SEC Greenlights XRP 2X ETF—Trading Begins April 30

The SEC just handed crypto bulls a loaded gun—a leveraged XRP ETF launches in 48 hours. Wall Street’s ’risk management’ rules apparently don’t apply when there’s fees to harvest.

What’s inside the wrapper? A 2X daily return bet on Ripple’s embattled token, now trading at a fraction of its 2021 highs. The product’s prospectus reads like a Vegas odds sheet: ’Investors may lose substantially more than their principal.’

Market makers are already stacking liquidity. One prime broker whispered about ’unusually aggressive’ put options flowing through Chicago—smart money hedging before the retail stampede.

XRP’s price twitched +7% on the news before settling back. The real action starts Thursday when the algo traders arrive. Just remember: the house always wins, especially when it’s your retirement account.

What XRP Investors Should Know About Market Volatility and ETF Launch

The XRP 2X ETF development comes at a time when market volatility in crypto continues to challenge investors in many ways. These structured products aim to provide more regulated exposure options despite all the ongoing price fluctuations that we’re seeing.

ProShares XRP ETF Details

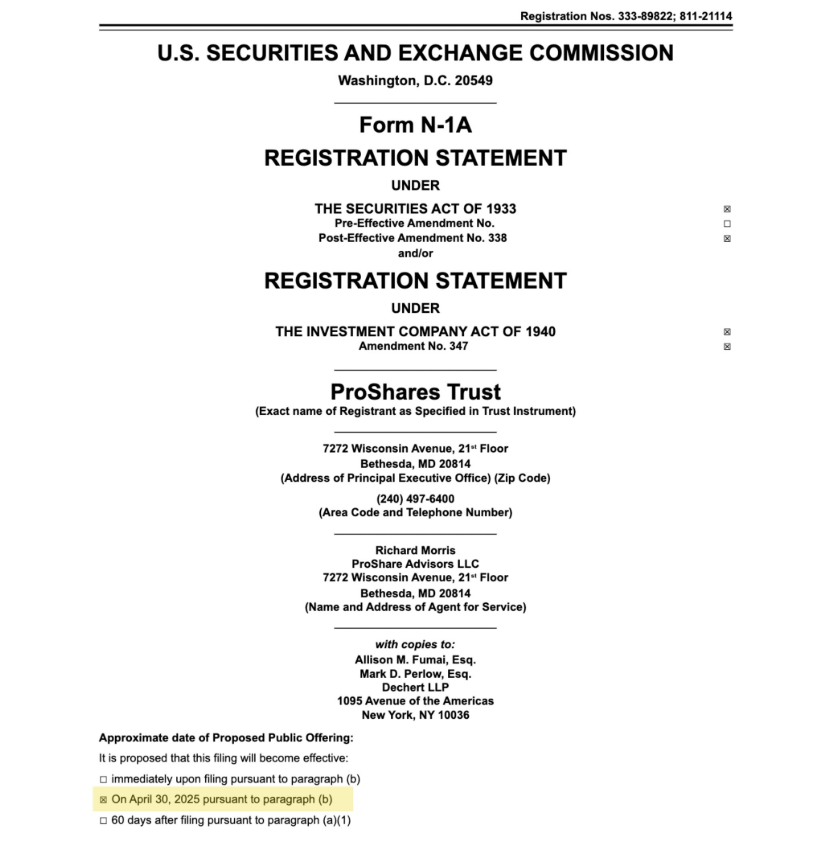

ProShares‘ strategic approach includes three distinct XRP 2X ETF variants: a leveraged fund, along with short and also ultra-short alternatives. The SEC clears path for XRP ETF launch after no formal objection emerged during the mandatory review period that just concluded.

A mutual fund framework actually structures these products, registered in compliance with both the Securities Act and Investment Company Act. ProShare Advisors LLC will serve as the investment advisor for these funds that aim to give investors regulated exposure despite persistent market volatility in crypto markets.

Regulatory Impact

The XRP 2X ETF introduction represents a really significant advancement in cryptocurrency’s integration into traditional finance at the time of writing. Regulatory uncertainty in crypto continues to be navigated by firms like ProShares, who have successfully filed these products without any SEC opposition.

Investment Considerations

All investors accessing the XRP 2X ETF need to know that leveraged products enhance both profit potential and risk potential to the same extent. The SEC established guidelines to allow XRP ETF products while crypto market regulators maintain practical challenges which impact investors who wish to buy these products.

The latest development represents a key advancement for XRP users but falls short from delivering the spot XRP 2X ETF customers have requested. This upcoming April 30 launch will likely influence XRP prices because of the recent cryptocurrency market volatility.

The effective date of April 30, 2025 emerges from ProShares’ records as the distribution company selects it to comply with their strategic development of crypto-linked investment products alongside ongoing crypto market regulatory ambiguities.