing geopolitical tensions boosts BTC’s safe-haven appeal. Various Bitcoin 2025 forecast scenarios increasingly include sustained trading above the $100K target if Trump’s policies continue supporting cryptocurrency adoption and development.

The sustained reduction in exchange supply combined with growing institutional interest creates rather favorable conditions for potentially reaching the elusive $100K target in the NEAR term.