Solana’s Comeback: Can SOL Crack $200 Before May 2025 Ends?

Solana bulls are eyeing a critical psychological level as the network shakes off FTX-era baggage. After a brutal 2022, SOL’s 2024 rally has traders wondering if the ’Ethereum killer’ can retest its all-time highs.

The setup: With institutional interest returning and meme coin activity surging, Solana’s blockchain is processing transactions at a fraction of Ethereum’s gas fees. But skeptics point to the token’s inflation schedule and the ever-present ’VC dump’ risk.

Key factors: Network upgrades slashing transaction failures, NFT volumes rebounding, and SOL futures open interest hitting $2B suggest momentum is building. Meanwhile, crypto’s favorite pastime—watching Bitcoin’s dominance—could make or break the rally.

Bottom line: In a market where dog tokens flip blue-chips, $200 SOL seems plausible. Just don’t tell the SEC we’re calling it an ’investment.’

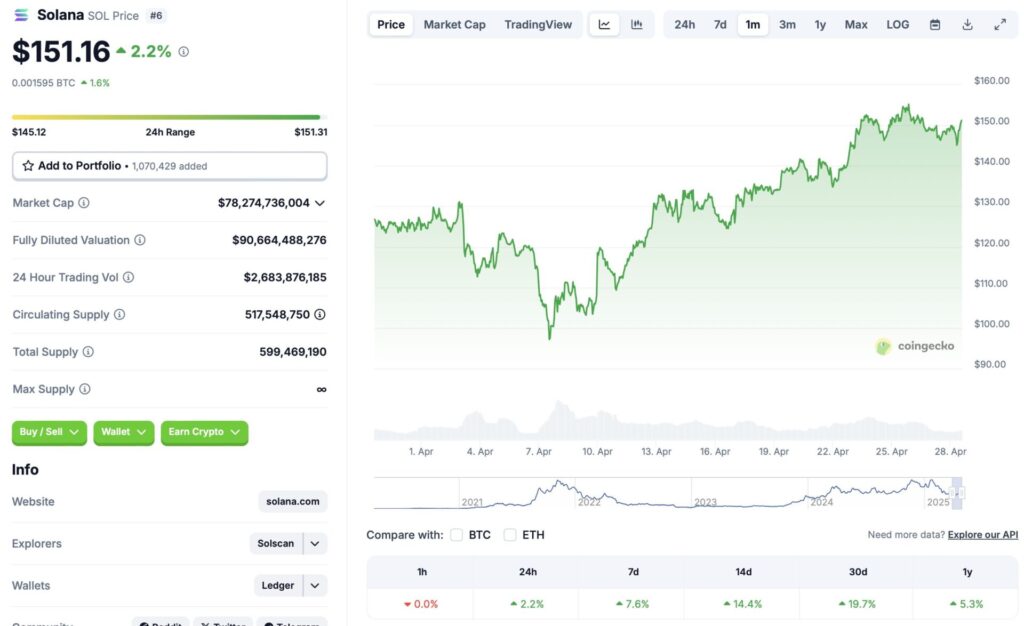

Source: CoinGecko

Source: CoinGecko

Solana’s Resilience Unchallenged

Solana (SOL) has emerged as one of the most resilient cryptocurrency projects in the market. The asset’s price fell to below $10 after FTX’s collapse in 2022. Since its 2022 lows, SOL’s price has hit multiple new all-time highs. The asset hit its latest peak earlier this year on Jan. 19.

SOL’s latest rally comes amid a market-wide recovery. The crypto market faced a substantial price crash after President Trump’s tariff spree. The markets have significantly rallied after Trump’s 90-day tariff pause.

SOL’s rally also comes amid a new pro-Bitcoin head, Paul Atkins, being appointed to the SEC. Many anticipate Atkins to take a more relaxed approach to the crypto sector.

Can The Asset Reclaim $200 In May?

According to CoinCodex, Solana (SOL) will move in a sideways trajectory over the coming weeks. The platform anticipates the asset to face a correction by May end. CoinCodex predicts SOL will trade at $138.63 on May 24. SOL’s price will dip by 8.29% if it falls to $138.63.

There is also a possibility that SOL will rally and not face a correction. The Federal Reserve may announce an interest rate cut soon. A rate cut could lead to a surge in crypto investments. The move could lead to a continued rally for the asset.