5 U.S. Economic Reports That Could Send Bitcoin on a Wild Ride This Week

Brace for impact—this week’s economic data dump might just be Bitcoin’s next volatility catalyst. From inflation prints to jobs numbers, here’s what traders are watching.

1. CPI Showdown: The inflation monster rears its head again. Hotter-than-expected numbers could send BTC tumbling as rate-cut hopes evaporate.

2. Jobs Jolt: Another strong payroll report? Say hello to ’risk-off’ mode. Weak data? Suddenly crypto looks like a hedge again.

3. Retail Roulette: Consumer spending figures will reveal whether Main Street’s still buying the ’soft landing’ fairy tale.

4. Manufacturing Mayhem: The Fed’s favorite sector gauge could move markets—if anyone still believes these surveys matter.

5. Powell’s Poker Face: The Fed chair’s post-meeting presser will be parsed for any hint that central bankers finally understand Bitcoin’s role in 21st century finance (spoiler: they don’t).

Wall Street’s algorithms are already primed to overreact—time to see if crypto traders can keep their cool when traditional finance starts panicking. After all, nothing moves crypto markets like old-school economic indicators... except maybe an Elon Musk tweet.

How U.S. Economic Indicators Could Rock Bitcoin And Crypto Forecasts

Consumer Confidence Report First on Deck

The Consumer Confidence report, which is actually releasing today, leads this week’s 5 key U.S. economic indicators that might affect crypto price forecasts in the coming days. The previous March reading of 92.9 showed quite a bit of consumer pessimism, and analysts are now expecting a further decline to about 87.4 for April.

Economist Justin Wolfers remarked:

JOLTS Job Openings Data Critical for Bitcoin Market Reaction

Tuesday’s Job Openings and Labor Turnover Survey represents another one of the 5 key U.S. economic indicators being closely watched by crypto traders at this time. The February report showed approximately 7.6 million job openings, while the expectations for March are sitting at around 7.4 million.

These U.S. economic indicators directly influence Federal Reserve policy decisions, which can then affect Bitcoin market reaction in various ways. With interest rates currently at 4.25%-4.50%, any signs of continued strength in the labor market could delay anticipated rate cuts, subsequently impacting speculative assets like Bitcoin and other cryptocurrencies.

ADP Employment and GDP Reports Mid-Week

Wednesday brings two more of the 5 key U.S. economic indicators: the ADP Employment Report and also the Q1 GDP estimate. The March ADP report showed about 155,000 new jobs added, while analysts are generally expecting around 110,000 for April.

The Q1 GDP estimate follows the Q4 2024 reading of 2.4%, and the results could trigger some cryptocurrency volatility depending on their implications for overall economic health and monetary policy decisions.

Core PCE Price Index Watches Inflation Trends

The CORE PCE Price Index, another important one of the 5 key U.S. economic indicators releasing on Wednesday, remains the Fed’s preferred inflation measure. The February reading showed inflation at 2.5% year-over-year, with economists now anticipating a decline to approximately 2.2% for March.

Hedge fund manager Ophir Gottlieb stated:

Labor Data Completes the Picture

Initial Jobless Claims on Thursday and then Friday’s Non-farm Payrolls report will round out this week’s U.S. economic indicators that could affect the markets. The March NFP report revealed about 228,000 new jobs with unemployment holding relatively steady at 4.2%.

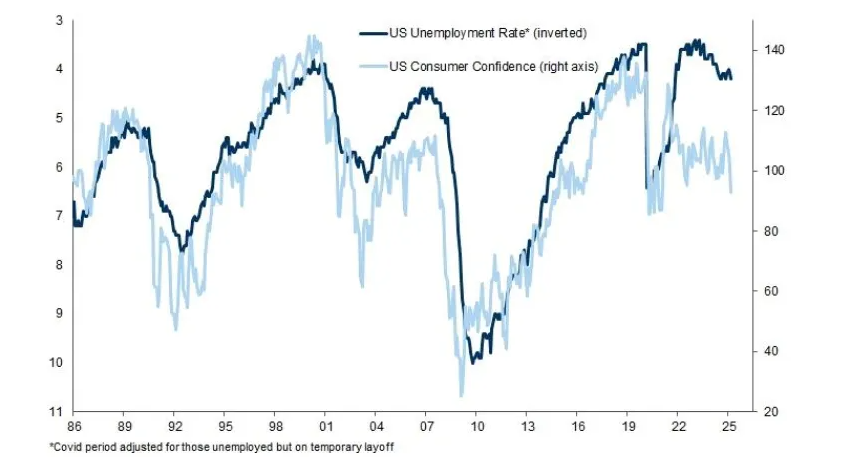

Soft data indicates that future hard data will experience a decline. Consumer Confidence indicators show a pattern that leads unemployment numbers to decline (indirectly). The result might lead to unemployment rates exceeding 6% if this pattern happens again.

With Bitcoin trading at around $94,154 at the time of writing, these 5 key U.S. economic indicators will very likely drive some cryptocurrency volatility as markets try to interpret their implications for monetary policy and economic stability in the coming weeks.