Putin’s Painting & Ceasefire Gambit—Could US-Russia Detente Upend Global Dollar Dominance?

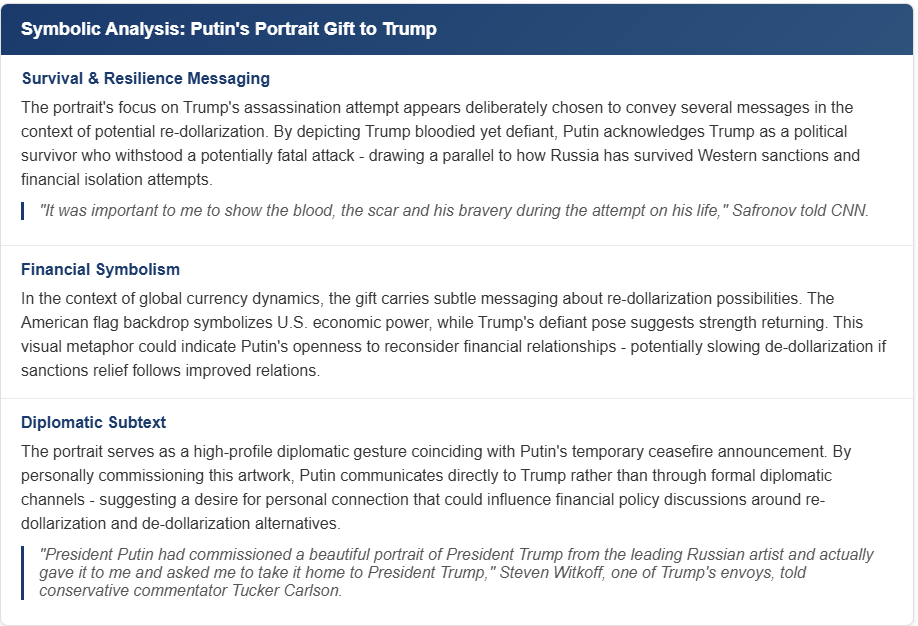

Geopolitical theater hits new heights as Putin gifts Trump a painting—paired with a ceasefire proposal. Behind the symbolism: a potential shakeup of the global financial order.

The Dollar Dilemma

A US-Russia axis could cut both ways: re-dollarization via renewed petrodollar flows, or de-dollarization if Moscow pushes crypto/BRICs alternatives. Watch gold and Bitcoin for hedging bets.

Cynical Take

Wall Street will spin either outcome as ‘bullish’—even if it means dollars becoming collateral damage in great-power poker. Never let a crisis go to waste.

Source: Watcher Guru

Source: Watcher Guru

Could Putin’s Ceasefire Proposal and US-Russia Axis Spark Re-Dollarization or De-Dollarization?

Putin’s Strategic Overtures

Putin announced, just yesterday, a three-day ceasefire from May 8-10, coinciding with World War II victory celebrations and all. This diplomatic gesture comes at a time when analysts are considering the implications for global currency trends, including potential re-dollarization scenarios.

The Kremlin stated:

President Zelensky questioned the timing and also noted:

Trump-Putin Relationship Implications

The US-Russia axis shows some signs of warming, though tensions definitely remain over Ukraine and related issues. The gift of a portrait symbolizes Putin’s outreach to Trump amid the ongoing ceasefire talks and diplomatic efforts that could affect currency preferences and re-dollarization trends.

White House deputy chief of staff James Blair revealed in a recent statement:

Financial Implications: Re-Dollarization or De-Dollarization?

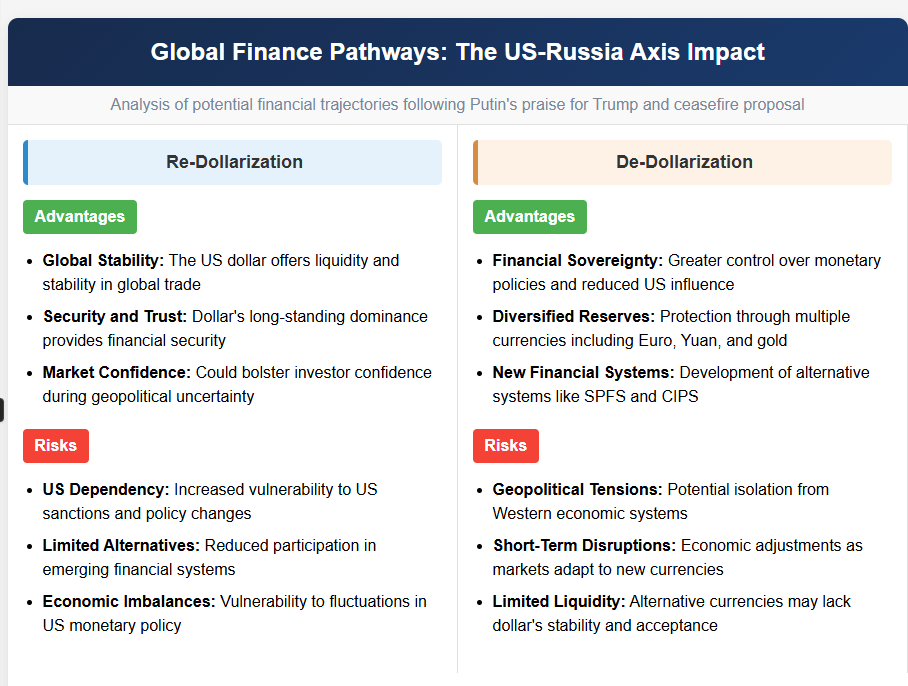

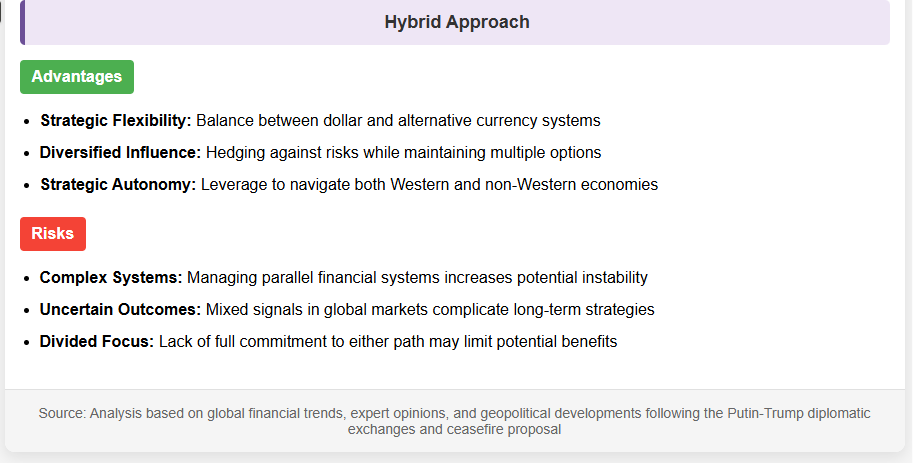

The potential US-Russia axis raises significant questions about re-dollarization versus continued de-dollarization at this point in time. Will closer ties strengthen the dollar in bilateral trade or will both nations continue to pursue alternative financial systems and structures?

George Barros of the Institute for the Study of War noted in his analysis:

Russian Foreign Minister Lavrov insisted on major concessions, and stated:

The outcome of these negotiations and diplomatic exchanges will probably determine whether we see a shift toward re-dollarization or even more continued momentum for de-dollarization in the global financial system going forward.